Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Learn Risk & Return on Equity Investment in Detail

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Market Valuation- Tips and Techniques

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 6: Stock market investment- Part 1

What do you do when you want to buy that beautiful dress or that expensive watch online?

Simple, you select the item and place an order.

It’s the same when it comes to buying shares. You place an order.

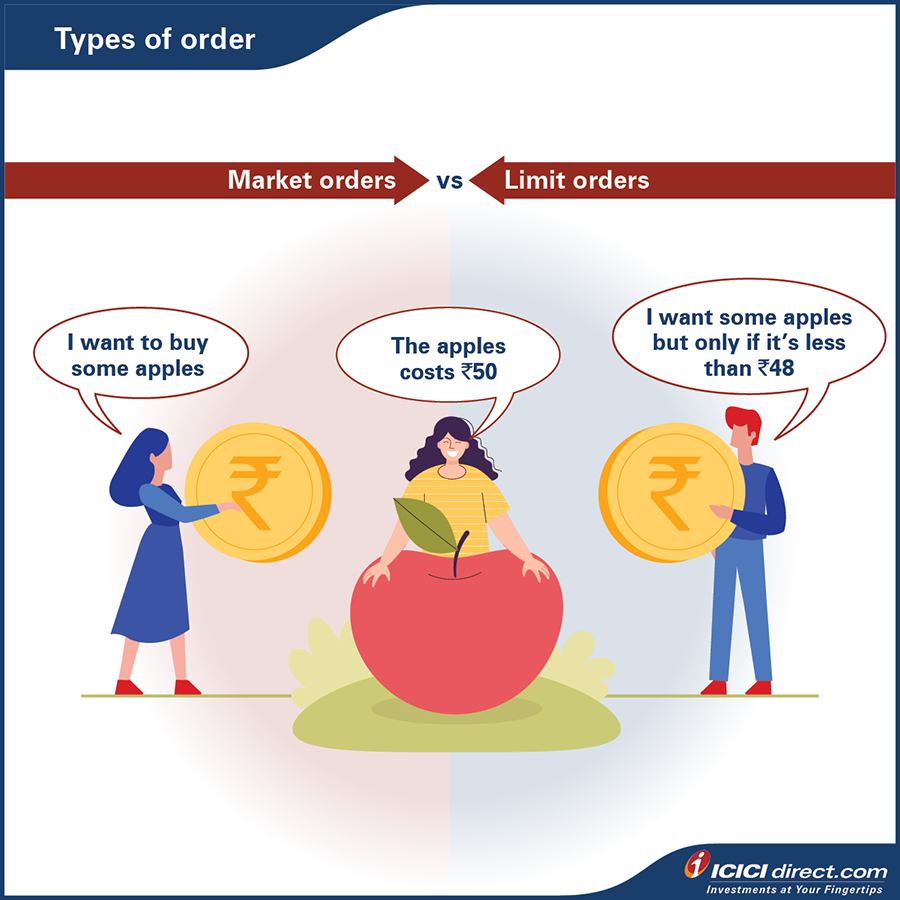

Types of order

There are two ways you can place an order in the stock market through your broker. They are -

- Market order

- Limit order

Let’s understand this with an example:

Let’s say you wish to buy a laptop. You have two options to go about it.

You either purchase the laptop at the offered price. Or you save it in your wish list and activate an alert to inform you when the price is reduced and then buy it.

In somewhat the same manner, with a market order, you trade your stock without negotiating on the price. In this case, your orders are executed immediately if the stock has enough liquidity.

- For a buyer: You purchase shares from the best available seller. If the seller does not have sufficient quantity, your order will be matched with the next best available seller till the time your complete order quantity is fulfilled.

- For a seller: Your order is matched with the best available buyer. If the best buyer cannot fulfill your order quantity in full, your order will be matched with the next best available buyer.

Let’s understand this with an example:

Following is a demand and supply scenario for a stock:

|

Bid Price |

Bid quantity |

Offer Price |

Offer Quantity |

|

100 |

220 |

100.30 |

40 |

|

99.90 |

50 |

100.40 |

150 |

|

99.75 |

70 |

100.50 |

220 |

|

99.55 |

340 |

100.70 |

320 |

|

99.20 |

200 |

100.85 |

30 |

If you place a market order to purchase 100 shares, your order is executed at the following prices:

- First 40 shares will be at Rs. 100.30

- Remaining 60 shares will be at the next best price i.e. Rs. 100.40

- Average purchase price: [(100.3*40) + (100.4*60)]/100 = 100.36

Whereas, a limit order means trading at a specific price and trying to negotiate with existing traders to get the best price.

- For a buyer: You may place a limit order below the current market price.

- For a seller: You may place an order to sell the stock at a price higher than the current price.

Similarly, if you are willing to buy the stock, limit price order execution will be done only if any seller is willing to trade on your quoted price.

