Learning Modules Hide

Hide

- Chapter 1: A Stock Market Guide on Equity Investment

- Chapter 2: Learn Risk & Return on Equity Investment in Detail

- Chapter 3: Learn the Basics of Stock Market Participants and Regulators

- Chapter 4: How Does the Stock Market Work?

- Chapter 5: Guide to stock market trading

- Chapter 6: Stock market investment- Part 1

- Chapter 7: Stock market investment- Part 2

- Chapter 8: What are stock market indices?

- Chapter 9: How to Calculate the Stock Exchange Index: A Stock Market Course for Beginners

- Chapter 10: IPO investing basics

- Chapter 11: Types of IPO Investors in Stock Market

- Chapter 12: IPO Process- From Merchant Banker to Company Listing

- Chapter 13: IPO investment and FPO

- Chapter 14: Important things and Advantages of IPO Investment

- Chapter 15: Corporate Actions: Meaning, Types & Examples

- Chapter 16: Bonus Issue and Rights Issue

- Chapter 17: Corporate Action Purpose and Participation Method

- Chapter 1: Stock Market Valuation- Tips and Techniques

- Chapter 2: Stock Market Valuation- Important Ratios and Terms

- Chapter 3: Types of Stocks in Share Market- Part 1

- Chapter 4 –Types of Stocks in Share Market- Part 2

- Chapter 5: Taxation on Stock Investments – Part 1

- Chapter 6 – Taxation on Stock Investments – Part 2

- Chapter 7 - Difference Between Micro & Macro Economics

- Chapter 8 – Inflation and its Impact on the Economy

- Chapter 9 - Introduction to Economic Policies – Part 1

- Chapter 10 – Introduction to Economic Policies – Part 2

- Chapter 11 – GDP and the Government Budget

- Chapter 12 – Introduction to Foreign Investments and Business Cycles

- Chapter 13 - Economic Indicators

- Chapter 14 - Behavioural Biases and Common Pitfalls in Investment – Part 1

- Chapter 15 - Behavioural Biases and Common Pitfalls in Investment – Part 2

- Chapter 16 - Behavioural Biases and Common Pitfalls in Investment – Part 3

Chapter 9 - Introduction to Economic Policies – Part 1

You must have wondered that why can’t poor countries just print more money and become rich.

More money can solve any problem!

But then, think again.

Let’s understand this situation with a simple example:

Let's say, you order a pizza from a famous restaurant near your workplace every month. Based on your current salary, you set a budget of Rs. 1000 per month for the pizza.

Now let's shift the view from the perspective of the pizza outlet.

The pizza restaurant has a capacity of preparing and supplying 100 pizzas every day. And, since you are a regular, one of those pizza has your name on it.

Three months down the line, you get a salary hike. You now revisit your monthly budget and look into your ordering habits.

With more money in hand, you decide to spend double the amount — Rs. 2000 every month — on the pizza instead of the former Rs. 1000.

Now your revised budget includes one pizzas every fortnight, instead of just one pizza every month.

But of late, their orders have doubled. And that's because all your colleagues who order from the pizza restaurant have also experienced a salary hike. And while that's good news for you and your colleagues, what does the restaurant do?

More orders, means more business and more demand. All this change resulted in the price of pizzas going up as well.

So now as you stare at the revised menu, you have to pay Rs. 1200 for one pizza as compared to Rs. 1000 last month.

You suddenly feel all the excitement draining out of you like a deflated balloon.

So, what has happened here is that your purchasing power has decreased even though you are earning more.

This can help you understand why having more money does not resolve a money problem. More money can lead to a higher prices of goods and sometimes it becomes unaffordable.

Money and a demand and supply of goods and services need to be in line for the economy to sustain and grow.

So, if not print money, what can the government do?

The government and the Central Bank play a vital role in the country's economic situation, and they implement a few planned policies to help manage such cases.

Monetary Policy

India’s central bank, known as The Reserve Bank of India (RBI), is also the one that prints the country’s currency. The RBI controls the money supply by altering interest rates through the monetary policy. This helps in managing inflation.

But what does that mean?

Let’s say the country is facing an economy crisis.

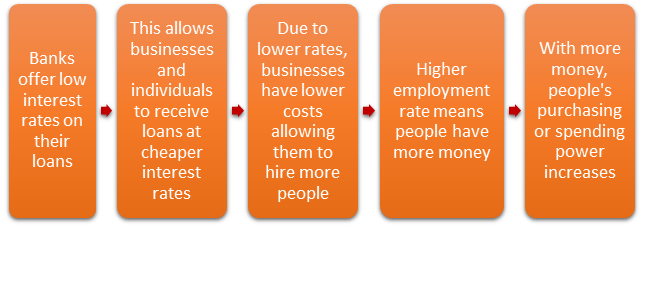

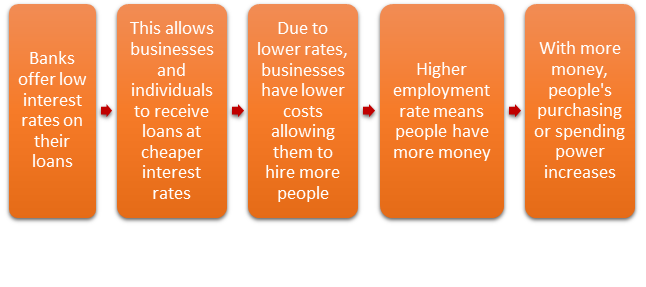

So, in order to help the economy, RBI lowers interest rates.

