Price Range (₹)

Price Range (₹)

Issue Size (₹ in Cr.)

Minimum Quantity

Bidding Period

- A super-premium and luxury furniture brand in India

- The fourth largest player in the home furniture segment in India in terms of revenue in Fiscal 2023

- Among the few home-grown super-premium and luxury consumer brands in India operating at scale in terms of manufacturing as well as retail operations

Largest and the fastest growing brand

The largest in terms of number of stores and the fastest in term of revenue growth growing brand in the furniture segment. (Source: RedSeer Report) Their revenue from operations increased from ₹ 1,957.80 million in Fiscal 2021 to ₹ 4,189.98 million in Fiscal 2023

Presence in Markets with High Growth Potential

Their product portfolio includes sofas, cabinetry and furniture for living rooms, dining rooms, family rooms, kitchens, bedrooms (including bedding products), and home offices, offering complete home solutions including installations. They have continuously expanded their product offerings by leveraging the “Stanley” brand

Pan-India presence with strategically located stores

They have an extensive pan-India retail presence across various store formats which allows them to target various markets ensuring enhanced brand visibility. They have the largest network of retail outlets that offer luxury furniture products in India, as of January 31, 2024.(Source: Company RHP)

Business is highly dependent on the sale of sofas and recliners

Their business is currently highly dependent on the sale of sofas and recliners. The sale of sofas and recliners are dependent on a number of factors, and may decline as a result of increased competition, pricing pressures arising out of increase in raw material costs or fluctuations in the demand for or supply of their products and other factors outside their control. (Source: Company RHP)

They depend on limited suppliers for the supply of leather, one of their primary raw materials

They currently rely on limited foreign and domestic suppliers to provide leather.The loss of one or more of their significant suppliers or any increase in the cost of leather we obtain from them could have an adverse effect on business, results of operations, financial condition and cash flows.(Source: Company RHP)

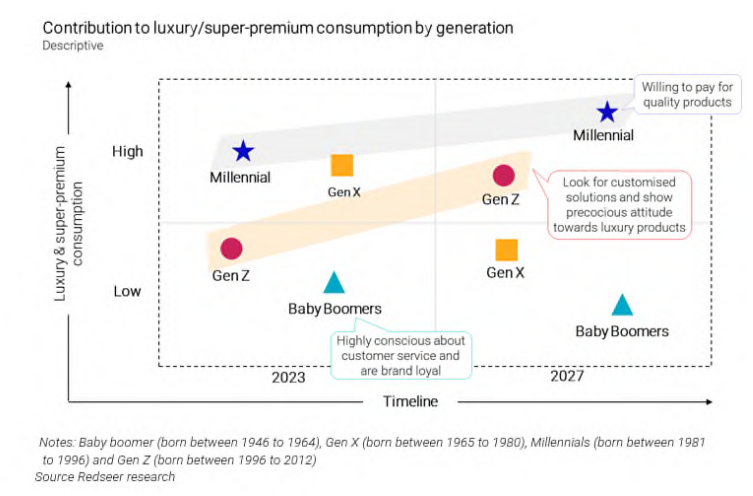

- Strong affinity towards personalised luxury/super-premium goods : Individuals have developed a high affinity for luxury/super-premium brands due to its ability to customise products and provide a sense of exclusivity, esteem, and prestige to the consumers. Personalised luxury/super-premiumgoods also serve as status symbols and help affluent showcase their wealth & social status.

