Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Learn Risk & Return on Equity Investment in Detail

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Market Valuation- Tips and Techniques

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 5: Guide to stock market trading

By now you already know it is mandatory to have a demat account to invest or trade shares.

But why is it so important?

Well, the reason for any kind of change is to improve your life and make it simpler

And it’s the same reason why demat account was introduced.

Demat account

Let’s understand it with the help of an example -

We look at the investment style of Rahul before the concept of Demat became mandatory.

Rahul wants to invest in Company XYZ Ltd. He calls up his broker and tells him to process the investment in XYZ Ltd. The broker gets the share certificate along with the transfer deed. He takes it to Rahul and he signs this application and hands it over. Now, the broker sent the signed form to the registrar and got it validated. Rahul got the Shares certificates on successful validation.

This lengthy, long-drawn process was the norm in the pre-digital era for all stock market investors. And would you believe it? It would typically take around 6 to 8 weeks to receive shares!

But due to digitalization:

You no longer need print to read the newspaper, thanks to online newspapers!

You no longer have to travel to your school building to attend the school, thanks to online school classes!

You can now drive a car without driving the car, thanks to Elon Musk!

Take a simple example here: Writing letters or notes through hand was a standard option for centuries, until emails emerged.

So, with change all around us in every aspect of our lives, there had to be some change in the finance sector as well.

In 1996, India introduced the Demat account system for trades in one of the stock exchanges i.e., National Stock Exchange of India Limited (NSE) which was quickly followed by the BSE Limited (BSE) as well.

This not only saved time but also made it easy to maintain the record and protect against frauds.

Now then, what is demat?

Well, the term demat is an abbreviation for the term dematerialization. It is the process of converting physical certificates into electronic form. These certificates are maintained in an account with the Depository Participant (DP).

So, what happened to the print certificates after dematerialization?

Since December 5, 2018, SEBI has mandated that all paper shares will be illiquid. So, all those who hold physical paper shares had to convert it into its electronic form. Today's Demat option has eliminated many issues, including fraudulent acquisition and transfer of securities, unscrupulous operators applying in the name of retail investors, theft, loss, etc., making stock transactions fair, practical and qualitatively improved.

This brings us to the many advantages of having a demat account.

- It eliminates loss of share certificates in transit.

- It saves the investor/trader a substantial amount of money if there is a need to obtain duplicate certificates in the event the original share certificates are mutilated or misplaced.

- It boosts the liquidity of securities due to instant transfer and registration.

- It allows investors receive bonuses and rights into their depository account as direct credit.

- It enables buying and selling even a single security that was unavailable in the past.

You must think opening a demat account would be difficult, right?

Well, no. Opening a demat account is as simple as opening a bank account.

How?

Here’s the procedure of opening a demat account

You can open a demat account online with any DP by following these steps:

- Fill up the account opening form available with the DP.

- Digitally sign and submit the DP-client agreement which defines the rights and duties of the DP and the person wishing to open the account.

- Fulfil the KYC norms by submitting the copies of the requested documents and complete the verification process online.

- Receive your Client Account Number (client ID). This client ID, along with your DP ID, gives you a unique identification in the depository system.

Did you know?

There is no restriction on the number of demat accounts you can open.

Procedure to dematerialize your share certificates

- Fill up a dematerialization request form, available with your DP. Submit your share certificates along with the form; (write "surrendered for demat" on the face of the certificate before submitting it for demat)

- Receive credit for the dematerialized shares into your account within two-three weeks.

- If your existing physical shares are in joint names, be sure to open the account in the same order of names before you submit your share certificates for demat.

Did you know?

If you wish to receive your securities back in their physical form, you will need to fill in the RRF (Remat Request Form). Send this form to your DP and request them for rematerialisation of your share certificates.

How to invest in the stock market?

Now, the following are some of the phrases you have heard many times before -

“You need good knowledge to invest in the stock market”

“Don’t invest in the stock market, it’s difficult to understand”

“Stock market is not for first time jobbers”

“Stock market is not for the faint of heart”

“Do you even know how to trade in the stock market?”

You remember them, don’t you?

