Download ICICI Direct app

Invest, Track, and Manage your Portfolio Anytime, Anywhere

Tier-I account mandatory to join NPS

Investment is locked-in until the age of 60

Withdrawals are conditional

Tax benefits can be claimed

Only Tier-I account holders can open it

No Lock-in period on investment

Flexible Withdrawal & Exit Rules

No Tax Exemptions on Contributions

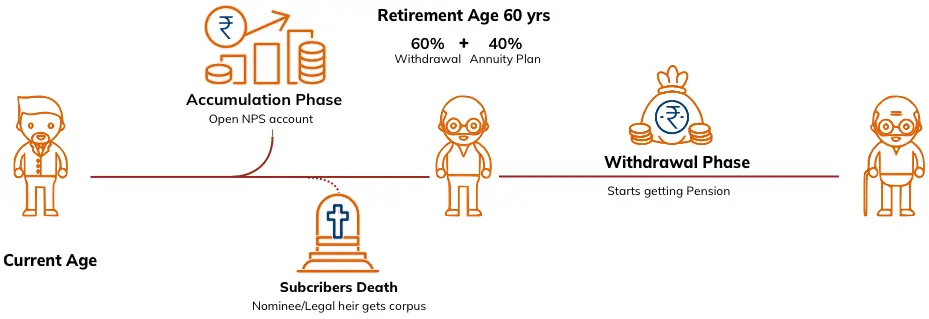

A government sponsored retirement savings scheme

Regulated by Pension Fund Regulatory and Development Authority (PFRDA)

Allows regular contribution to a pension fund during working life

Subscribers choose from Equity and Fixed Income funds to grow savings

On retirement, a part of the corpus can be withdrawn in lump sum

Remaining corpus is invested in an annuity plan to secure regular income

Open your paperless account in less than 15 minutes

Corporate & Individual contribution in the same account

Seamlessly transfer pension account across jobs and location

Annual Fund Management fees on investment less than 0.09%

Combination of Equity & Debt may offer you attractive market linked returns

Stay invested till retirement age to enjoy the benefits of compounding

| Category | IT Section | Investment Limit in Old Regime | Investment Limit in New Regime |

|---|---|---|---|

| Self-Contribution | 80 CCD (1) | 1,50,000 | Not Applicable |

| Self-Contribution | 80 CCD (1B) | 50,000 | Not Applicable |

| Employer Contribution | 80 CCD (2) | 10% of Basic Salary* | 14% of Basic Salary* |

*Employer Contribution to NPS account qualifies for deduction u/s 80 CCD (2). Permissible limit is 10% of basic salary for employees in old regime and 14% of basic salary for employees in new regime. Please note that employer’s contribution to NPS, EPF and/or Superannuation Upto Rs. ₹7.5 Lakhs P.A are eligible for deduction; excess amount will be taxed as perquisite in the hands of the employee

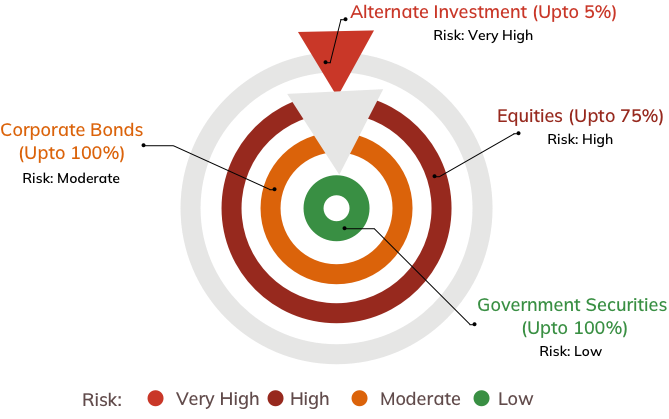

| Fund Options | Risk Profiling | Exposure Limit |

|---|---|---|

| Government Securities | Low | Upto 100% |

| Corporate Bonds | Moderate | Upto 100% |

| Equities | High | Upto 75% |

| Alternate Investment | Very High | Upto 5% |

Under Active Choice, subscribers get the flexibility to decide allocation mix across 4 asset classes

Under Auto choice, funds are invested across asset classes as per a pre-defined portfolio. Subscribers get to choose from Aggressive, Moderate and Conservative allocation. As a subscriber approaches retirement, exposure to more risky investments reduce automatically.

