Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Learn Risk & Return on Equity Investment in Detail

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Market Valuation- Tips and Techniques

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 7: Stock market investment- Part 2

'Mahima Corporation gains 4.12%.'

'Cubit Pharma loses 1.48%.'

The ticker in front of your laptop is churning out market stats and stock quotes second-by-second, and you feel your heart beating faster with every sudden jumps and fall in stock prices. You wonder what's that all about.

Is something wrong with the stock market? Is everything okay?

If you're new to stock markets, relax! It's just a typical trading day.

Stock prices fluctuate frequently; they increase and decrease in value, and even though it may appear shocking, it basically revolves around a simple factor — supply and demand.

What causes the prices of stocks to move?

Let's understand this with an example:

There's that brand-new Bluetooth speaker you've always been wanting to buy. But there are only 20 units on sale. You quickly buy it even though its price is way higher than on the market, just because you don't want to miss it.

The following week, you see that the speaker is now available at MRP [much lower than what you paid for], and you suddenly think if you made the right decision buying it when it was first launched.

And then you realize. Since the demand for the speaker was so high and available in limited quantity, people were prepared to pay any price just to get their hands on it. But now that it's readily available, its cost has reduced drastically.

Similarly, the stock market is basically an auction in which buyers and sellers drive the price of stocks purely on supply and demand.

So, what causes the prices of stocks to move?

Stock prices change every day due to market forces, i.e. because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), the price moves up. Conversely, if more people wanted to sell a stock than buy it, there will be greater supply than demand, and the price will fall.

But what increases or decreases the demand and supply?

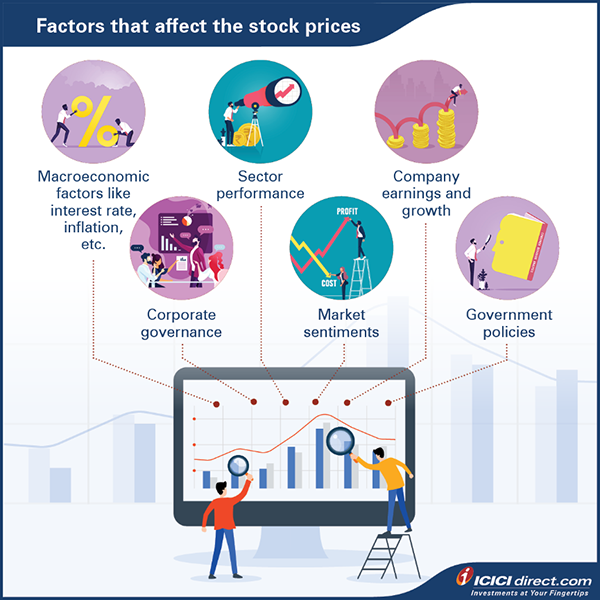

Factors affecting demand and supply

Many factors drive the demand and supply for stocks. Let’s look at a few of them:

1. Internal factors

These are aspects that apply specifically to the company/stock. It includes factors such as company earnings, growth and profit, dividend payout, management etc. and so on. For example, if the company is declaring higher-than-expected profits or earnings growth, the stock could rise.

Investor confidence typically rises when they observe good corporate governance in a stock that helps to boost its stock price.

On the other hand, if you view that profits are lower-than-expected or earnings growth has fallen, the market may not be enthusiastic about the stock, and its price may fall.

2. External factors

Conditions and circumstances such as overall industry scenario, interest rates, economic situations, and similar aspects comprise external factors. For example, when you go to the stock market, you notice that many industries are capital intensive. That means interest cost can have a tremendous impact on their financials. With high interest rates in the economy, the profitability of these companies could be affected, which could result in a fall in their stock prices.

3. Market sentiments

Sometimes, certain behavioural features or sentiments of stock market participants can affect the price of a stock. That means how market participants react to the particular news that can affect the price of a specific company or companies of a particular sector.

For instance, let's say the finance minister has announced an excellent budget this year. With this, market sentiments are suddenly enthusiastic and positive. This announcement encourages market participants to boost the stock market. Also, budget announcements may not bring about immediate change in the economic condition. But it still can boost the morale of all market participants.

This shows you that there is no way to understand or predict how stock prices will behave and how they can move in the future.

Did you know?

When Steve Jobs resigned as the chief executive role at Apple Inc., the stocks of the company fell. And the same thing occurred after his death in October, 2011.

To summarise, these are the factors that affect the stock market -

So, what goes into all this buying and selling?

Clearing and Settlement

There are three processes involved to complete a certain transaction of stock. They are execution, clearing and settlement.

What do these mean and how do they work?

Let's understand this with an example.

You go to your favorite e-commerce website and choose from the list of smartphones that the seller has posted online. You order the smartphone you need and make the payment. This completes the execution process.

Now, the seller processes and confirms your order. You receive a notification regarding the order is shipped and on its way. This explains the clearing process.

