Price Range (₹)

Price Range (₹)

Issue Size (₹ in Cr.)

Minimum Quantity

Bidding Period

| Shareholder | |

| Retail Individual Investor | |

| Non-Institutional Investor | |

| Qualified Institutional Buyers | |

| Employee | |

| Overall |

JSW Cement IPO: A Detailed Overview

JSW Cement, a subsidiary of the renowned JSW Group, is gearing up for its Initial Public Offering (IPO), which has generated significant interest from investors. The company, known for its strong presence in the Indian cement industry, is positioning itself to raise capital to fuel future growth and expansion. JSW Cement is part of the larger JSW Group, a multi-billion-dollar conglomerate with interests in sectors like steel, energy, and infrastructure.

This article provides an in-depth look at the upcoming JSW Cement IPO, its business model, financial performance, market outlook, and factors that investors should consider before deciding to invest.

About JSW Cement

JSW Cement is one of India’s leading producers of green cement, with a focus on sustainability and environmental responsibility. The company has built a reputation for manufacturing high-quality cement using advanced technology and a commitment to reducing its carbon footprint. As part of the JSW Group, the company benefits from strong brand recognition, a vast distribution network, and a diversified portfolio of businesses.

Key Business Segments of JSW Cement

Why JSW Cement is Going Public

The decision to launch an IPO is a key step in JSW Cement’s growth strategy. Here are the primary reasons why the company is opting for an IPO:

JSW Cement IPO Details

Indian Cement Industry Overview

The cement industry in India is one of the largest in the world, with the country being the second-largest producer of cement globally. The industry is driven by strong demand from sectors like infrastructure, real estate, and housing. The government’s push for infrastructure development through projects like Smart Cities, highways, and affordable housing has further boosted the demand for cement.

In recent years, there has been a growing focus on sustainable construction and green building materials. This shift has created an opportunity for companies like JSW Cement, which are committed to environmentally friendly production methods. With India’s growing urbanization, rising population, and increasing infrastructure spending, the demand for cement is expected to remain strong in the coming years.

Financial Performance of JSW Cement

JSW Cement’s financial performance has been robust in recent years, driven by strong demand for its products and strategic investments in capacity expansion. Below is a summary of the company’s financial performance for the fiscal years ending March 31, 2024, 2023, 2022 and 2021

Table: Financial Summary of JSW Cement (in INR crore)

|

Financial Metrics |

31 Mar 2024 |

31 Mar 2023 |

31 Mar 2022 |

31 Mar 2021 |

|

Total Assets |

28,290 |

21,622 |

22,473 |

13,949 |

|

Total revenue from operations |

169.5 |

406.7 |

186.1 |

92.8 |

|

Total expenses |

12.07 |

5.9 |

5.7 |

5.1 |

|

Profit for the year |

118.6 |

299.6 |

134.6 |

65.7 |

Key Financial Insights

Growth Prospects for JSW Cement

The cement industry in India is expected to continue growing at a healthy pace, driven by the government’s infrastructure push and rising demand from the housing sector. JSW Cement, with its focus on green cement and sustainability, is well-positioned to capitalize on these growth opportunities.

Risks and Challenges

While JSW Cement has strong growth prospects, there are several risks and challenges that investors should be aware of before investing in the IPO:

Conclusion

The JSW Cement IPO presents a promising opportunity for investors looking to invest in one of India’s leading cement manufacturers. With a focus on sustainability, capacity expansion, and technological innovation, JSW Cement is well-positioned to capitalize on the growing demand for cement in India and international markets.

However, as with any investment, there are risks involved. Investors should carefully consider the company’s financial performance, market conditions, and competitive landscape before making a decision. Overall, JSW Cement’s strong brand, commitment to sustainability, and growth potential make it a compelling investment option in the Indian cement industry.

For ICICI Bank linked A/c

For non ICICI Bank A/c

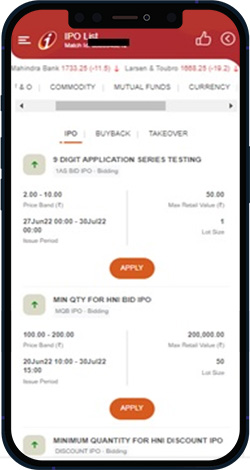

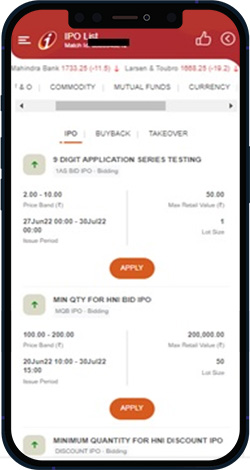

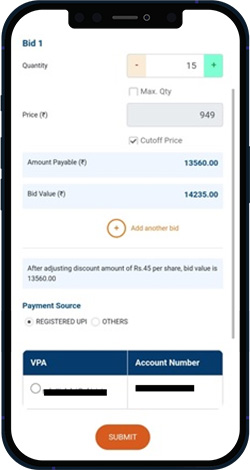

Go to the IPO section, select the IPO you want to apply from the list and click on ‘Apply’.

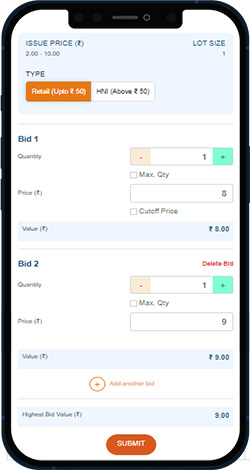

Fill in the quantity of the number of shares you want to buy. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

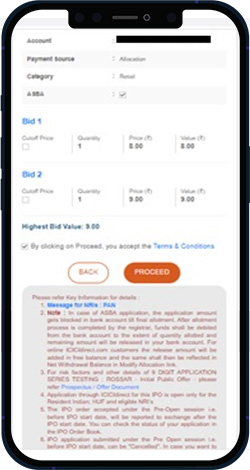

Click on proceed to confirm the order. You can view the placed order under “order book”.

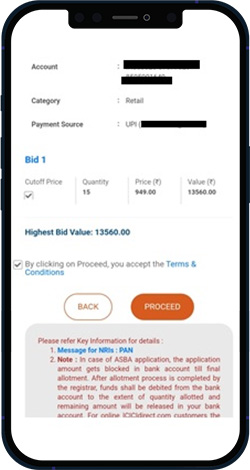

Choose the IPO you want to apply from the list. Click on Apply.

Fill in the quantity of shares. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

Check the A/C, UPI details and click on proceed. You will get an UPI link by which payment can be made.

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.