Price Range (₹)

Price Range (₹)

Issue Size (₹ in Cr.)

Minimum Quantity

Bidding Period

- A leading manufacturer of white oils by revenue with a growing focus on the consumer and healthcare end-industries (Source: CRISIL Report)

- As of June 30, 2022, their product suite comprised over 350 products primarily across the personal care, healthcare and performance oils (“PHPO”), lubricants and process and insulating oils (“PIO”) divisions under the “Divyol” brand

Extensive and diversified customer base

The company has catered to an extensive customer base of 3,529 Indian and global companies during the Financial Year 2022. Their customers in the PHPO division include P&G, Unilever, Marico, Emami, Bajaj Consumer Care, Encube, Patanjali Ayurved, Dabur, Amrutanjan Healthcare, Supreme Petrochem and other leading Indian manufacturers of pharmaceutical products (Source: Company DRHP)

Strategically located manufacturing facilities and in-house R&D capabilities

The company currently operate three manufacturing facilities, with two plants located in Western India and one plant located in Sharjah, UAE, spread across 1,28,454 square meters to cater to Indian and global operations. They have an R&D facility located at Silvassa manufacturing facility.(Source: Company DRHP)

Resilient, flexible and scalable business model with prudent risk management framework

The company has three decades of experience in the specialty oils industry. They focus on minimizing price risk and foreign exchange risk, efficient inventory management and prudent capital, credit and liquidity management. (Source: Company DRHP)

Exposed to counterparty credit risk and any delay in, or non-receipt of, payments may adversely affect cash flows

They are exposed to counterparty credit risk in the usual course of business due to the nature of, and the inherent risks involved in, dealings, agreements and arrangements with counterparties who may delay or fail to make payments or perform their other contractual obligations. (Source: Company DRHP)

They have had negative operating cash flows in the past and may have negative operating cash flows in the future.

The Company has incurred negative cash flows from operating activities in the quarter ended June 30, 2022 aggregating to ₹1,058.08 million, primarily due to an increase in working capital requirements. Their ability to generate cash flows is subject to general economic, financial, competitive, industry, legal and other factors, and conditions, many of which are outside their control (Source: Company DRHP)

Global specialty oil to reach $149 billion by 2027: The global specialty oil market value, estimated at $125.99 billion in 2022, is expected to grow to $148.7 billion by 2027, at a CAGR of 3.4%. It is estimated to create an absolute incremental opportunity of ~$23 billion over the next five years driven by increasing consumption of specialty oils in different end-use industries such as consumer, pharmaceuticals, automotive, manufacturing, power generation, and others.

White oil market is the fastest growing product type in the specialty oil market globally: Mineral oils that have been refined to make them pure, stable, colourless, odourless, and non-toxic are known as white oils and their demand is mainly driven by increasing usage of personal care products (such as creams, lotions, and laxatives) and pharmaceuticals. Both these industries are on an uptrend due to improving lifestyles, an increasing focus on self-care, and rising awareness about personal hygiene and health. (Source: Company DRHP)

| Retail Individual Investor | |

| Non-Institutional Investor | |

| Qualified Institutional Buyers | |

| Employee | |

| Overall |

Applications

refunds

Convenient investments

of application

For ICICI Bank linked A/c

For non ICICI Bank A/c

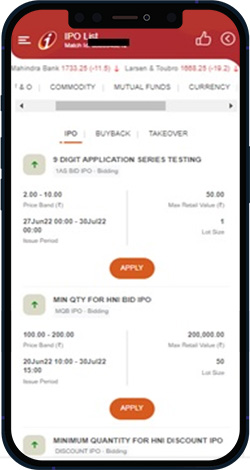

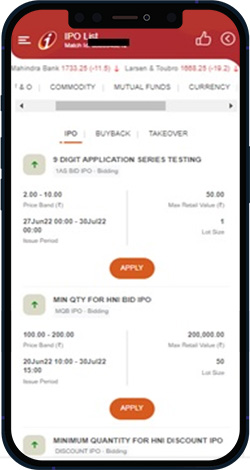

Go to the IPO section, select the IPO you want to apply from the list and click on ‘Apply’.

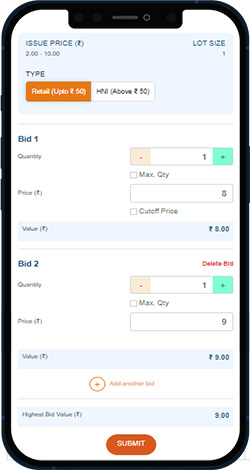

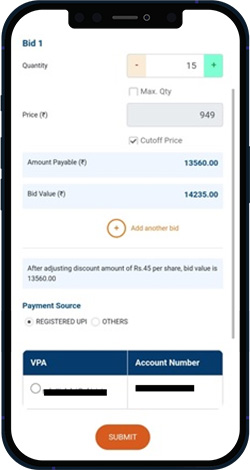

Fill in the quantity of the number of shares you want to buy. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

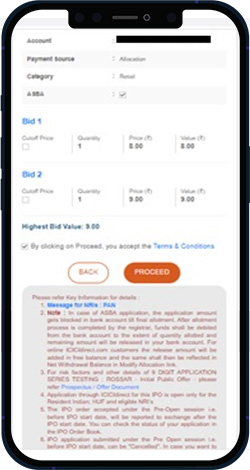

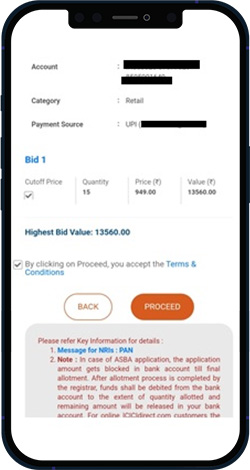

Click on proceed to confirm the order. You can view the placed order under “order book”.

Choose the IPO you want to apply from the list. Click on Apply.

Fill in the quantity of shares. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

Check the A/C, UPI details and click on proceed. You will get an UPI link by which payment can be made.

Trusted by

customers

Investments & Liability Products

Investment Basket

Access to

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.