Price Range (₹)

Price Range (₹)

Issue Size (₹ in Cr.)

Minimum Quantity

Bidding Period

Hero FinCorp: A Rising Star in India's Financial Services Industry

Hero FinCorp, a prominent player in the non-banking financial company (NBFC) sector, is preparing for its much-anticipated Initial Public Offering (IPO). As part of the renowned Hero Group, which is well-known for its dominance in the two-wheeler market through Hero MotoCorp, Hero FinCorp has carved out a significant niche for itself in the Indian financial services sector. The IPO is expected to be a major event, attracting both institutional and retail investors.

This article delves into the details of Hero FinCorp's business model, market position, and key financials, while offering insights into why this IPO could be a good investment opportunity for potential investors.

Overview of Hero FinCorp

Hero FinCorp initially began its journey as a provider of financing solutions for Hero MotoCorp customers, offering loans for two-wheelers. Over the years, it diversified its offerings, growing into a full-fledged financial services company. The company now serves a broad customer base, offering products that cater to individuals, small and medium-sized enterprises (SMEs), and large corporations.

Key Services Offered by Hero FinCorp

Why Hero FinCorp is Going Public

Hero FinCorp is set to launch its IPO with the aim of raising capital for expansion and to strengthen its balance sheet. The company is well-established in the financial services industry but has ambitious growth plans. Here are some of the main reasons why Hero FinCorp is opting for an IPO:

Hero FinCorp IPO Details

Financial Performance

Hero FinCorp has experienced robust financial growth over the past few years, driven by its expanding customer base, product portfolio, and strategic initiatives. Below is a summary of the company’s financial performance for the fiscal years ending March 31, 2024, 2023, and 2022.

Table: Financial Summary of Hero FinCorp (in INR crore)

|

Financials Metrics |

31 Mar 2024 |

31 Mar 2023 |

31 Mar 2022 |

31 Mar 2021 |

|

Total revenue from operations |

7,755.24 |

6,003.77 |

4,440.58 |

4,045.93 |

|

Total expenses |

6,879.49 |

5,320.33 |

4,746.71 |

4,001.57 |

|

Total liabilities |

42,789.72 |

34,842.01 |

27,000.41 |

22,657.63 |

|

Profit/ (loss) after tax |

601.92 |

457.33 |

194 |

70.62 |

Key Financial Insights

Industry Outlook

India’s financial services sector is undergoing rapid transformation, driven by technological advancements, regulatory reforms, and changing consumer preferences. The country’s large population, growing middle class, and increasing demand for credit provide a significant opportunity for companies like Hero FinCorp to expand.

The Indian financial services market is expected to grow at a compound annual growth rate (CAGR) of 15.77% between 2023 and 2029. Factors such as increased financial inclusion, digitization, and rising demand for consumer loans are likely to drive this growth.

Hero FinCorp is well-positioned to benefit from these trends, thanks to its strong brand presence, diverse product offerings, and commitment to innovation. The company’s focus on expanding into underserved markets, especially in rural areas, will further strengthen its position in the Indian financial services landscape.

Risks and Challenges

While Hero FinCorp has significant growth potential, there are several risks and challenges that the company needs to navigate:

Conclusion

Hero FinCorp has established itself as a prominent player in India’s financial services sector, with a strong focus on customer-centric solutions, innovation, and growth. The company’s solid financial performance, expanding product portfolio, and strategic initiatives make it well-positioned to capitalize on the opportunities in India’s fast-growing financial services market.

However, as with any financial services company, Hero FinCorp faces certain risks, including competition, regulatory changes, and credit risk. Investors and customers alike should keep these factors in mind while considering the company’s future prospects.

Overall, Hero FinCorp’s growth trajectory, strong brand association with Hero MotoCorp, and commitment to expanding financial inclusion make it a compelling entity in India’s dynamic financial landscape.

| Shareholder | |

| Retail Individual Investor | |

| Non-Institutional Investor | |

| Qualified Institutional Buyers | |

| Employee | |

| Overall |

Applications

refunds

Convenient investments

of application

For ICICI Bank linked A/c

For non ICICI Bank A/c

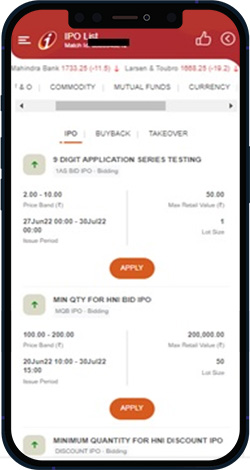

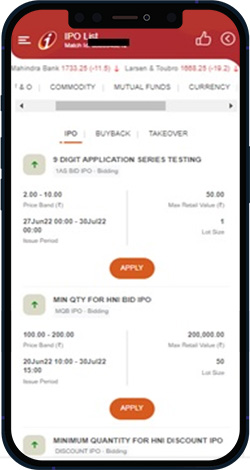

Go to the IPO section, select the IPO you want to apply from the list and click on ‘Apply’.

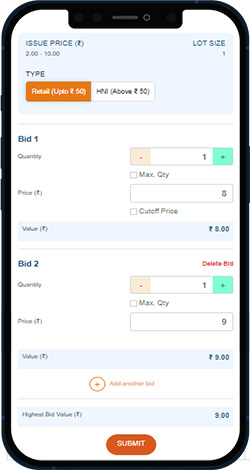

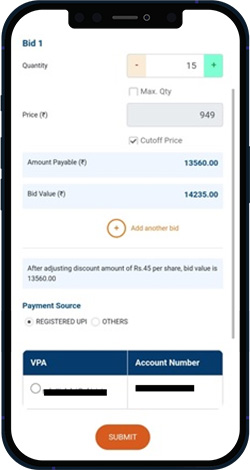

Fill in the quantity of the number of shares you want to buy. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

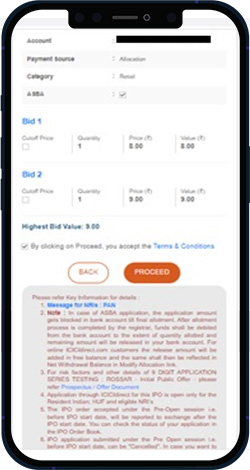

Click on proceed to confirm the order. You can view the placed order under “order book”.

Choose the IPO you want to apply from the list. Click on Apply.

Fill in the quantity of shares. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

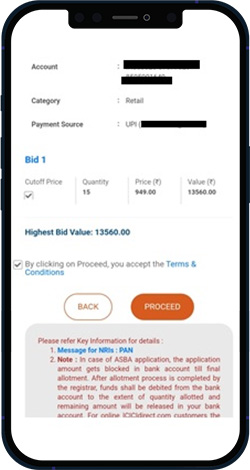

Check the A/C, UPI details and click on proceed. You will get an UPI link by which payment can be made.

Trusted by

customers

Investments & Liability Products

Investment Basket

Access to

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.