How to Choose Equity Mutual Fund: A Comprehensive Guide

You must have heard a lot about investing in mutual funds. But before jumping on this trend, you need to assess a mutual fund scheme according to your goals, investment horizon, risk profile, liquidity needs and many other factors to find a suitable match. This is exactly what we will cover in this article on How to choose the best equity mutual fund.

What an equity mutual fund is and how it functions?

Equity mutual funds make investments in the shares of different companies as per pre-defined mandate. Since their performance hinges on market conditions, the risk associated with equity funds is comparatively higher than debt funds or hybrid funds. As they happen to be riskier, they also hold the potential to yield higher returns than their counterparts.

The main objective of the equity fund is to invest in a right set of companies to generate better returns for the investors.

Factors which you need to consider while choosing an equity mutual fund

The 3 most crucial factors which should preferably be central to your decisions are:

- Your investment objective,

- Your time horizon and

- Your risk tolerance

Let’s go through them one by one.

Investment objective: What is your objective behind putting your hard-earned money in an equity fund? Is it a short-term goal or a long-term goal like accumulating some corpus for starting your business, funds for a vacation, a house, a vehicle or your children’s education? The goal can be anything, but you should preferably have a goal so that you can make congruent choices while selecting an equity fund to invest in.

Time Horizon: The next important factor which you need to consider is the time horizon, which is the time period for which you are willing to keep your money invested in an equity fund. Historically, equity mutual funds have generated better returns when invested over a long time-frame. Due to this, investors need to consider the holding period of equity funds while keeping in mind their own liquidity needs.

Risk Tolerance: And thirdly, one of the most important factors is your risk appetite. This essentially is the amount of risk you can tolerate with your investments in equity funds. As a general rule, higher risks should translate to higher returns, equity funds are relatively riskier and hold the potential to provide higher returns.

Metrics which you should consider before you start investing in an equity fund

Before choosing an equity fund, you need to compare its performance amongst its active peer group. This means that the performance of a large-cap fund should be compared with that of other large-cap funds, small-cap funds with other small-caps funds, and so on and so forth. This is crucial in order to get a holistic view of the fund’s performance.

On top of this, you should choose a scheme which performs consistently. The fund’s performance needs to be assessed not only over the past few years, but over multiple market cycles so as to select a fund that has consistently beaten its benchmark in both the bullish and the bearish phases of the stock market.

The expense ratio also needs to be considered before choosing to invest in an equity fund. Expense ratio is basically the expenses which is charged by the fund for managing the money of investors. It is important to choose funds which have a comparatively lower expense ratio, but this could not be the deciding factor.

Read More: Total Expense Ratio: What is TER in Mutual Funds

Ratios which are useful in measuring a fund’s performance

A few ratios that one should consider while choosing the equity mutual funds are:

- Standard Deviation

- Sharpe Ratio

- Beta

- Treynor Ratio

- Sortino Ratio

- Alpha

Let’s go through some of them in brief.