* Indicative Value at Retirement for an investment of ₹ 10,000 per month for 25 Years

Available In : English | हिंदी

NPS Corporate Sector Model is the customized version of core NPS to suit various organizations and their employees to adopt NPS as an organized entity within purview of their employer-employee relationship.

On successful registration of NPS Tier I account, a unique 12 digit PRAN (Permanent Retirement Account Number) is allotted to the subscriber. PRAN is a portable number provided to each subscriber under NPS and remains with him throughout the investment tenure.

Yes. Subscriber has to submit Form ISS to the POP

Two types of accounts are available to the employees under this model:

There is no requirement for minimum number of employees for adopting NPS.

There is flexibility to select scheme either at Corporate level or Subscriber level. Corporate may opt for investment choice for its employee or leave the option to the employees.

NPS architecture involves below mentioned entities:

PFRDA : PFRDA is regulator for NPS. It is responsible for registration of various intermediaries in the system such as CRA, Pension Fund Managers, etc. It shall also monitor the performance of various intermediaries and ensure that all stakeholders comply with the guidelines/regulations issued by PFRDA from time to time.

CRA: Record keeping, administration and customer service functions for all NPS subscribers will be centralized and performed by CRA Protean eGov Technologies Limited (formerly known as NSDL e-Governance Infrastructure Limited) & KFintech CRA. On basis of instructions received from subscribers, CRA shall transmit such instructions to the appointed Pension Funds on regular basis. CRA will also provide periodic & consolidated NPS statements to each subscriber.

Pension Fund/Pension Fund Managers: Pension Fund Managers are responsible for managing investments of NPS subscribers. Pension fund managers invest strictly as per PFRDA investment guidelines. They also communicate NAV of each scheme to CRA on regular basis. NPS allows you to choose from any 1 of below mentioned Pension Fund Managers:

Annuity Service Providers: Annuity Service Providers are responsible for delivering pension/annuity to NPS subscriber as per chosen annuity plan. You have choice to select any 1 of annuity service providers upon exit from NPS as per guidelines.

To view Annuity Service Providers empaneled with PFRDA you may click on below mentioned link http://www.npstrust.org.in/content/list-annuity-service-providers-asps-empanelled-pfrda

Trust & Trustee Bank: NPS trust is responsible for taking care of the funds under NPS and is registered owner of all NPS assets. Trust holds an account as NPS Trustee Bank (Axis Bank). NPS Trustee Bank facilitates fund transfers across various entities of NPS system viz. Pension Fund Managers, Annuity Service Providers, subscriber, etc. NPS Trust is being administered by the Board of Trustees, as constituted by PFRDA.

Point of Presence (POP): POP is first point of interaction between subscriber and NPS architecture. POP is responsible for performing functions relating to registration of subscribers, undertaking Know Your Customer (KYC) verification, receiving contributions and instructions from subscribers and transmission of the same to designated NPS intermediaries like CRA etc. ICICI Securities is one of the PFRDA empanelled POP.

Custodian: Custodian is responsible for the custody of underlying assets. Custodian is SEBI registered custodial service. Stock Holding Corporation of India (SHCIL) is currently Custodian under NPS.

Adopting NPS will not dilute any statutory requirement for the corporate.

The minimum NPS Tier 1 contribution is Rs 1,000 per year. However, there is no maximum limit on the NPS Tier 1 contribution.

Scheme preference can be changed four times and Pension Fund Manager can be changed once in a financial year.

An exit is defined as the closure of the individual pension account of the subscriber under the National Pension System. In the following scenarios:

A subscriber shall submit the exit or withdrawal application for the purpose of withdrawing the benefits upon exit as provided in the regulations, on or before the expected date of exit from the National Pension System (NPS) to the associated point of presence. In case of death or subscriber being declared missing, the nominee(s), family member(s) as specified under the service rules or legal heir(s) shall submit the claim settlement application along with the required documents to the associated point of presence of the deceased subscriber.

Annuitization – Minimum of 40% of accumulated pension wealth will be utilized for monthly annuity or pension.

However, subscriber has the option to utilise more than 40% of accumulated pension wealth for purchase of annuity.

Lumpsum – Remaining 60% of accumulated pension wealth shall be paid to the subscriber.

Yes, if your accumulated pension wealth is equal to or less than a sum of five lakh rupees.

No, the right of the subscriber to receive any pension or other amount under the NPS will extinguish.

You will continue to remain subscribed to the NPS upto the age of 75 (seventy-five) years.

