|

|

|

Saudi Arabia,

UAE & Russia to raise

output by 3.9m b/d in

Apr'20 |

|

Russia opposing OPEC

deal to cut OPEC+ output

by a further 1.5m b/d

has triggered a market

share war. Saudi Arabia

has announced plans to

boost oil output to

12.3m b/d in Apr'20

implying rise of 2.6m

b/d over 9.7m b/d in

Feb'20. Press reports

suggest Saudi Aramco has

tied up tankers for

transportation of

additional oil

production to export

markets. UAE plans to

raise output by more

than 1m b/d to over 4m

b/d while Russia has

indicated an output

increase of 0.3m b/d.

Thus, supply may rise by

over 3.9m b/d in Apr’20

when global oil demand

is likely to be flat or

YoY lower. Saudi Arabia

and UAE have also

announced plans to

expand production

capacity by 1m b/d each

to 13m b/d and 5m b/d,

respectively, with no

clarity on timeline to

expand capacity.

|

|

2 scenarios -

OPEC+ output cut or

non-OPEC output fall as

no deal |

|

We

see the following two

possible scenarios:

1. There is no OPEC+

output cut deal and

therefore, after

plunging, oil gradually

recovers as US oil

output starts declining

and global demand starts

recovering after corona

pandemic is contained.

2. OPEC+ reaches a

deal to cut output

leading to oil price

recovery. Ball is now in

Russia's court with oil

price well below

US$42.4/bbl (likely to

decline further), which

it had indicated it was

fine with. Thus, a

plunge in oil prices may

lead to Russia agreeing

to an output cut deal.

|

|

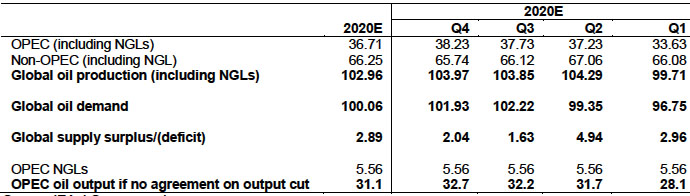

1.6-4.9m b/d supply

surplus in Q2-Q4CY20 if

no OPEC deal reached |

|

We

estimate global oil

supply surplus of 2.96m

b/d in Q1CY20 based on

IEA's estimate of 2.5m

b/d YoY decline in

global demand. We

estimate global supply

surplus to expand to

4.94m b/d in Q2CY20 if

Saudi Arabia, Russia and

UAE raise output by over

3.9m b/d from Apr'20 and

global oil demand is

flat YoY (IEA's

estimate). Such an

unprecedented surge in

global supply surplus is

likely to trigger a

plunge in WTI and Brent

to US$20-25/bbl or

lower. We estimate

global oil supply

surplus of 1.6-2.0m b/d

in Q3-Q4CY20 assuming no

OPEC+ deal to cut

output, rise in Libya

output by 0.5-1.0m b/d

but non-OPEC production

growth slowdown in Q3

and YoY fall in Q4.

|

|

Supply surplus at 1.63-4.94m

b/d in Q2-Q4CY20 if no OPEC output

cut agreement is reached

|

|

|

Source:

IEA, ICICI Securities

|

|

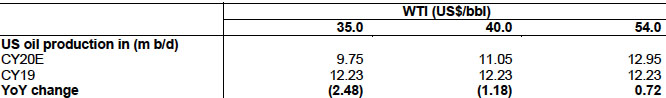

US

oil output to fall by 1.2-2.5m b/d

in CY20E if WTI at US$35-40/bbl

|

|

S&P Global Platts

Analytics estimates US oil production to rise by 0.72m

b/d YoY at 12.95m b/d in CY20 at WTI price of US$54/bbl.

However, it estimates US oil output to decline in CY20

by:

a)

1.18m b/d YoY to 11.05m b/d at WTI price of US$40/bbl

b) 2.48m b/d YoY to 9.75m b/d at WTI price of US$35/bbl

|

US oil output to fall by

1.2-2.5m b/d in CY20E if WTI at

US$35-40/bbl |

|

|

Source: S&P Global Platts

Analytics, ICICI Securities

|

|

|

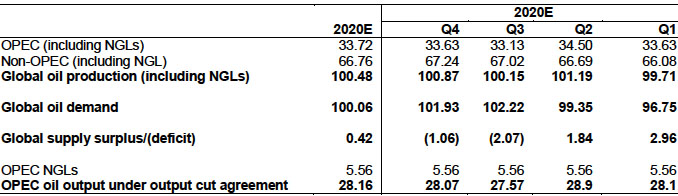

Surplus in Q2, but 2.1-1.1m

b/d deficit in Q3-Q4 if OPEC cuts

output |

|

If

OPEC+ were to reach a deal to cut

output by a further 1.5m b/d from

May'20, it would bring down Q2CY20E

supply surplus to 1.84m b/d from

2.96m b/d in Q1. A supply deficit of

2.1m b/d is likely in Q3 and 1.1m

b/d in Q4 assuming Libyan output

recovers by 0.5m b/d each in Q3 and

Q4CY20E.

|

Supply surplus of

2.96-1.84m b/d in Q1-Q2CY20

but deficit of 2.07-1.06m

b/d in Q3-Q4CY20 if OPEC

agrees on production cuts |

|

|

|

Source: IEA, ICICI Securities

|

|

Cut FY21E Brent price estimate to US$40/bbl from

US$60/bbl earlier |

|

We are

assuming that OPEC+ is

unable to reach a deal and

therefore have cut our FY21E

Brent price forecast to

US$40/bbl from US$60/bbl

earlier. We estimate Brent

at:

US$30/bbl in

Q1FY20

US$35/bbl

in Q2FY20

US$45/bbl in Q3FY20

US$50/bbl in Q4FY20 |

|

We estimate Brent at

US$50/bbl in FY22E and long

term Brent price of

US$60/bbl. |

|

|

|

|

|

|

|

|

|

|

|

|

Disclaimer: We expressly clarify that this

communication is neither a solicitation nor an invitation of any

sort whatsoever from ICICI Securities Ltd. or any of its

subsidiaries to create a client relationship. This communication

is not intended to be a source of advertising or any specific

advice; the recipient should always seek the advice of competent

counsel licensed to practice in the recipient's country/state.

In case this mail doesn't concern you, please href="mailto:unsubscribe@icicisecurities.com?Subject=Unsubscribe">

Unsubscribe/a>/strong> from mailing list.

|

|

| |

| |