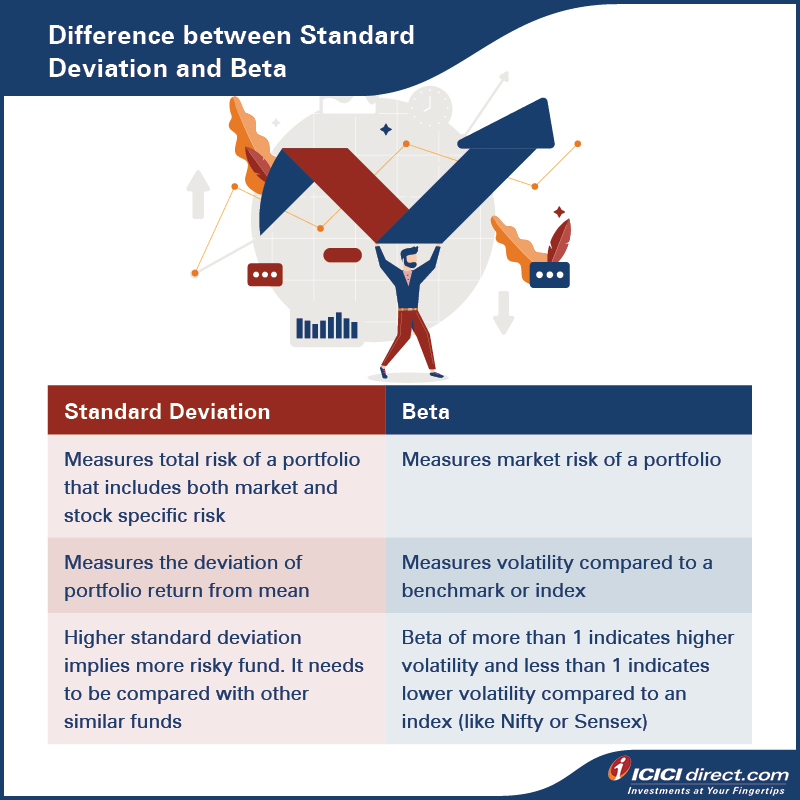

Standard Deviation: Firstly, there is the standard deviation which conveys how volatile a fund is by measuring the deviation in the fund’s returns as compared to its average returns spread over a period of time. If we were to take an example, a fund with deviation of 4% implies that it has a tendency to deviate by 4% from its average returns. Funds having higher standard deviation are inherently riskier than their counterparts having lower standard deviation, so risk-averse investors should prefer funds having lower standard deviation.

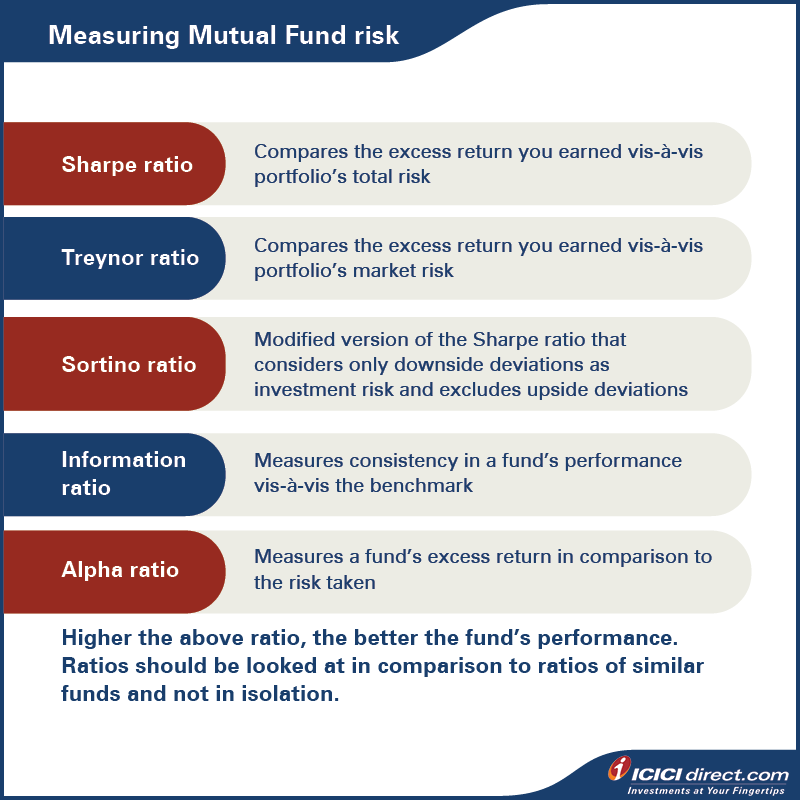

Sharpe Ratio: Secondly, the Sharpe ratio conveys whether an equity fund generates the returns in comparison with the total risk it carries. A higher Sharpe ratio indicates better returns from an investment in comparison to the total risk taken. Therefore, assessing the Sharpe ratio for similar funds is useful for investors in identifying good funds. You can calculate the Sharpe ratio by using the following formula:

