Nykaa is a digitally native consumer technology platform, delivering a content-led, lifestyle retail experience to consumers. They have a diverse portfolio of beauty, personal care and fashion products, including their owned brand products manufactured by Nykaa. Since incorporation in 2012, they have invested both capital and creative energy towards designing a differentiated journey of brand discovery for their consumers.

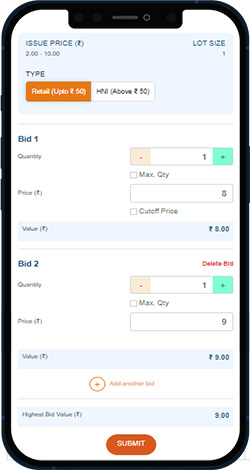

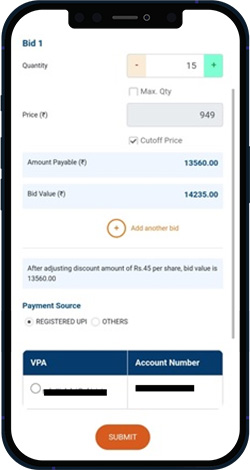

Price Range (₹)

Top Mutual Funds

Top Mutual Funds

25 Oct 2021

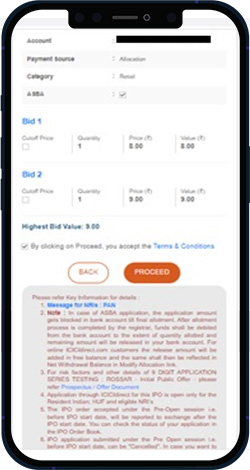

ICICI Securities

25 Oct 2021

ICICI Securities