Candlestick patterns and their significance- Hammer, Hanging Man and Inverted hammer

Candlestick charts has been around for hundreds of years. They are often referred to as "Japanese candles" because the Japanese would use them to analyze the price of rice contracts. A rice trader named Homma from the town of Sakata deserves much of the credit for candlestick development and charting. Over many years of trading, it's likely that his original concepts were altered and improved, eventually leading to the candlestick charting system that we use today. But many of the guiding principles remained the same throughout the years:

- The price action is the supreme parameter and is above the noise(news, earnings, and so on) in the market

- Price is a reflection of the behaviours of the bears and bulls in the market—the underlying assumption will always be based on the fear and greed of the market.

- The actual price may/may not reflect the intrinsic value of the underlying asset

Individual candlesticks can take a variety of forms, some have long bodies, some short wicks/shadows, some have short bodies with long wicks, and so on.

The colour of the body, the size of the wick and the body and where the candle sits relative to the wick tell a lot about the price action that occurs over the time period represented by the candlestick.

We can see how well even a single candlestick communicates the “market sentiment”: whether (and to what extent) bears or bulls were in control and how far traders managed to push prices in both directions.

Let us look at some of the candlestick patterns and their significance:

One-candlestick Patterns

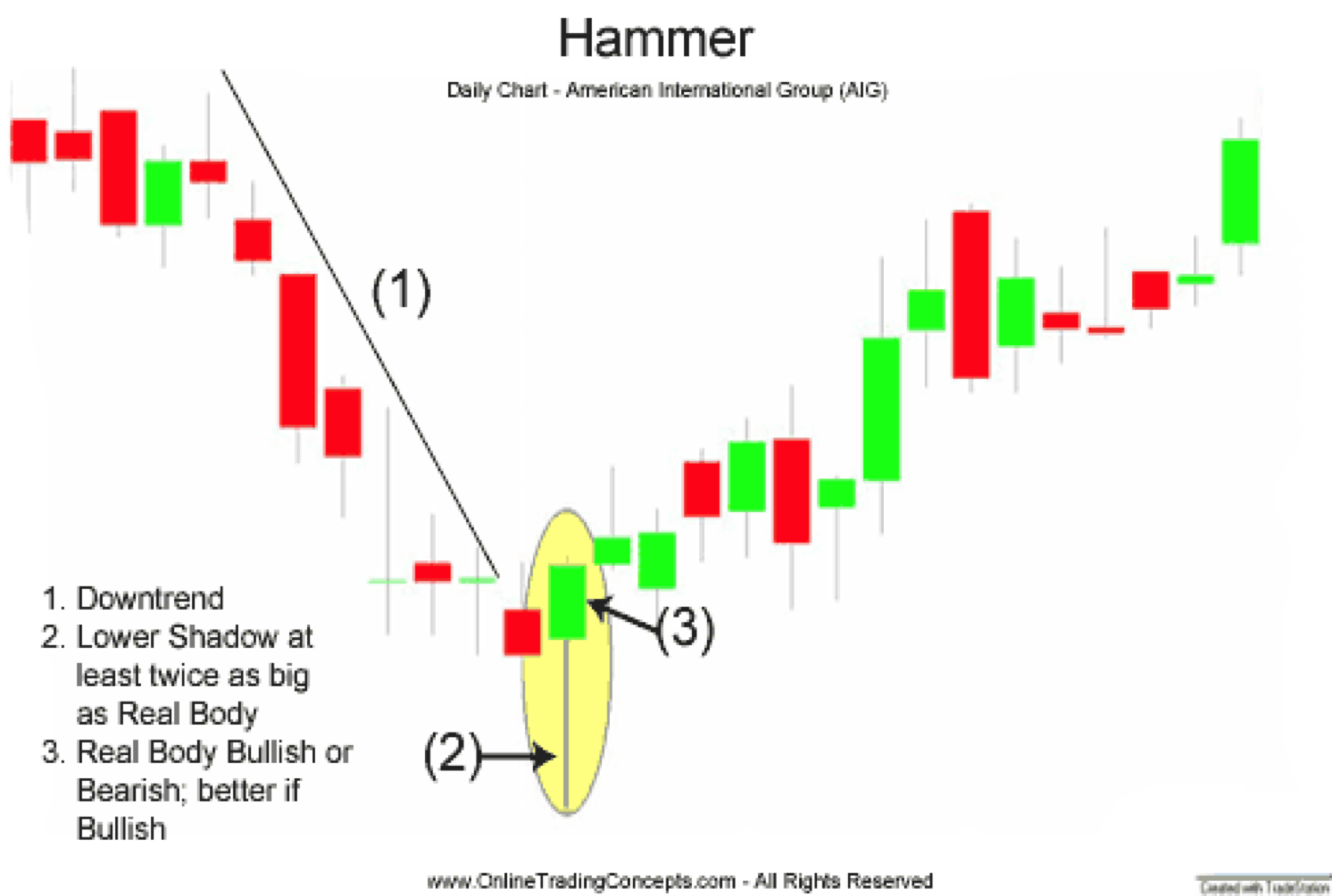

1. Hammer

Hammer is a bullish trend reversal single candlestick pattern that forms after a decline in trend. Therefore, it indicates a change in trend, i.e. from a downtrend to an uptrend. It is so named because it hammers out the bottom. The resulting candlestick has a long lower wick with a short body and little to no upper wick.

Market view

The long lower wick's low suggests that sellers pushed prices lower throughout the session. The strong finish, on the other hand, suggests that buyers recovered to end the session strongly. Even though it might seem like enough to proceed, hammers need more bullish support. The low of the hammer indicates that there are still many sellers. Before taking action, there needs to be more buying pressure, ideally on an increasing volume. A gap up or a long green candlestick could provide such confirmation.

Criteria

- The lower wick should be at least two times the length of the body.

- There should be no upper wick or a very small upper wick.

- The body is at the upper end of the trading range. The colour of the body is not important, although a green body should have slightly more bullish implications.

- A positive day, i.e. a green candle, is required the next day to confirm this signal.

- The stop loss level is the low of the hammer.

- The open and close of the hammer should be in the same price range. A perfect hammer can have its open=high or open=low with the body being in a small range with a 2x size shadow than its body

Trade setup

- The longer the lower wick, the higher the potential of a reversal occurring.

- Large volume on hammer day increases the chances that a blow-off day has occurred.

- A gap down from the previous day's close sets the stage for a stronger reversal move if the day following the Hammer opens higher.

- Hammers can also be used to indicate support or bottom levels in addition to potential trend reversals.

The below examples are taken from the daily timeframe chart of LTI Mindtree and Maharashtra Scooter

2. Hanging Man

The "hanging man" pattern refers to a candle that has the same shape as a hammer, except that hammers occur in downtrends and the hanging man pattern occurs in uptrends.

Market view

The hanging man pattern is formed when bulls push prices higher at the open price of a trading session but bear then enter the market and push prices lower. The bulls eventually manage to push prices back up, but they can't maintain the momentum, and prices close near the open. This creates the small real body and long lower wick that characterizes the hanging man pattern.

The hanging man pattern is considered a bearish reversal pattern because it suggests that the bulls are losing control and bears are taking over. It is often interpreted as a signal that the uptrend is weakening and a downtrend may be starting.

Criteria

- The candlestick must have a small real body near the lower end of the range for the day.

- The candlestick must have a long lower shadow, at least twice the length of the body.

- The upper shadow should be small or non-existent.

- The candlestick must occur after an uptrend.

Trade setup

- To confirm the hanging man pattern, wait for the next candlestick to form. If the following candlestick closes below the hanging man's low, or there is a gap down, or a long red candle is formed with a heavy volume, then it could be a confirmation of the bearish reversal.

- You can sell the stock once the next candlestick closes below the hanging man's low, with a stop-loss set above the high of the hanging man candlestick.

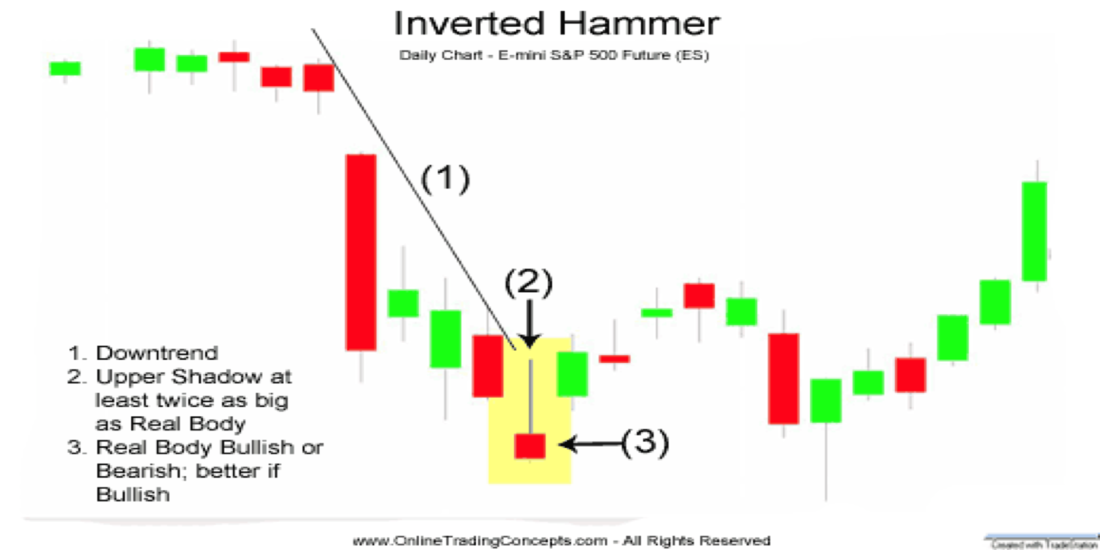

3. Inverted hammer

An "inverted hammer" is a bullish candlestick pattern that can potentially indicate a reversal in a downtrend. The candle has a small body, a long upper wick and a small or non-existent lower wick. This candlestick marks potential trend reversals but requires confirmation before action.

Market view

Inverted Hammers indicate a possible trend reversal or support levels. The long upper wick, which follows a decline, signals buying pressure during the session. The bulls, however, were unable to maintain this buying pressure, and prices closed substantially below their highs, resulting in a lengthy upper wick. This failure calls for bullish confirmation before taking any further action. Bullish confirmation could be provided by an Inverted Hammer supported by a gap-up or a long green candlestick with high volume.

Criteria

- The candlestick must have a small real body near the upper end of the range for the day.

- The candlestick must have a long upper wick, at least twice the length of the body.

- The lower wick should be small or non-existent.

- The candlestick must occur after a downtrend.

Trade setup

- A gap down from the close of the prior day creates the conditions for a more strong reversal

- To confirm, a positive day is required the following day to confirm this signal

To read about candlesticks and technical analysis in detail, click here

Top Mutual Funds

Top Mutual Funds

COMMENT (0)