Yes, the subscriber may exit at any point of time from NPS, by submitting a request to the associated point of presence or NPS Trust.

The entire accumulated pension wealth of the subscriber will be paid to the nominee(s) or legal heir(s) of the subscriber.

Yes, the nominee(s) or legal heir(s) of the subscriber have the option to purchase any of the annuities being offered upon exit.

Yes, you can defer the withdrawal of the lump sum amount. Such deferment can be upto the age of seventy-five years.

In case of death of subscriber during the period of deferment, such deferred amount of the subscriber will be paid to nominee(s) or legal heir(s).

Yes, you can defer the purchase of annuity. Such deferment can be upto the age of seventy- five years.

Yes, the subscriber has an option to purchase an annuity at any point of time during the deferment period by submitting a request to NPS Trust or any intermediary or entity authorized by the Authority for this purpose.

If death of the subscriber occurs before the due date of extended period of purchase of annuity, the entire accumulated pension wealth of the subscriber shall be paid to the nominee(s) or legal heir(s), of the subscriber.

Yes, both lump sum and purchase of annuity can be deferred but the subscriber agrees to bear the maintenance charges of the PRA, including the charges payable to the Central Recordkeeping Agency (CRA), Pension Fund (PF), Trustee Bank or any other intermediary, as may be applicable from time to time.

The subscriber shall submit his/her written request for deferment of the lump sum and/or purchase of annuity, fifteen days prior to attaining the age of 60 years, to any intermediary or NPS Trust.

Yes, the subscriber can exit from the NPS at any point of time during the deferment period.

No, upon exercising the option of continuation after attaining the age of 60 years, the options of deferment of benefits (lump sum and/or annuity) shall not be available.

No, the option of deferment of defer the lump sum withdrawal and/or purchase of annuity, shall not be available.

Yes, you are eligible for exit from NPS in case of physical incapacitation or suffering bodily disability leading to incapability to continue under NPS.

A disability certificate from a Government surgeon or doctor (treating such disability or invalidation of subscriber) stating the nature and extent of disability and also certifying that:

(a) The affected subscriber shall not be in a position to perform his regular duties and there is a real possibility of the affected subscriber, being not able to work for the remaining period of his life.

(b) Percentage of disability is more than seventy-five percent in the opinion of such Government surgeon or doctor (treating such disability or invalidation of subscriber).

Same as exiting from NPS upon attaining age of 60 years (refer Q3 to Q5).

If employer provides pensionary relief in case of invalidation or disability during service, the employer shall have the right to adjust or seek to transfer the part or full accumulated pension corpus of the subscriber to itself as per the applicable service rules. The remaining accumulated pension corpus, if any, shall be paid in lump sum to the subscriber.

You can voluntarily exit from NPS before attaining the age of 60 years if you are having subscribed to NPS for at least a minimum period of five years.

Annuitization – Minimum of 80% of accumulated pension wealth will be utilized for monthly annuity or pension.

Lumpsum – Remaining 20% of accumulated pension wealth will be paid to the subscriber.

Yes, if your accumulated pension wealth is equal to or less than a sum of two lakh fifty thousand rupees.

No, the right of the subscriber to receive any pension or other amount under the NPS will extinguish.

You will remain in NPS, until you attain the age of eligibility for purchase of any annuity. After attaining the minimum age required for purchasing any annuity, you can purchase the annuity as per your choice.

The entire accumulated pension wealth of the deceased subscriber shall be paid to the nominee(s) or legal heir(s).

Yes, the nominee(s) or legal heir(s) of the deceased subscriber has the option to purchase any of the annuities being offered upon exit.

Where no valid nomination exists in accordance with these regulations, at the time of exit on account of death of subscriber, the nomination, if any, existing in the records of his or her employer for the purpose of receiving other admissible terminal benefits shall be treated as nomination for exit under the NPS.

The employer shall send a confirmation of such nomination in its records, to the NPS Trust or the CRA, while forwarding the claim for processing.

However, if valid nomination cannot be established even after referring the employer’s record as mentioned above, such case shall be settled to legal heirs.

If employer provides pensionary relief to the family members as specified under the service rules or on the basis of the legal heir certificate of the deceased subscriber, the employer shall have the right to adjust or seek to transfer the part or full accumulated pension corpus of the subscriber to itself as per the applicable service rules.

The remaining accumulated pension corpus, if any, shall be paid in lump sum to the nominees (s) or the legal heir(s).

