Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Risk & Return on Equity Investment

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Valuation Terms Explained – Part 1

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 7: Learn Risk Profiling and Risk Management

So, let’s begin with ‘what is a risk profile’?

You must remember your first roller-coaster ride. That’s the kind of experience you never want to forget. But while you enjoyed the ride, there is always that one kid nearby who clearly wished he had skipped the unpleasant experience.

So, while you were ready to embrace the risk involved in riding a roller-coaster, your little friend would have rather stayed back and observed.

Similarly, some people might be ready to take more risks than others while investing. And your risk profile gives you an evaluation of how much risk you are willing to take while investing.

Risk Profile

Every person has different financial goals in life. That means, your financial goals coupled with your current financial health is what decides your risk tolerance.

Let’s look at the different categories of risk profiles. There are three main types –

Conservative Investor

This means you wish to take low risk.

Moderate Investor

This means you are willing to take some risk for better returns.

Aggressive Investor

This means you are willing to accept more risk for an opportunity that may yield high returns.

But you don’t have to fall in any one category. You can choose to be in all of them depending upon your investment goal.

Let's understand this with an example

When it comes to maintaining an emergency fund, you look to invest in an avenue that offers you stability and liquidity rather than high returns. In that case, you opt for a low risk, low return profile, indicating you are being conservative.

However, for an investment goal, such as retirement, which maybe 25 years away, you can choose to be an aggressive investor. That’s because you are seeking good returns over a long period. Here, the high returns would be directly proportional to the risk involved. Besides, since your investment horizon is decades away, the risks may be managed in the long run.

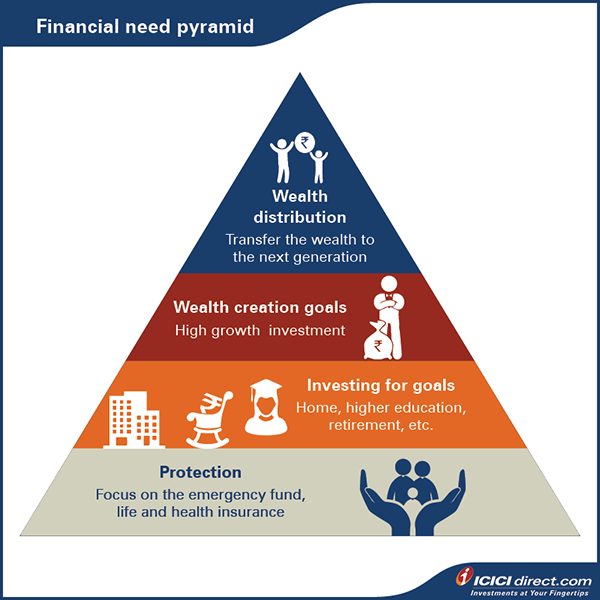

The following diagram - ‘Financial needs pyramid’ can help you understand the proper order to accomplish your goals.

If you are a new earner, your investments could be starting at the bottom of the pyramid. Over time, your investment risk profile can become aggressive as you climb up the pyramid.

Additionally, you can also invest aggressively in your financial goals if they are years or decades away on your timeline. That would give your investments the time to ride out any market fluctuations.

Simply put, when you start investing in your newborn’s higher education goal, buying some stocks won’t hurt. This is because your investment has ample time to grow.

Is giving investments time the only way to manage the risks? No, there’s more. Let’s look at them in detail.

How to manage investment risk?

There are two ways you can manage investment risks:

- Invest for the long-term

- Invest small sums regularly

Invest for the long-term

Did you know?

Charlie Munger, successful investor and partner to Warren Buffett once said, “It's waiting that helps you as an investor, and a lot of people just can't stand to wait.”

Some investors look to outperform the market in a short frame of time. But historically, it has been seen that short-term investments do not provide the kind of returns that long-term investments do. The reason why long-term investing works is because bull and bear markets are excellent opportunities to help you ride out the highs and lows in cycles while giving you an opportunity to invest in high-return-yielding assets.

Invest small sums regularly

Investing in small amounts allows you to take advantage of rupee cost averaging. This mechanism ensures you buy more shares (or units) when the prices are low and less when the prices are high. Thus helping you average out the cost of investment and tackle market volatility.

In addition, having a disciplined approach like investing small sums regularly helps develop good financial habits which will definitely come in handy in the long run.

But won’t investing a small amount of money regularly mean building a small corpus?

On the contrary, investing small amounts over a period of time can grow your investments. All thanks to the power of compounding. When your stock investments produce earnings, they get reinvested and help your investments generate more profits. So, the more time your money stays invested, the higher the opportunity for growth and compounding, even if you’ve started off with a small amount.

But did you know you can use both these techniques to minimize risk in high-risk investments?

Here’s how

If you have a large sum to invest in a high-risk investment, you may want to park your funds in a low-risk investment tool such as a debt fund. You can then transfer small sums of money from that fund to a high-risk investment instrument over time.

For example, if you want to invest Rs. 10 lakhs into equity stocks or fund, you can invest Rs. 1 lakh in the first month and keep the rest in a short-term debt fund.

Then, you can transfer the remaining amount in small chunks over the next few months.

Did you know?

British-born American economist, professor and investor, Benjamin Graham was known as the Father of Value Investing. Here is a famous quote from him, "The essence of investment management is the management of risks, not the management of returns.

In this way, you can manage market volatility while ensuring you earn good returns in the long term.

Summary

- While developing an investment strategy, understand the nature of the risks involved and the possible consequences.

- Your investment should always align with the financial goal, investment tenure, and risk appetite.

- Evaluate your investment risk profile by looking into your ‘Financial needs pyramid’.

- To manage investment risks, consider investing for the long term and investing small sums of money regularly.

Pat yourself on the back, for you have now successfully completed the module on the basics of investments. But now is not the time to slow down. Let's keep up the pace and dive deeper to ensure a smooth investing journey for you.

Track your application

COMMENT (0)