Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Learn Risk & Return on Equity Investment in Detail

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Market Valuation- Tips and Techniques

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

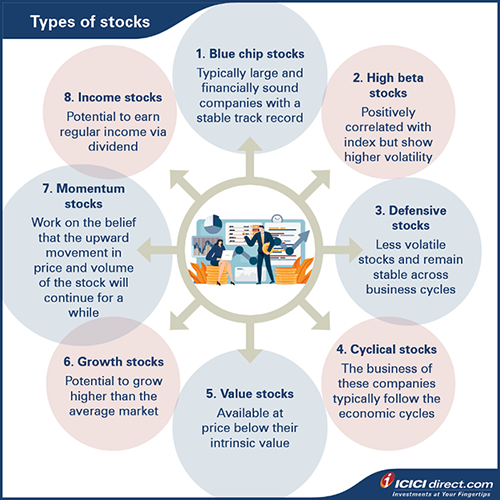

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 4 –Types of Stocks in Share Market- Part 2

In his most profound book, Benjamin Graham mentioned - Growth stocks are worth buying when their prices are reasonable.

But what are these growth stocks?

Well, let’s find out.

1. Growth stocks

You may have guessed how underlying stocks work in this category. Yes, these stocks belong to companies whose earnings are growing at a faster pace compared to peer group companies.

But due to higher growth rate, these stocks command a higher valuation compared to their peers. Since they are growing exponentially, they need more funds to expand. And that’s the reason why these stocks will pay zero or very less dividend and plough back earnings primarily in the company.

But the problem with these stocks is that the high growth rate of a company does not usually continue for a long time. This means when the company's growth rate falls back to normal, their stock price may fall along with it.

Say you come home after a tiring day at work and your sibling asks you join in a game.

Game 1 – You win

Upon your sibling’s request, you play another game.

Game 2 – You win again

Now, your sibling requests again.

Game 3 – You lose

Now, if your sibling asks you play again, what would you say?

Chances are, you would say - No!

Why is that?

Well, after winning the first game, you believed that the probability of your winning the next match would be high. So, you play another game. But after a loss, you thought that the likelihood of your losing the next game would be just as high. And no one wants to lose, right?

Our next type of stock works on the same principle.

2. Momentum stocks

Momentum stocks work on the belief that if a stock is on an upward trend, it remains in the upward trajectory for a while. This means the investors would hold on to the rising stocks and sell them when they seem to have peaked.

It is common for investors to invest in up-trend momentum stocks at higher prices with the expectation that they will be able to sell at even higher prices. Investors who ride on the momentum rally early, are likely to benefit the most.

But for new investors, momentum can be a trap if they ride on the stock late, especially if the rally is on the verge of a collapse.

The reason why momentum strategy works is because of the ‘Fear Of Missing Out’ (FOMO).

When a stock starts trending upwards, investors fear they may miss the next big move and so they start jumping in. This pushes the stock even higher and so on.

Momentum investing relies on technical data rather than fundamentals. And although it may not be a feasible option for new investors, momentum investing can lead to impressive returns, if done properly.

Now let’s say you are looking for a secondary source of income.

You could get a part time job or better yet – invest in stocks that offer dividend. These dividends can be your secondary source of income.

And where do you invest for this purpose?

3. Income stocks

The motive of these investors is to earn a regular income along with chances of capital appreciation. Income stocks carry lower risk compared to other stocks in the market.

So, here’s a quick recap. So far, we’ve discussed:

Value stocks and growth stocks.

Both are viable options, aren’t they?

But what if you could devise a strategy that combines the two?

And that brings us to GARP.

4. Growth at a reasonable price (GARP)

GARP also known as Growth at Reasonable Price is a combination of growth and value investing. With GARP investing, you look to try and identify growth stocks available at a reasonable valuation.

The aim is to identify growth stocks, which consistently show above average earnings growth but with a low valuation. These stocks have an average P/E ratio and higher earnings growth rate, making their PEG ratio equal to one or lesser than one.

But there is an area of difference between GARP and value investing.

Value investors look for stocks available at a bargain, but with GARP, the risk of losing money is minimal.

Did you know?

While Warren Buffet was an advocate for Value investing, GARP was popularized by legendary investor and portfolio manager, Peter Lynch.

Since we are discussing stock investing strategies, here’s another one.

Let’s say you want to invest in stocks. But you are swamped with office work, family responsibilities and you can’t afford to sacrifice the little sleep you manage every night. And you think, it’s near impossible to find the time to research and pick good stocks.

Don’t worry. That’s why we have stock indices.

5. Index investing

Index investing is all about having the same combination of shares in the same ratio as the underlying index.

So, what this means is that your investment replicates the index itself. Index investing is essentially a passive form of investing. it works for investors who do not want to take on the risk of creating their own portfolio but want to invest in a fully diversified index.

But would there be any change in the holdings?

Yes, but only when a company enters or leaves the index.

Did you know?

Index investing as a strategy will not beat market returns but makes sure you get at least the returns offered by the market.

A good way to get into index investing is through mutual funds or ETFs. There are many index mutual funds and ETFs in the market and that can help you implement this strategy.

Have you heard of the phrase, ‘to go against the flow’?

Well, our next type of investing is for those who have good stock knowledge and may want to take an off-the-beaten-path approach, better known as ‘against the trends’.

6. Contrarian investing

As the name suggests, contrarian strategy is all about having a contrary view against majority investors. This strategy relies on that fact that just because majority investors are buying a set of stocks, they might be mis-priced. Contrarian investors take an opposite view and invest against the wind.

But isn’t this risky?

Well, this strategy can offer high returns if the market moves in favour of contrarian investors. Otherwise, yes, it could be very risky.

Sounds more like value investing, doesn’t it?

The significant difference is that the contrarian investing approach relies more on market sentiments and investor behaviour. It is more about investing in stocks that are currently not favourable for other stock market participants.

Here’s a tip: With contrarian investing, if you read about it in the newspapers or watch it on the news that means you are too late.

Also Read: Why is Investing Important and Where Should One Invest

Summary

- Growth stocks are the stocks of the companies that are growing at a faster pace compared to peer group companies.

- Momentum stocks work on the belief that if a stock is on an upward trend it remains in the upward trajectory for a while.

- Income stock investors aim to earn a regular income along with chances of capital appreciation.

- GARP also known as Growth at Reasonable Price is a combination of growth and value investing.

- Index investing is all about having the same combination of shares in the same ratio as the underlying index.

- Contrarian strategy is all about having a contrary view against majority investors.

'In this world nothing can be said to be certain, except death and taxes.' And so, while it's great to receive high returns, let's get to know all about taxes on investing in stocks in the next chapter.

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The securities quoted are exemplary and are not recommendatory. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)