Delivery based investment and intraday trading

But how long should one hold on to shares?

Well, you can buy and sell your shares in the short term or you can keep it for the long run.

When you’re buying and selling stocks within the same trading day, you indulge in an activity known as intraday trading.

On the other hand, you can choose to purchase stocks and hold it for the long run with the expectation that it’s price would increase in future resulting into high levels of profitability. This is known as delivery-based investment.

Both - intraday trading and delivery-based investment are different approaches you can choose depending on your time horizon and risk profile.

To make it simple, let’s look at them one by one:

Intraday trading

- Holds a time horizon of a single day only and within trading hours.

- You need to book profit/loss on the same day.

- Your broker can offer you the advantage of leverage to increase your profitability. However, you need to note that in the event of adverse stock-price movement, leverage may increase your losses.

- You can choose to take help from technical analysis to pick the right time to enter and exit a trade position to increase your chances of profitability.

- You can take either long or short positions, based on the anticipated stock-price movement during trading hours.

You must be wondering what long and short positions are. Stay tuned as we will get to that later in this chapter.

Delivery based investment

- Requires full payment of money to credit shares in your demat account.

- You can sell shares whenever you feel comfortable.

- The time horizon can range from one day onward.

- This may be a good investment approach for all your long term goals.

- As a long-term investor, you can rely on fundamental analysis to choose stocks. This analysis examines a company’s management composition, rivals, industry status, growth movement, growth potential, profit, and revenues to ascertain its advantage.

Somewhere in intraday trading, you read about your broker offering leverage. Now what's that?

That's a smart point to notice! Let us explain.

If you're looking to invest in a stock that is promising but you don't have sufficient funds, your broker can provide you with leverage. This means, if you accept your broker's leverage, it would increase your purchasing capacity or increase your trading position without having to spend a substantial amount from your pocket.

A few examples of leverage include buying on margin, futures and options etc.

That being said, there are ways to earn profits using the leverage offered by your broker.

Let's understand this with an example.

Suppose you have Rs. 1000 in your trading account. Your broker offers you a leverage of 10 times on the stock of Anita Travel limited, currently trading at Rs. 1000. This means you can buy up to 10 shares worth Rs.10000 (1000x 10) at a time.

Now, if you purchase 10 shares in the morning and were able to sell all of them at Rs. 1040 in the afternoon, your profit is 40*10 = Rs. 400. Thanks to the leverage, you now have a huge 40% (400*100/1000) Return on Investment [ROI].

While using leverage can help you purchase a stock that you can't afford, it comes with some degree of risk. For example: If the stock you’ve invested in falls, to say Rs. 980 by afternoon, you may lose 20% of your capital investment. That’s why it's not recommended to use leverage in every stock in the market.

Long and short position

Now, let’s dive deep into how we can earn profits in the stock market.

Of course, it goes without saying that one can earn profits in the stock market when the market is going up.

But Why?

Because the price of your stocks are rising.

Okay. But now what if you were told you can profit in both bull and bear markets?

By making the right move at the right time, you can earn profits during both bull and bear markets.

Let’s understand how -

Long position

How do you think your local shopkeeper earns profit?

It’s simple.

He buys the products below MRP and bills you at MRP. The margin earned is his profit.

long position

means you are buying the stock first with the intention of selling it later. If you expect the price to rise during the day, you would prefer to purchase the stock first and sell it off (square off) later in the day, at a higher price.

Let’s understand this with an example:

Stock Market Outlook – Bullish

- Buy the stock at Rs. 100 at 9:30 am

- Sell the stock at Rs. 102 at 1:30 pm

- Book a profit of Rs. 2 per share

Short position

On the other hand, a short position means you will be selling the stock first with the intention to purchase it later at a comparatively lower price.

So, if you expect the price to fall during the day, you would prefer to sell the stock first, and square off your position later in the day at a lower price.

Let’s understand this with an example:

Stock Market Outlook – Bearish

- Sell the stock at Rs. 100 at 9:30 am

- Buy the stock at Rs. 98 at 1:30 pm

- Book a profit of Rs. 2 per share

And what if the price of that stock rises later in the day?

Well, in that case, you will be inclined to cover your position at a loss.

Additional Read: Types of Stocks & Investing

Summary

- The two ways you can place an order in the stock market are market order and limit order.

- There are two ways to transact in the stock market — intraday trading and delivery-based investment.

- How long you wish to hold onto your shares/securities will depend on your risk profile and time horizon.

- You can choose to accept leverage from your broker to enhance your purchasing capacity or increase your trading position without spending a full amount from your pocket. If you use leverage to take a delivery position, you also need to pay interest on the funded amount.

Let's wind up on stock market basics by moving on to the second and final part of the basics of stock investing in the following chapter.

Disclaimer:

ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities/stocks quoted exemplary and are not recommendatory. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)