- Transition in customer segmentation: There has been a rapid increase in the millennial population (anyone born between 1981 and 1996 ages 25 to 40 in 2021) and Gen Z population (anyone born between 1996 and 2010). These group of population embrace luxury/super-premium products as they prioritise value offered by the products.Millennials and Gen Z populations are also digital natives and continuously engage with online content and are expecting highly sophisticated digital experiences

| Retail Individual Investor | |

| Non-Institutional Investor | |

| Qualified Institutional Buyers | |

| Employee | |

| Overall |

Applications

refunds

Convenient investments

of application

For ICICI Bank linked A/c

For non ICICI Bank A/c

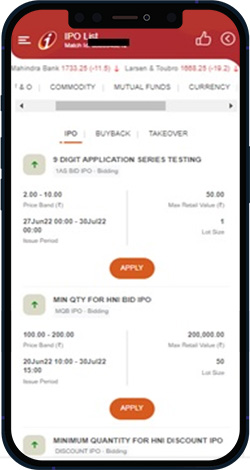

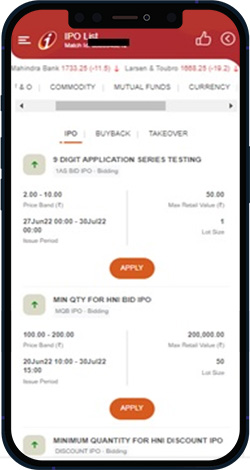

Go to the IPO section, select the IPO you want to apply from the list and click on ‘Apply’.

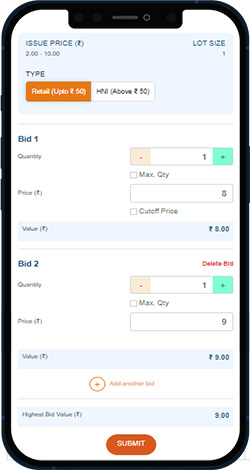

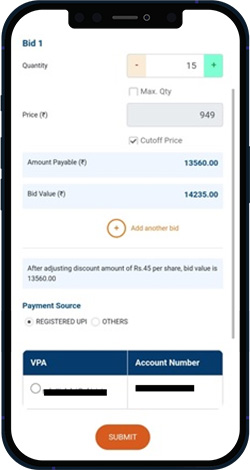

Fill in the quantity of the number of shares you want to buy. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

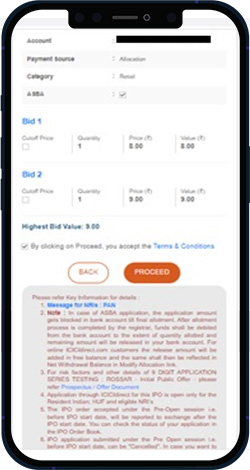

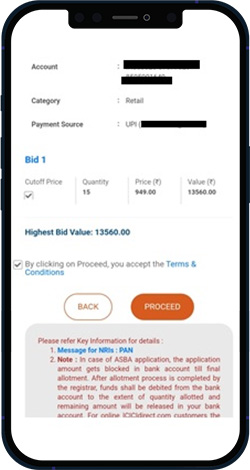

Click on proceed to confirm the order. You can view the placed order under “order book”.

Choose the IPO you want to apply from the list. Click on Apply.

Fill in the quantity of shares. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

Check the A/C, UPI details and click on proceed. You will get an UPI link by which payment can be made.

Trusted by

customers

Investments & Liability Products

Investment Basket

Access to

The lot size is 40 shares and minimum investment required is Rs.14,760 for Stanley Lifestyles IPO

Stanley Lifestyles IPO is mainboard IPO of issue size up to Rs.537.02 Crores

Stanley Lifestyles IPO issue dates are from 21st – 25th Jun, 2024.

The allotment date is 26th June, 2024 and listing date is 28th Jun, 2024 for Stanley Lifestyles IPO.

Head to IPO section on ICICI Direct website and select Stanley Lifestyles IPO. Enter and submit bid details and then click on proceed to apply once details are verified. It’s that simple!!

The price band of Stanley Lifestyles IPO is Rs.351 – Rs.369.

The book runners for the Stanley Lifestyles IPO are ICICI Securities Ltd, SBI Capital Markets Ltd, Axis Capital Ltd, Jm Financial Markets Ltd

The objective of Stanley Lifestyles IPO are for

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.