Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Risk & Return on Equity Investment

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Valuation Terms Explained – Part 1

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 - How Foreign Investments Influence Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 8 – Inflation and its Impact on the Economy

So, what’s the one thing that makes everyone cry – ONIONS

The humble onion has had a legendary run in creating ripples in the financial markets on several occasions.

Really! When and how?

Well, not too long ago, there was a price hike of 50% in the onion prices in the last two and a half months on Nov 24. The prices went up from Rs 3,600 per quintal on Aug 24 to Rs 5,400 per quintal on Nov 6, 2024.

This price increase in commodities and the decline of purchasing power of the currency over time is known as inflation.

Why did the onion price rise?

Commodity prices could increase at any time due to many reasons. But if you were to take the case of the recent price hike in onions, that was due to torrential rainfall that affected the supply of onions. Farmers across the country experienced heavy losses as the onion crops were rotten. Hence, the cost of onion was increased due to phenomenon of shortage in supply and higher demand.

How does this affect you or the people at large?

When prices skyrocketed, people were forced to pay the high price while some avoided onions completely.

But how can onions have the power of affecting business?

Indian cuisine relies heavily on onions and most sauces, gravies and dishes have onion in some form or the other. Businesses such as restaurants, hotels, street food vendors, fast food makers were greatly affected due to the hike in price.

But would something like an ‘onion price’ affect the government?

You'd be surprised!

History shows us the power of onions in toppling governments. Yes, something like an onion price has led to governments been shaken down. If you were to look up on the details of The Onion Election, 1980, you'd be amazed to see the worth and value of an onion shaping mindsets and public opinion.

However, this is just one of the many examples of how inflation on a simple commodity like an onion begins affecting the grassroots level right up to country.

This gives you a fair idea on how the effects of inflation on any commodity, big or small, can make an impact.

Did you know?

Inflation numbers are declared by the government between the 11th and the 14th of every month.

But why is inflation such a big problem?

The real problem is that not everything inflates at the same time.

For example, if the cost of a commodity, say, tomatoes increases today, your salary may not keep up with rise in cost. So, with the same salary you will have to buy the commodity at a higher price or skip it on the whole.

This means your purchasing power has decreased.

Let us understand this with a common example:

If 1 kg of tomatoes costs Rs. 11 today, compared to Rs. 10 last year, it indicates a price rise (or inflation) of 10% over a year.

So, if you had Rs. 100 last year, you could’ve bought 10 kgs of tomatoes.

Now let’s assume you kept Rs. 100 unspent for a year. With inflation, the price of tomatoes has risen to Rs. 11, and your ability to buy (or purchasing power) has gone down to 9 kgs of tomatoes with the same amount of money.

So, should you be worried about inflation?

Inflation is not going to just disappear. But governments track inflation obsessively and try their best to keep it as low as possible. To ensure the government can estimate where the inflation rate is heading, it goes through a vast amount of economic data compiled by experts.

But on a personal level, the right way to address inflation is to put your money to work in the right investments and ensure that it grows with time to keep up with inflation.

For example: If you had invested that unspent Rs. 100 at 10% p.a., you would have been able to buy the same quantity of tomatoes, like the year before.

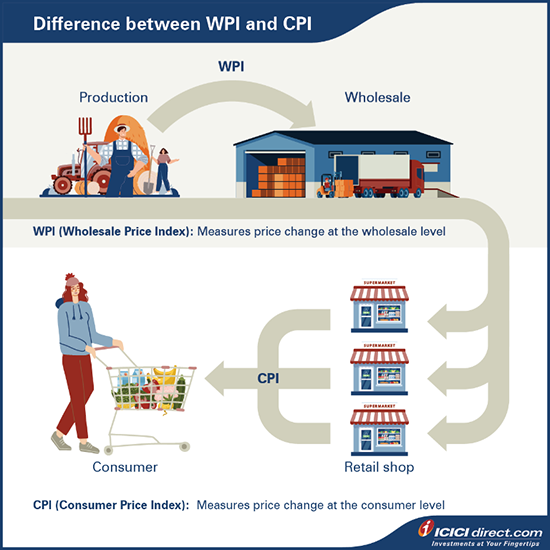

CPI & WPI

In India, inflation is measured by two methods:

Consumer Price Index (CPI) and Wholesale Price Index (WPI).

CPI measures price change at the consumer level, while WPI measures price change at the wholesale level.

To measure inflation, the government has created a basket of essential goods and services and assigned a weightage to each commodity and service.

In India, the basket of goods for CPI is composed of the following groups:

|

Commodity |

Weightage in basket |

|

Food and beverages |

45.86% |

|

Pan, tobacco and intoxicants |

2.38% |

|

Clothing and footwear |

6.53% |

|

Housing |

10.07%, |

|

Fuel and light |

6.84% |

|

Other miscellaneous items |

28.32% |

Source: MOSPI, Dec 2024

Remember, price change in goods and services decides the value of CPI.

But if price changes take place, won't that affect different goods and services differently?