This means,

Sounds perfect. Then why not keep this as it is?

Well, haven’t you heard? Too much of anything is not a good thing.

It’s the same with the economy.

Let’s continue the above process and see where it’s going.

But how does RBI control the money supply?

RBI controls the money supply and control inflation through various monetary policy tools such as CRR, Repo Rate, SLR, OMO, etc.

Let’s start by discussing them one by one:

Additional Read: A Beginner’s Guide to Monetary Policy Tools

Cash Reserve Ratio (CRR)

When we say that the RBI is India’s central bank, it means that the RBI is the central body that controls all the banks in the country.

Let’s say you keep some money in your bank account for safe keeping.

But did you know that not all of the amount is saved in the bank? A tiny amount is given to the RBI.

Is there an exact amount that the central bank takes?

This amount is decided by the Cash Reserve Ratio. It is the percentage of deposits that banks need to maintain in cash form with the central bank.

Let’s consider the CRR is 5%. When you deposit Rs. 1000 in your bank, this 5% i.e., Rs. 50 is given to the RBI. And the rest, i.e. Rs. 950 is what’s left with the bank to work on.

Why work on?

Well, the bank doesn’t just keep the money. It gives away the money in the form of loans.

But how does this small amount make much of a difference?

So, let’s continue the above example – the bank decides to give the Rs. 950 as a loan to another customer, Rohit, who is in need of money. This money is then deposited in Rohit’s bank account. According to the rules, since the amount is deposited in the bank account, now 5% of Rs. 950 i.e. Rs. 47.5 is again set aside to be given to the RBI. This cycle continues and as the money keeps on circulating, it increases the total money in circulation. This leads to a multiplier effect.

So, let’s see this in action:

|

|

Money deposited in bank 1 |

Money lent out and deposited in bank 2 |

Money went out and deposited in bank 3 |

Money lent out and deposited in bank 4 |

Money kept as reserve by banks |

Total money supply in the market |

|

Stage 0 |

1000 |

0 |

|

|

0 |

1000 |

|

Stage 1 |

1000 |

1000 - 5%*1000 = 950 |

|

|

1000*5% = 50 |

1000 +950 = 1950 |

|

Stage 2 |

1000 |

950 |

950 - 5%*950 = 902.5 |

|

50+ (5%*950) = 97.5 |

1000+950+ 902.5 =2852.5 |

|

Stage 3 |

1000 |

950 |

902.5 |

902.5 - 5%*902.5 = 857.4 |

97.5+(5%*857.4) =140.4 |

1000+950+902.5+857.4 = 3709.9 |

So, how much money does the bank ultimately end up with?

You can find that out by using the money multiplier formula which is basically the inverse of CRR.

So, in the above example with CRR = 5%.

Money Multiplier = (1/CRR) = (1/5%) = 20.

This means Rs. 1,000 in deposit can lead to Rs. 20,000 in money circulation.

Also to note, a slight variation in the CRR can have a significant impact. For instance, with a 4% CRR, total money in circulation would be Rs. 25,000 which also means that the liquidity increases by 25% by increasing the CRR by 1%.

But what if you need your money?

Yes, and that’s why they don’t give away all the money as loans. Banks invest some of the money in liquid assets like government bonds, gold and similar such securities. You see, the bank analyses the regular demand and supply and will set the liquidity accordingly since it is highly unlikely that all their customers withdraw the money at the same time.

Summary

- Money and a demand and supply of goods and services need to be in line for the economy to grow.

- India’s central bank, known as The Reserve Bank of India (RBI), is also the one that prints the country’s currency.

- RBI controls the money supply through various monetary policy tools such as CRR, Repo Rate, SLR, etc.

- Cash Reserve Ratio (CRR) It is the percentage of deposits that banks need to maintain in cash form with the central bank.

Let’s continue this conversation in the next chapter, where we will understand a few more monetary policy tools and touch upon fiscal policy.

Disclaimer: ICICI Securities Ltd.( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Mumbai - 400025, India, Tel No : 022 - 2288 2460, 022 - 2288 2470. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730) and BSE Ltd (Member Code :103) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investment in securities market are subject to market risks, read all the related documents carefully before investing. Composite Corporate Agent License No.CA0113, AMFI Regn. No.: ARN-0845. PFRDA registration numbers: POP no -05092018. We are distributors of Insurance and Mutual funds, Corporate Fixed Deposits, NCDs, PMS and AIF products. We act as a Syndicate, Sub -syndicate member for IPO, FPO. Please note that Mutual Fund Investments are subject to market risks, read the scheme related documents carefully before investing for full understanding and detail. . ICICI Securities Ltd. acts as a referral agent to ICICI Bank Ltd., ICICI Home Finance Company Limited and various other banks / NBFC for personal finance, housing related services etc. & the loan facility is subjective to fulfilment of eligibility criteria, terms and conditions etc. NPS is a defined contribution plan and the benefits would depend upon the amounts of contributions invested and the investment growth up to the point of exit from NPS. Insurance is the subject matter of solicitation. ICICI Securities Ltd. does not underwrite the risk or act as an insurer. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon.

The non-broking products / services like Mutual Funds, Insurance, FD/ Bonds, loans, PMS, Tax, Elocker, NPS, IPO, Research, Financial Learning etc. are not exchange traded products / services and ICICI Securities Ltd. is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)