Price Range (₹)

Price Range (₹)

Issue Size (₹ in Cr.)

Minimum Quantity

Bidding Period

- The largest flexible workspace solutions company in India as on December 31, 2023, based on total number of centers (Source: CBRE Report)

- Ranked 1st among the top 5 benchmarked players in the flexible workspace segment with presence in 16 cities in India, as on December 31, 2023 (Source: CBRE Report)

- As on December 31, 2023, they have over 2,295 clients and have presence in 52 micro markets in India

Leadership in a large and growing marketplace

The total addressable market (“TAM”) for the flexible workspace operators represents a sizeable opportunity of ₹ 474-592 billion by 2026.As the largest flexible workspace solutions company in India as on December 31, 2023, based on total number of centers, they believe they are well-positioned to benefit and capture this growth in the flexible workspace segment. (source: Company RHP)

Innovating in the flexible workspace industry with the adoption of MA model

They have reimagined workspace sourcing strategy with their distinctive 'Managed Aggregation (MA)' model. They have increased the percentage of operational seats under the MA model from 46.37%, in FY21 to 57.66% in FY23 and have the largest number of centers under the MA model among the organized flexible workspace players in India as of December 31, 2023. (Source: Company RHP)

Diverse space sourcing and demand strategies

Their diverse supply sourcing strategy targets all segments of the India commercial office market ranging from organized to unorganized, institutional to non- institutional and across various grades and classes of properties. They have also adopted a demand-based build approach wherein they typically only build a small portion of the center with base amenities after they identify a center. The rest of the center is built out as and when they enter arrangements with clients for the utilization of the space at the center (Source: Company RHP)

Has a history of net losses, negative earnings per share (“EPS”) and return on net worth (“RoNW”)

They have incurred losses for Fiscals 2021, 2022 and 2023 and nine months ended December 31, 2023.They may continue to incur losses, have negative EPS or RoNW for the foreseeable future and may not achieve or maintain profitability in the future. Any failure by us may have an adverse impact on the value of their Equity Shares. (Source: Company RHP)

Their growth may be negatively impacted by macroeconomic factors

Their results of operations are affected by the level of business activity of their clients, which in turn is affected by the macroeconomic conditions in the economy and the industries in which they operate. Any slowdown in the global economy or India’s economic growth, or the information technology industry in India, could affect the overall business environment and specifically demand for flexible workspaces leading to a decrease in demand for their solutions(Source: Company RHP)

- Rental Trends: Key markets such as Bengaluru, Pune, Hyderabad, and Chennai have consistently witnessed rent growth since 2014, driven by constrained supply in prime locations coupled with robust demand from technology tenants. Cities like Mumbai, Gurgaon and Noida have also witnessed growth albeit at a slower pace. Given the sustained demand momentum, rental growth has further accelerated since 2016. However, limited growth in rental witnessed during 2020-21 owing to the onset of COVID-19 pandemic.

- Tenant Sectors driving demand in commercial office in India: Technology sector and financial services contribute to major office take-up in India. Space take-up by the technology sector was 29.2% and 22.1% in 2022 and 2023, respectively. Further, the co-working sector to continue driving demand of office space offtake.

| Retail Individual Investor | |

| Non-Institutional Investor | |

| Qualified Institutional Buyers | |

| Employee | |

| Overall |

Applications

refunds

Convenient investments

of application

For ICICI Bank linked A/c

For non ICICI Bank A/c

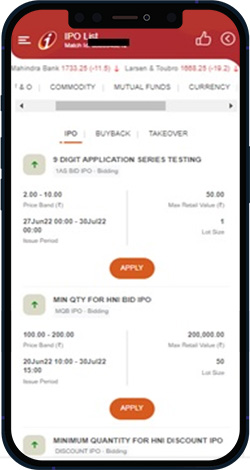

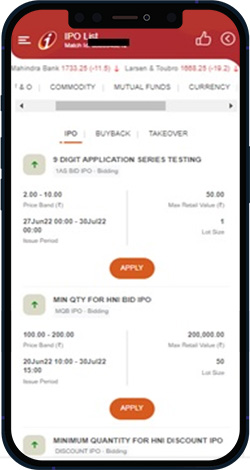

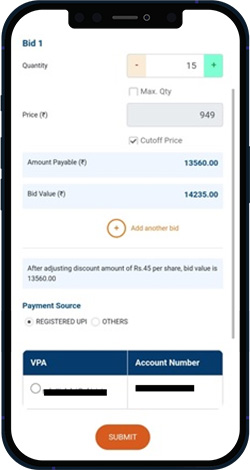

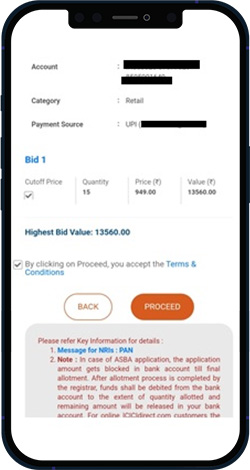

Go to the IPO section, select the IPO you want to apply from the list and click on ‘Apply’.

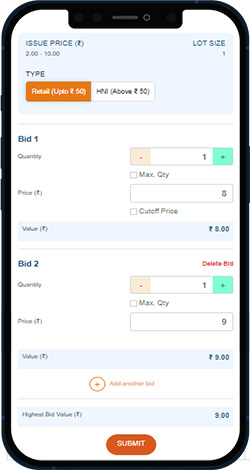

Fill in the quantity of the number of shares you want to buy. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

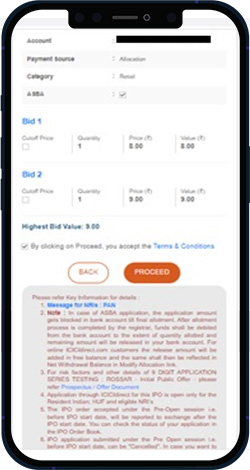

Click on proceed to confirm the order. You can view the placed order under “order book”.

Choose the IPO you want to apply from the list. Click on Apply.

Fill in the quantity of shares. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

Check the A/C, UPI details and click on proceed. You will get an UPI link by which payment can be made.

Trusted by

customers

Investments & Liability Products

Investment Basket

Access to

The lot size is 39 shares and minimum investment required is Rs. 14,937 for Awfis Space Solutions IPO

Awfis Space Solutions IPO is mainboard IPO of issue size up to Rs.598.93 Crores

Awfis Space Solutions IPO issue dates are from 22nd – 27th May, 2024

The allotment date is 28th May and listing date is 30th May, 2024 for Awfis Space Solutions IPO

Head to IPO section on ICICI Direct website and select Awfis Space Solutions IPO. Enter and submit bid details and then click on proceed to apply once you cross-check all the bid details. It’s that simple!!

The price band of Awfis Space Solutions IPO is Rs.364 – Rs.383

The book runners for the Awfis IPO are ICICI Securities Ltd, Axis Capital Limited, IIFL Securities Ltd, Emkay Global Financial Services Ltd

The objectives of Awfis Space Solutions IPO are

1.Funding capital expenditure towards establishment of new centers

2.Funding working capital requirements

3.General corporate purposes.

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.