That's an astute observation, well done!

It's true that commodities such as food and energy are likely to be affected by inflation more frequently than, say, clothing. And for this very reason, when inflation is measured, it is further divided into headline inflation and core inflation.

Headline and Core inflation

Headline inflation measures overall inflation figures as reported in the CPI. However, these are highly volatile and are affected by a one-off inflationary movement like the changes in food or energy prices.

Like you noticed in the onion example, a natural occurrence, ‘rain’ affected the price of onions drastically.

So, this doesn’t seem very accurate, does it?

And that’s why the Central Government looks into core inflation. This takes off the one-off or the volatile components to give you a more accurate measure of inflation.

Did you know?

CPI numbers are published by the Indian Ministry of Statistics and Programme Implementation, every month with a lag of about two weeks. In contrast, the Office of the Economic Adviser in the Department for Promotion of Industry and Internal trade is responsible for compiling WPI.

What’s considered an ideal inflation range?

Periodically, the RBI reviews the monetary policy and takes corrective action to control inflation as per the present scenario. So, although it’s hard to give an exact number, usually a CPI ~ 4% may be considered as good inflation.

What happens if the inflation range is a lot higher than that?

An inflation-range higher than the standard may

- Slow down the economy or even cause the economy to collapse if it becomes too high

- Increase unemployment

- Purchasing power of money will reduce drastically

Did you know?

There have been instances of very high inflation in countries like Zimbabwe (March 2007 to Mid-November 2008). The most recent one would be Venezuela, which began in 2016 and the inflation rate reached 344,509% in February 2019. This very high inflation is also known as hyperinflation.

Source: Trading economics

So, does that mean low inflation is good?

Technically, no. Low inflation may also cause:

- Decrease in demand for goods

- Low supply of goods

- Decrease in industry output

- Economic slowdown

Hence, it is crucial to maintain inflation at a steady, desirable range so that goods remain affordable to consumers and business find favorable growth opportunities.

It is like riding a bicycle, where you continuously need to pedal to move and maintain balance.

How does the government control inflation?

The Reserve Bank of India (RBI) controls inflation by changing its monetary policy. The definition of inflation is "more money chasing too few goods". This means when money is circulated at a higher rate or let’s say when there’s high liquidity inflation increases.

To control inflation, the RBI needs to regulate money supply through available tools in the monetary policy. These tools include repo rate, reverse repo rate, CRR, SLR, etc.

We will dive deeper into CRR, SLR and repo rate in the upcoming chapters.

But what if inflation is negative?

Well, in that case, it is termed as deflation.

In this situation, supply exceeds demand. And so, to maintain equilibrium between demand and supply, supply needs to reduce. At the same time, it can help if a stimulus package is provided to boost demand.

So, doesn’t that sound like deflation could be good for the economy?

On the contrary, no.

Deflation could lead to a slowdown and an increase in unemployment. It could also cause the closure of industrial units, layoffs and dive the entire economy into a recessionary phase.

And that’s why it is important to maintain a healthy inflation rate in the economy for sustainable growth.

Also Read: What is Inflation, and how does it impact your investments

Summary

- In India, inflation is measured by two methods: Consumer Price Index (CPI) and Wholesale Price Index (WPI).

- CPI measures price change at the consumer level, while WPI measures price change at the wholesale level.

- The Reserve Bank of India (RBI) regulates inflation by using monetary policy tools. These tools include repo rate, reverse repo rate, CRR, SLR, etc.

In the next chapter, let’s understand the different types of economic policies and how it influences the nation’s economy and you as an investor.

ICICI Securities Ltd.( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Mumbai - 400025, India, Tel No : 022 - 2288 2460, 022 - 2288 2470. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730) and BSE Ltd (Member Code :103) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Composite Corporate Agent License No.CA0113, AMFI Regn. No.: ARN-0845. PFRDA registration numbers: POP no -05092018. We are distributors of Insurance and Mutual funds, Corporate Fixed Deposits, NCDs, PMS and AIF products. We act as a Syndicate, Sub -syndicate member for IPO, FPO. Please note that Mutual Fund Investments are subject to market risks, read the scheme related documents carefully before investing for full understanding and detail. . ICICI Securities Ltd. acts as a referral agent to ICICI Bank Ltd., ICICI Home Finance Company Limited and various other banks / NBFC for personal finance, housing related services etc. & the loan facility is subjective to fulfilment of eligibility criteria, terms and conditions etc. NPS is a defined contribution plan and the benefits would depend upon the amounts of contributions invested and the investment growth up to the point of exit from NPS. Insurance is the subject matter of solicitation. ICICI Securities Ltd. does not underwrite the risk or act as an insurer. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The non-broking products / services like Mutual Funds, Insurance, FD/ Bonds, loans, PMS, Tax, Elocker, NPS, IPO, Research, Financial Learning etc. are not exchange traded products / services and ICICI Securities Ltd. is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism.

Please Enter Email

Thank you.

Track your application

COMMENT (0)