Sharpe Ratio = (Portfolio Return – Risk-free Return)/Total Risk

Read More: Sharpe Ratio: What is Sharpe Ratio Explained

As an investor, look for mutual funds with a higher Sharpe ratio. These are likely to produce a better risk-adjusted return. The following example will illustrate why this happens:

|

Mutual Fund A |

Mutual Fund B |

|

|

Annual Return |

15% |

12% |

|

Risk-free Return |

6% |

6% |

|

Total Risk of the Portfolio (Standard Deviation) |

20% |

12% |

|

Sharpe Ratio |

(15% – 6%)/20% = 45% |

(12% – 6%)/12% = 50% |

|

|

|

Better risk-adjusted return |

The table above reveals two things:

a) Fund B has a better risk-adjusted return.

b) Based on returns alone, Fund A may seem to be a better choice. But the higher returns are due to the high risk taken by that fund.

Beta: Then comes Beta, which is a measure of the volatility of the equity fund in response to market fluctuations as compared to the index. A beta of 1 implies an equivalent shift in the prices compared to the index movement, a positive beta of more than 1 indicates a greater shift in the fund’s prices as compared to the index and a negative beta implies the opposite movement in the prices. Risk-averse investors should consider a fund with positive beta less than 1 as it conveys that the funds prices aren’t that severely impacted by volatility. Investors with a higher risk appetite can consider funds with a beta of greater than 1.

Treynor Ratio: Then there is the Treynor ratio, which measures the risk-adjusted returns delivered by a fund, similar to the Sharpe ratio but considers only market risk instead of total risk. So, again a higher Treynor ratio is considered better. Market risk is non-diversifiable. So, the Treynor ratio is best used for funds that

a) are fully diversified and

b) have zero or negligible unsystematic risk.

To calculate the Treynor ratio, use the following formula:

Treynor Ratio = (Portfolio Return – Risk-free Return)/Beta of a Fund

The return from a 91-day treasury bill is considered to be the risk-free return.

Sortino Ratio: Then comes the Sortino ratio which measures the performance of the investment in accordance with the downside risk. It is different from Sharpe ratio which considers both upside and downside risk. As the Sortino ratio gives an idea about the negative deviation of a portfolio’s returns from the mean, the Sortino ratio is thought to provide a better view of the fund’s risk-adjusted performance as positive volatility is beneficial.

Alpha: Let’s finally come to Alpha, which represents the fund manager's performance as being able to bring additional profits compared to the risk taken. An alpha of zero conveys that the fund manager did not add value to the fund. Investors should consider selecting equity funds with a positive alpha, as this ratio tells the investor whether the fund manager will be able to pull off profits. For example, if the expected returns for a fund is 7% and the manager can generate a 9% return with similar risk, then the alpha will be 2%. Investors should consider alpha after taking an average of the past returns and not only on the presently available data.

It is paramount that investors use all these ratios in combination with each other and not in isolation in order to make holistic decisions.

The bottom line is that your investment strategy should be in-sync with that of the equity fund you select. If there is any mismatch between these two investment strategies, it may lead to you selling-out your investments at undesirable prices due to the conflict of interest.

Summary

- The 3 most important factors which need to be considered while selecting an equity fund are investment objectives, time-horizon and risk appetite.

- Before choosing an equity fund, compare its performance with other funds in the same category to get a holistic view of the performance.

- Ensure that the equity fund has consistently beaten its benchmark in both the bullish and bearish phases of the stock market.

- Carry out the required ratio analysis by comparing funds across the ratios which we discussed like alpha, beta, Sharpe ratio, Treynor ratio and others to better judge the fund’s performance and the risk involved.

Read More: Learn more about different types of Mutual Funds here

Top Mutual Funds

Top Mutual Funds

COMMENT (0)