Price Range (₹)

Price Range (₹)

Issue Size (₹ in Cr.)

Minimum Quantity

Bidding Period

- The fastest growing port-related infrastructure company in terms of growth in installed cargo handling capacity and cargo volumes handled during Fiscal 2020 to Fiscal 2022. (Source: CRISIL Report and Company DRHP)

- They provide maritime related services including, cargo handling, storage solutions, logistics services and are evolving into an end-to-end logistics solutions provider. (Source: Company DRHP)

Fastest growing port-related infrastructure company and second largest commercial port operator in India

The fastest growing port-related infrastructure company and the second largest commercial port operator in India in terms of growth in installed cargo handling capacity and cargo volumes handled from Fiscal 2020 to Fiscal 2022. Their installed cargo handling capacity in India grew at a CAGR of 22.35% between March 31, 2020 and March 31, 2022,(Source: CRISIL Report & Company DRHP)

Predictable revenues driven by long-term concessions, committed long-term cargo and stable tariffs

Port Concessions are long life assets with concession periods typically ranging between 30 to 50 years. As of December 31, 2022 the capacity weighted average balance concession period of the company's ports and port terminals is approximately 25 years, providing them long-term visibility of revenue streams.(Source: Company DRHP)

Diversified operations in terms of cargo profile, geography and assets

The company has evolved into a large maritime infrastructure company and has developed and operate multi-cargo ports and port terminals that are equipped to handle various categories of cargo, including dry bulk, break bulk, liquid bulk, LPG, LNG and containers. (Source: Company DRHP)

Their port services, logistics operations and other operations are subject to operational risks.

The operation of port services may be adversely affected by many factors, such as the breakdown of equipment, accidents, fatalities, labour disputes, increasing government regulations, lack of qualified equipment operators(Source: Company DRHP)

The Company and certain of its Subsidiaries have incurred losses in the past.

The company recorded losses before tax of ₹513.16 million during the nine months ended December 31, 2022 on a standalone basis on account of sharp depreciation in the Indian Rupee. In addition, few subsidiaries have incurred losses.In the event company and its subsidiaries continue to incur losses, consolidated results of operations and financial condition will continue to be adversely affected. (Source: Company DRHP)

- India has been capturing share in global export of goods and services : The share of India in global export of goods and services has increased from 2.1% in the year 2016 to 2.4% in 2021. Historically, India has performed well in exporting IT services. Export of goods has also picked up in last few years. (Source: Company DRHP)

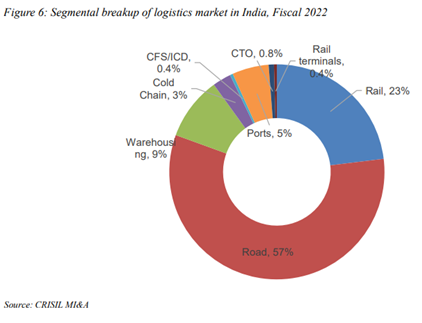

- Overview of logistics sector in India : In logistics, the market size of key segments : Road transport, rail transport, warehousing, cold chain, logistics, and rail freight terminals is estimated to be approximately Rs 13.0 trillion in Fiscal 2022(Source: Company DRHP). The segmental contribution in market size is shown in the chart below:

| Retail Individual Investor | |

| Non-Institutional Investor | |

| Qualified Institutional Buyers | |

| Employee | |

| Overall |

Applications

refunds

Convenient investments

of application

For ICICI Bank linked A/c

For non ICICI Bank A/c

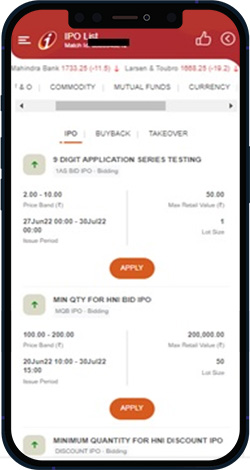

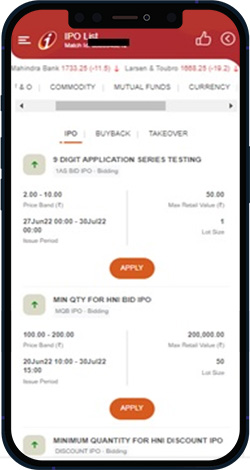

Go to the IPO section, select the IPO you want to apply from the list and click on ‘Apply’.

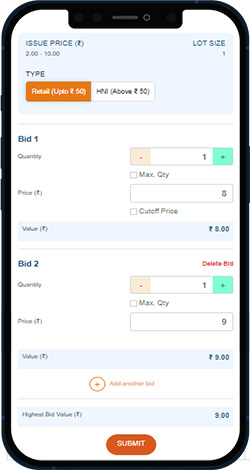

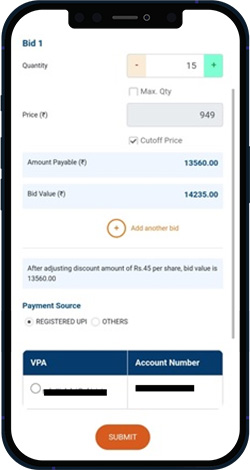

Fill in the quantity of the number of shares you want to buy. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

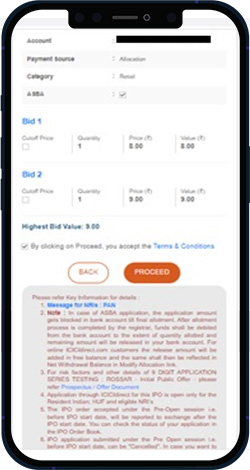

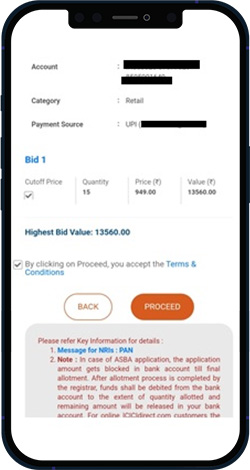

Click on proceed to confirm the order. You can view the placed order under “order book”.

Choose the IPO you want to apply from the list. Click on Apply.

Fill in the quantity of shares. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

Check the A/C, UPI details and click on proceed. You will get an UPI link by which payment can be made.

Trusted by

customers

Investments & Liability Products

Investment Basket

Access to

The lot size is 126 shares for JSW Infrastructure IPO

The issue size of JSW Infrastructure IPO is up to Rs.2800 Crores

JSW Infrastructure IPO opens from Sep 25th,2023 and closes on Sep 27th,2023 for subscription.

JSW Infrastructure IPO shares will be allotted on Oct 03rd, 2023

JSW Infrastructure IPO listing date is Oct 06th ,2023

The price band of JSW Infrastructure IPO is Rs.113 –Rs.119 per share.

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.