It’s probably the reason why you haven’t started investing in the stock market yet. But while some of them might ring a bell, understanding the stock market is actually easier than you think.

Let’s look at the process of investing in the stock market

You've done a good background check on company ABC and you're convinced that its future prospects are bright. So, armed with this knowledge, you wish to invest in this company. So what do you do?

You first open a trading account with a broker. This is because the buying and selling of shares in the stock market is not done by individuals but by stock brokers or brokerage firms. You can place an order from your trading account to buy or sell stocks on the stock exchange.

For example, you place the 'buy' order from your trading account. The broker then passes on the request to the stock exchange to look for the 'sell' order.

Once the stock exchange locates the ‘sell’ order, a price is agreed upon and the transaction is finalized.

Your broker receives confirmation from the stock exchange who then informs you about the successful transaction. And it takes a fraction of a second to complete these activities.

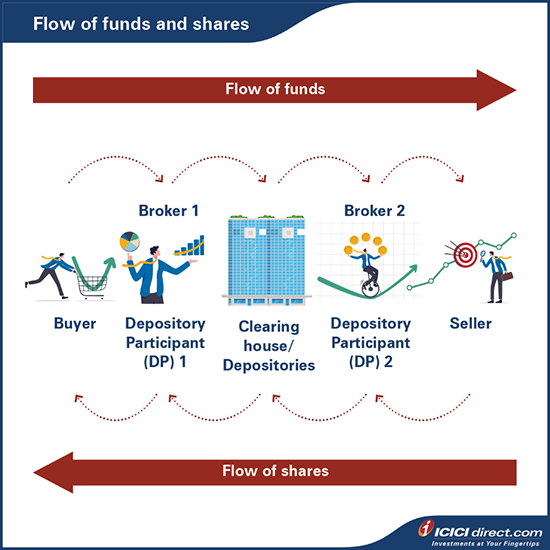

After ensuring there is no default on either end, the clearing house/depositories initiates the transfer of funds/shares, also known as the settlement process. The settlement cycle takes two working days.

The DP then credits your demat account with the purchased shares. However, there are few other intermediaries also involved in the settlement process. We will discuss about them and the settlement process in detail in the later chapters.

Did you know?

The Stock Market is around 419 years old. The oldest securities market, Amsterdam Stock Exchange was established in 1602 by the Dutch East India Company.

Source: Wikipedia

Wasn’t so difficult to understand, was it?

But how do you read the stock market? How do you evaluate its performance?

You certainly recollect two terms that got your attention when you were flipping through the channels one day. One of the streaming tickers on a business news channel read, “The global bull market will run through 2021….” Following that, you also remember reading this, "Investors buying stocks in a bear market…”

‘Bull’ and ‘Bear’

How do these terms connect to the stock market?

In stock market parlance, here's what they actually mean:

- Bull market: stock prices rising or are expected to rise

- Bear market: stock prices falling or are expected to fall

But why – ‘Bull’ and ‘Bear’?

Do you know how a bull attacks its opponent? By thrusting its horns up into the air. That’s right!

This upward motion of the bull’s attack is compared to be the upward movement of stock market prices.

Whereas, how does a bear strike its opponent? By swiping his paws towards the ground.

Here, the downward motion of the bear’s attack is compared to be the downward movement of stock market prices.

Did you know?

The term ‘bear’ came before ‘bull’. It supposedly originated with a proverb – “sell the bear’s skin before one has caught the bear.”

Additional Read: How to Choose the Best Equity Mutual Fund

Summary

- Changing physical certificates into electronic form is known as demat -- an abbreviation for the term dematerialization.

- Holding demat securities has eliminated illegal transfer of securities, unscrupulous operators, theft, loss, etc., making stock transactions fair, practical and qualitatively improved.

- To buy and sell in the stock market, you need to open a trading account with a broker.

- The terms bull and bear in the stock market imply how the stock market is performing at a particular time — a bull market is on the rise while a bear market occurs when the economy is receding, and stocks are on the decline.

In the next chapter, we will understand the process of buying and selling shares when investing in the stock market.

Disclaimer:

ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)