Twenty percent of the accumulated pension wealth shall be paid as an interim relief in lump sum to the nominee(s) or legal heir(s) of the subscriber and after determination of subscriber as missing and presumed dead as per the provisions of the Indian Evidence Act 1872 and amendments thereto, the remaining eighty percent out of the accumulated pension wealth of the subscriber shall be paid to the nominee(s) or legal heir(s) of the subscriber.

Yes, the President of India or the Governor of a State, or the head of the organisation, in respect of a body corporate or other entity under the ownership and control, either of the central government or any state government or a government company, as the case may be, if so specifically provided in the service rules, governing the terms of employment of the subscriber with it, reserves the right of withholding the part of pension wealth, accumulated through co-contributions made by the employer to the Tier-I account of the subscriber and the investment income accruing thereon, for the purpose of recovery of the whole or part of any pecuniary loss caused, provided such loss is established, in any departmental or judicial proceedings, initiated against such subscriber by the employer concerned.

Right of withholding has to be exercised by the employer prior to the date of superannuation of the subscriber, pursuant to a notice to be given to the NPS Trust, and seeking to withhold the said pension wealth of such subscriber.

The amount withheld which is payable under the NPS will not be paid to the subscriber until the conclusion of the departmental or judicial proceedings, and subject to the final orders, passed in such proceedings.

The amount withheld which is payable under the NPS will not be paid to the subscriber until the conclusion of the departmental or judicial proceedings, and subject to the final orders, passed in such proceedings

The amount withheld by the employer will remain subscribed to the scheme in the mode and manner in which it was held prior to resorting to such action by the employer specified.

The amount withheld becomes payable to the subscriber on the final settlement, as certified by the employer specified, which has sought withholding of such benefits, and will be paid to the subscriber as per applicable regulation while executing exit as soon as possible and in no case beyond ninety days of receipt of the final order by the NPS Trust. Provided that, in case the amount withheld becomes payable after the death of subscriber, on the final settlement, the benefits, will be paid to the nominee(s) or legal heir(s) of such subscriber as per the applicable regulations.

You can exit at any point of time, before attaining age of seventy-five years. However, your benefits at exit may vary depending upon the subscribed period (before or after completing three years from the date of joining of NPS).

Annuitization – Minimum of 40% of accumulated pension wealth will be utilized for monthly annuity or pension.

However, subscriber has the option to utilise more than 40% of accumulated pension wealth for purchase of annuity.

Lumpsum – Remaining 60% of accumulated pension wealth shall be paid to the subscriber.

Yes, if your accumulated pension wealth is equal to or less than a sum of five lakh rupees.

No, the right of the subscriber to receive any pension or other amount under the NPS will extinguish.

Annuitization – Minimum of 80% of accumulated pension wealth will be utilized for monthly annuity or pension.

Lumpsum – Remaining 20% of accumulated pension wealth will be paid to the subscriber.

Yes, if your accumulated pension wealth is equal to or less than a sum of two lakh fifty thousand rupees.

No, the right of the subscriber to receive any pension or other amount under the NPS will extinguish.

The entire accumulated pension wealth of the deceased subscriber will be paid to the nominee(s) or legal heir(s).

Upon exit from tier-I of the NPS, the tier-II account of the subscriber will also be simultaneously and automatically closed, even if an application so specified for the purpose has not been received from the subscriber or nominees or legal heirs, and amounts under the said account will be paid to the subscriber or nominees or legal heirs.

Yes, you can continue with Tier - II account as per your requirement, till closure of Tier - I account.

You can withdraw any number of times from Tier – II account.

A subscriber can withdraw the accumulated wealth either in full or part, at any time.

There shall be no limit on such withdrawals till the account has a sufficient amount of accumulated pension wealth to take care of the applicable charges and the withdrawal amount.

Up to 25% of own contributions (without considering the appreciation / returns on the amount) as on the date of application of such withdrawal.

You are allowed to partially withdraw maximum of three times during the entire tenure of subscription under the NPS.

You can initiate first partial withdrawal after completing period of three years from the date of your joining the NPS.

No.

However, you will receive 25% of own contribution made between two partial withdrawals.

Partial withdrawal is allowed for the following specific purposes only.

(a) For Higher education of his or her children including a legally adopted child.

(b) For the marriage of his or her children, including a legally adopted child.

