Multiple Candlestick Patterns: Every Traders Should Know

Multiple Candlestick Patterns provide valuable insights into the market.

1. Bullish Engulfing

The Engulfing pattern is a bullish reversal pattern comprised of two candlesticks of opposite colours. Therefore, this is a bullish reversal pattern that is formed at the bottom of a downtrend. The pattern consists of a large green candle that engulfs a small red candle during a downtrend. It signifies that the buyers are taking over the sellers and a trend reversal is expected.

Market view

The pattern suggests an increase in activity from both bulls and bears as well as a turn in the market's overall sentiment in favour of the bulls. Thus, a bullish engulfing pattern in a downtrend indicates a trend change and the beginning of buyers overtaking sellers, which ultimately drives prices higher in an uptrend.

Criteria

- The body of the previous day’s candlestick should completely be overshadowed by the next day’s candlestick.

- The green candle should have a close above the prior open and the open below the prior close. In other words, the body of the green candle should engulf or overlap the body of the red candle.

- The second candle does not need to engulf the previous candle’s range (high and low). Therefore, ignore the wicks of the candle.

- The color of the first candle is similar to that of the previous one and the body of the second candle is opposite in color to that of the first candlestick.

Trade tip

- Always avoid bullish engulfing candles that appear in a downward primary trend. The bullish engulfing candlestick reverses the primary downward trend, but only for a short time. Ultimately, the primary downward trend takes over and price resumes falling.

- You should trade a bullish engulfing candlesticks when the primary trend is upward and simultaneously look for a downward retrace in a rising price trend.

- The engulfing patterns are most favorable when traded on the higher time frames. Anything below the daily time frame should be ignored.

- Place a stop loss order below the low of the bullish engulfing pattern to limit the loss in case the trade goes against you.

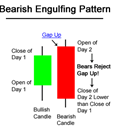

2. Bearish Engulfing

A bearish engulfing pattern is the opposite to the bullish engulfing pattern as it is formed when the bears get the better of the bulls. Therefore, this is a bearish reversal pattern that is formed at the top of an uptrend. This pattern consists of a small green candlestick with a short wick followed by a large red candlestick that engulfs the small green candle.

Market view

The pattern suggests an increase in activity from both bulls and bears as well as a turn in the market's overall sentiment in favour of the bears. A bearish engulfing pattern is most suggestive of the beginning of a bearish price move when it appears at the top of a primary uptrend.

Criteria

- The body of the previous day’s candlestick should completely be overshadowed by the next day’s candlestick.

- The red candle should have a close above the prior open and the open below the prior close. In other words, the body of the red candle should engulf the body of the green candle.

- The second candle does not need to engulf the previous candle’s range (high and low). Therefore, ignore the wicks of the candle.

- The color of the first candle is similar to that of the previous one and the body of the second candle is opposite in color to that of the first candle.

Trade tip

- A bearish engulfing pattern shows the sellers are in control, but it doesn’t mean the price is about to reverse lower.

- Always avoid bearish engulfing candles that appear in an uptrend primary trend. The bearish engulfing candlestick reverses the primary upward trend, but only for a short time. Ultimately, the primary upward trend takes over and price resumes making higher highs.

- The engulfing patterns are most favorable when traded on the higher time frames. Anything below the daily time frame should be ignored.

- Place a stop loss order above the high of the bearish engulfing pattern to limit the loss in case the trade goes against you.

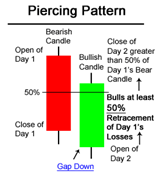

3. Piercing

Piercing pattern is a bullish reversal pattern that can be seen at the end of a downtrend. The first candle of the pattern is a long bearish candle, representing the continuation of the downtrend, and the second candle opens lower than the previous close but then rallies up to close at least halfway up the previous candle.