On the following day, you receive your smartphone in hand with a physical invoice from the seller. You also receive an email and SMS notification that the delivery is complete. This explains the settlement step.

Similarly, when it comes to transacting in stocks, here's what happens:

1. Execution: The buyer and seller enter into a legally binding agreement to transfer securities in exchange for money from the buyer to the seller.

2. Clearing: Performs all the steps required leading to fulfilment, such as depositing sufficient margin and securities regarding the transaction. This process takes the help of clearing members, clearing banks, custodians and depositories to settle with trades. In this process, the clearing house will determine the total amount of funds or securities the stockbroker or depositories needs to receive or pay.

3. Settlement: Money is exchanged for securities/stocks. That means the securities are transferred to the buyer while the money is transferred to the seller.

In India, the stock market follows the T+2 (trade day plus 2 days) cycle for settlement. This settlement is also known as Rolling Settlement. However, if you want to sell your shares the next day, you can sell those shares, popularly known as BTST (Buy Today, Sell Tomorrow). As purchased shares still not reached into your demat account, there is a risk involved. If you have not received your shares, selling the shares will be considered as short selling and you don’t have shares to settle that selling transaction. This risk is not in every transaction but may be present in the case of illiquid stocks.

Let’s understand this with an example

Let's say you traded in Company ABC on Monday. So, according to the T+2 cycle, it will be settled on Wednesday. In this case, Monday is your Trade Day (T Day), Tuesday is T+1, and Wednesday is T+2.

Only business working days are considered in the settlement period calculation. That means all Saturdays, Sundays, bank holidays and stock exchange holidays are excluded from the settlement process.

So, if you carry out a trade on Friday, it will only be settled on the following Tuesday.

Circuit filters

Now, all this sounds good. But there is a slight worry at the back of your mind.

What if there are abnormal fluctuations in the stock market? What if there is widespread panic and the market just keeps crashing?

Don’t worry! That's where the SEBI comes in!

It lays down circuit filters/limits for stock and index prices.

Consider the circuit filter/limit like the brake in your car/bike. Similarly, the SEBI ensures the upward or downward speed limit of the stock market is also kept in check!

What are these circuit limits, and how do they help?

A market-wide circuit breaker is applied if either the BSE Sensex or the Nifty 50 breaches the limits in the Indian stock market. This market-wide circuit breaker system is used at three stages of the index movement. Stock trading is halted if:

The index moves up or falls 10%, 15% and 20%. If it touches the upper limit, it is known as the upper circuit. Conversely, if it touches the lower limit, it is known as the lower circuit. Similarly, individual stocks also have circuit limits and triggers at 5%, 10% and 20%. These limits will be set and defined by stock exchanges. The stock exchange may change the circuit limit from a higher level to a lower level to reduce the volatility of the stocks. For example, a stock exchange can reduce the circuit filter limit of a stock from 20% to 10% or 10% to 5% to cut down volatility. Please note that the circuit filter is not applicable for stocks available in the derivative segment. The extent of the duration of the market halt is as given below:

|

Trigger limit |

Trigger time |

Market halt duration |

|

10% |

Before 1:00 pm |

45 minutes |

|

At or after 1:00 pm up to 2.30 pm |

15 minutes |

|

|

At or after 2.30 pm |

No halt |

|

|

15% |

Before 1 pm |

1 hour 45 minutes |

|

At or after 1:00 pm before 2:00 pm |

45 minutes |

|

|

At or after 2:00 pm |

Remainder of the day |

|

|

20% |

Any time during market hours |

Remainder of the day |

Example With the help of circuit breakers, there is a coordinated trading halt in all equity and equity derivatives markets. This filter or breaker helps in limiting speculative trading that could result in massive losses. The market then re-opens after an index-based market-wide circuit filter breach.

Let's say you purchased stocks of Fusion Systems at Rs. 100 five years ago. At the current market price, the stock is trading at Rs. 500. If the stock prices fall back to Rs. 100 - level in a single day, it could result in a heavy loss. A circuit limit is applied to avoid such drastic crashes. Similarly, an upper limit ensures that the stock does not rise indefinitely.

Did you know?

Circuit breakers were set in after the Black Monday crash of 1987 in US stock markets.

This shows you how regulators design circuit filters for stock markets as a risk protective mechanism to safeguard retail investors.

Additional Read: Taxation on Equity Investments

Summary

- Stock prices fluctuate every day due to supply and demand.

- Supply and demand are affected by internal factors, external factors and market sentiments.

- There are three processes involved in completing the stock transaction — execution, clearing and settlement.

- To safeguard the concerns of retail investors, SEBI institutes market-wide and stock-wise circuit breakers/limits whenever there is a breach in the limits of indices or stock prices.

Why is a stock index important? We find out just that and more in the next chapter about stock indices.

Disclaimer:

ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. The securities/stocks quoted exemplary and are not recommendatory. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)