(c) For the purchase or construction of a residential house or flat in his or her own name or in a joint name with his or her legally wedded spouse. In case, the subscriber already owns either individually or in the joint name a residential house or flat, other than ancestral property, no withdrawal under these regulations shall be permitted.

(d) For treatment of specified illnesses: if the subscriber, his legally wedded spouse, children, including a legally adopted child or dependent parents suffer from any specified illness, which shall comprise of hospitalization and treatment in respect of the following diseases:

The request for withdrawal may be submitted through any family member of such subscriber.

If a subscriber has a family at the time of making a nomination, the nomination shall be in favour of one or more persons belonging to his/her family.

For the purposes of nomination wherever provided in the regulation.

(i) In relation to a male subscriber, shall mean his legally wedded wife, his children, whether married or unmarried, his dependent parents and his deceased son’s widow and children.

(ii) In relation to a female subscriber, shall mean her legally wedded husband, her children, whether married or unmarried, her dependent parents, her husband’s dependent parents and her deceased son’s widow and children.

(iii) In relation to any subscriber who does not identify themselves as male or female - their legally wedded spouse, their children, whether married or unmarried, their dependent parents and their deceased son’s widow and children.

Explanation – in any of above three, if the child of a subscriber or as the case may be, the child of a deceased son of the subscriber has been adopted by another person and if, under the personal law of the adopter, adoption is legally recognized, such a child shall be considered as excluded from the family of the subscriber.

Any such nomination made in favour of a person not belonging to your family shall be invalid and the you (subscriber) have to submit fresh nomination belonging to your family.

Such Nomination shall become void and the subscriber has to submit nomination again.

Yes, you can nominate more than one nominee and can assign percentage of accumulated pension wealth among them in a way that total of such assignments should be equal to 100%.

Yes, a fresh nomination is required to be made by the subscriber upon his/her marriage.

The nomination made before marriage becomes invalid and you have to submit nomination again.

If you have no family at the time of making a nomination, the nomination may be in favour of any person or persons but if you subsequently acquire a family, such nomination shall forthwith be deemed to be invalid and you shall make a fresh nomination in favour of one or more persons belonging to your family.

Yes - the nomination can be wholly or partly in favour of a minor. Further, the subscriber may appoint a major person of his family, to be the guardian of the minor nominee in the event of the subscriber predeceasing the nominee and the guardian.

Yes – if there is no major person in the family.

You can change the nomination any number of times.

Annuity means series of payments/benefits to the subscriber at specified intervals as per the choice of subscriber paid by annuity service provider (ASP). The main objective of an annuity is to give regular income to the subscriber even after retirement/working age.

Yes, except there are some scenarios where the subscriber/nominees/legal heirs can withdraw the whole accumulated pension wealth as mentioned above.

Annuity shall be purchased from Annuity Service Providers (ASPs) empaneled with the PFRDA. The list of 14 ASPs empaneled is as under:

* For any update in empaneled Annuity Service Providers (ASPs), you are requested to refer PFRDA’s website.

Annuity starts immediately after the minimum age as required for purchasing any annuity (depending upon choice of ASP and Annuity scheme for e.g. 30, 35, 38) from any of the empaneled annuity service providers. Subscriber/nominees/legal heirs need not wait till the age of 60 years.

The following are the most common variants that are available:

(a) Annuity for life with return of purchase price (amount given to annuity service provider) on death- Subscriber will receive payment of annuity till he/she is alive and payment stops after the death of subscriber. However, purchase price will be returned to nominees / legal heirs.

(b) Annuity guaranteed for 5, 10, 15 or 20 years and for life thereafter -

On death during the guarantee period – Subscriber will receive payment of annuity till he/she is alive and thereafter during the remaining guaranteed period, annuity will be paid to the nominee till the end of the guaranteed period after which the same ceases/stops. However, return of purchase price will not be returned to nominees / legal heirs.

On death after the guarantee period – Subscriber will receive payment of annuity till he/she is alive even after the guaranteed period is over. Payment of annuity stops after the death of the subscriber. However, return of purchase price will not be returned to nominees / legal heirs.

(c) Annuity payable for life - Subscriber will receive payment of annuity till he/she is alive and payment stops after the death of the subscriber. However, return of purchase price will not be returned to nominees / legal heirs.

(d) Annuity for life increasing at simple rate of 3% p.a. – Subscriber will receive payment of annuity till he/she is alive increasing at simple rate of 3% p.a. and payment stops after the death of the subscriber. However, return of purchase price will not be returned to nominees / legal heirs.

(e) