- A pure EV player in India. Manufactures EVs and certain core EV components like battery packs, motors and vehicle

frames at the Ola Futurefactory

- Has delivered four products and additionally announced six new products since their first product announcement in August 2021.

- Has the highest revenue of all Indian incorporated electric 2Ws (“E2Ws”) original equipment manufacturers (“OEMs”)

from E2W sales in Fiscal 2023 according to the Redseer Report

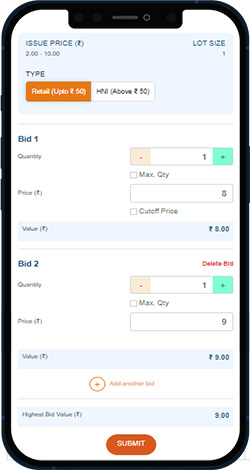

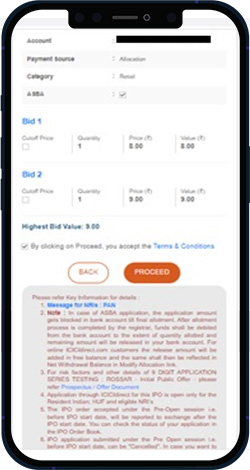

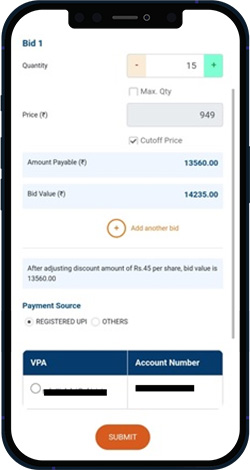

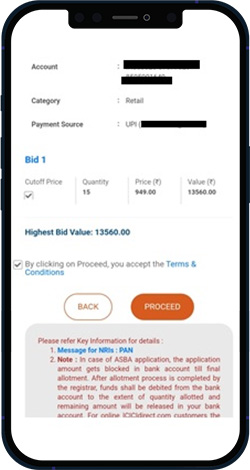

Price Range (₹)

Top Mutual Funds

Top Mutual Funds