Market view

The piercing pattern shows that the bulls are starting to take control and are pushing the prices higher, and it suggests that the selling pressure may have come to an end. The long lower wick of the second candlestick indicates that buyers have stepped in at the low of the previous candle and have been able to push prices back up. Therefore, piercing pattern shows that there is a sudden shift in market sentiment from bearish to bullish, and it could potentially indicate the end of a downtrend and the start of a new uptrend. The size and strength of the piercing candlestick can provide additional information about the market sentiment. A larger and more bullish piercing candlestick can suggest that there is more buying pressure and more conviction among buyers, while a smaller and weaker piercing candlestick may indicate a more cautious sentiment among buyers.

Criteria

- The downtrend has been evident for a good period, and a long red candle occurs at the end of the trend.

- The body of the first candle is red; the body of the second candle is white.

- The green candle closes more than halfway up the red candle.

- The second day opens lower than the trading of the prior day.

- The second candle must have a long lower wick, indicating that buyers have taken control and pushed prices up from the low of the previous candle.

- The bigger the second candle and the lower the wick, the stronger the reversal signal.

- The piercing pattern performs best during bear markets, particularly following a downward breakout.

Trade tip

- You can then take a long position with a stop-loss below the low of the piercing pattern candle and a profit target at a predetermined level or using a trailing stop as the price continues to move higher.

- You can also enter a trade at the opening of the next candle after the piercing candle or wait for a pullback to a support level before entering.

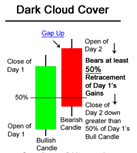

4. Dark cloud cover

The Dark Cloud Cover pattern is the opposite of the Piercing candlestick pattern. It is a bearish reversal pattern occurring at the top of an uptrend. The first green candle is followed by a red candle that opens with a gap up and then closes at least halfway down the body of the preceding candle.

Criteria

- A definite uptrend must be formed before the pattern.

- A red candle must follow a green candle, and the red candle must cross over the midpoint of the previous day's candle. It must open above the high of the previous day, i.e. with a gap up, and it must close more than halfway down the body of the previous day's candle.

- The following day's price must continue to drop and close lower, that is the trend should start weakening, in order to confirm the pattern's presence.

Market view

The pattern occurs at the end of an uptrend and signals a potential shift in market sentiment from bullish to bearish. It shows that the bears are starting to take control and are pushing prices lower. The long upper wick of the second candlestick indicates that sellers have stepped in at the high of the previous candle and have been able to push prices back down. The size and strength of the Dark Cloud Cover pattern can provide additional information about the market sentiment.

Some key points to note:

- The strength of the reversal will increase with the size of the gap up from the close of the previous day. This demonstrates how the market was unable to support those high prices.

- The reversal will be pronounced when the candles are longer.

- The lower the red candle closes into the green candle, the stronger the reversal will be.

- The reversal is more likely to occur when the volume is high on both days.

Trade tip

- You can enter a trade at the opening of the next days's candle after the formation of the Dark Cloud Cover or wait for a pullback to a resistance level before entering.

- Place a stop-loss above the high of the Dark Cloud Cover candle to limit your potential losses if the trade goes against you.

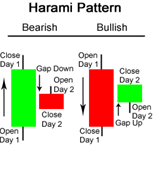

5. Bearish and Bullish Harami

A candlestick that forms within the body of the previous candlestick is in a Harami position.

- Bearish harami: A bearish harami is formed in an uptrend, as it is a bearish reversal pattern. In an uptrend, the bearish harami pattern the first candle (usually a green candle with a large body) encompasses the body of the second candle (usually a small red candle).

- Bullish Harami: A bullish harami is a bullish reversal pattern formed in a downtrend. The pattern consists of a large red candlestick which is followed by a smaller green. candlestick whose body is located within the vertical range of the larger body, i.e the first candle totally encompasses the body of the second candle.

Market view

The harami pattern signifies that the immediately preceding trend may be concluding, and that the bulls and bears have called a truce. The harami pattern also suggests an impending rise in volatility. Due to this, traders now have the chance to set up trades that are based more on an increase in volatility than on a breakout in a particular direction.

Trade tip

For the best results as a reversal candle, look for the bearish harami to appear at the top of an upward retrace in a primary downward price trend. When price breaks out downward, it rejoins the existing primary trend and price tends to drop. The opposite is true for bullish harami pattern too.

Criteria

- The first candlestick has a large body and the second candlestick has a smaller body.

- The wick, both upper and lower, of the second candlestick do not have to be contained/engulfed within the first candlestick. Only the body of the second candlestick, i.e., the open and the close, should be within the range of the first candlestick.

- As harami is a reversal pattern, confirmation is needed. Therefore, the next day should show weakness.

6. Morning and Evening star

A star is a candlestick that has a small body that lies outside of the range of the body before it. It implies an opening gap, and the second candlestick’s body does not overlap the previous candlestick’s body at all. It is similar to a doji in that it represents a sudden halt in a trend and some indecision between buyers and sellers.

In terms of market segments, a star pattern can indicate a potential shift in market sentiment from bearish to bullish or vice versa. If the star pattern forms after a prolonged downtrend, it may suggest that sellers are losing their grip on the market, and a potential reversal could be on the horizon. Conversely, if the star pattern forms after a prolonged uptrend, it may suggest that buyers are losing their grip on the market, and a potential reversal could be on the horizon.

Morning star

- The Morning Star is a bottom/bullish reversal signal. Like its name, the morning star signifies brighter things, like the dawn of a sunrise, or simply the prices are going to go higher. It is formed by a long red candle, a second candle with a small body that gaps below the first body to form a star, and a third green candle that closes well into the first session’s red body.

Market view

Before the morning star pattern is formed, a downtrend has been in place which is assisted by a long red candlestick. The formation of the morning star signifies the weakness of the downtrend. After the first red candle of the morning start of formed, the next day prices gap lower on the open, trade within a small range and close near their open of the first candle. This small body shows the beginning of indecision. The third day prices gap higher on the open and then close much higher, indicating a significant reversal of the downtrend. This 3-candlestick pattern confirms that the bulls have started taking over the trend and a trend reversal is expected.

Criteria

- The first candle should be a long red candle extending the current downtrend.

- The second candle should be short(can be a doji too) and op0en with a gap down.

- The third candle in the pattern should open with a gap up and consists of a closing that is at least halfway up the red candle of two days prior.

Trade tip

For the best performance from the morning star candlestick, look for it when the primary trend is rising. Then the morning star appears as part of a downward retrace of that uptrend. When an upward breakout occurs, price joins with the rising price trend already in existence and away the stock goes like a child's helium balloon untethered.

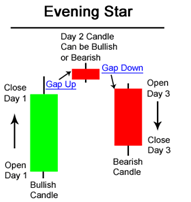

Evening star

The Evening Star pattern is a bearish reversal signal. Again, like its name, the evening star pattern represents the dawn of a sunset, or simply the start of the trend in which the prices are going to decline. Therefore, the evening start is a top/bearish reversal pattern that occurs at the top of an uptrend. It is formed by a long green candle which extend the uptrend, a second candle with a small body that gaps above the first candlestick to form a “star” and a third long red candle that closes well into the first session’s green body.

Criteria

- The uptrend should be apparent before the start of the formation of the evening star.

- The body of the first candle is green and long, continuing the current uptrend.

- The second candle has small trading range showing indecision formation. It should open with a gap up(it could be a doji too).

- The third day shows evidence that the bears have stepped in. This candle is a long red candle which open with a gap down and close at least halfway down the white candle.

*Note: A gap indicates the space between the close of the previous candle and the open of the subsequent candle. Therefore, a gap up means the open of the second candle is above the close of the first candle. Similarly, a gap down means that the open of the second candle is below the close of the first candle.

Key takeaways

- It's important to note that no single indicator can guarantee a successful trade, and traders should use multiple indicators to confirm their trading decisions.

- Additionally, it's important to manage risk by setting appropriate stop-loss orders and position sizing.

Disclaimer: ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. I-Sec is a SEBI registered with SEBI as a Research Analyst vide registration no. INH000000990. AMFI Regn. No.: ARN-0845. Name of the Compliance officer (broking): Ms. Mamta Shetty, Contact number: 022-40701022, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Such representations are not indicative of future results. The securities quoted are exemplary and are not recommendatory. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds

COMMENT (0)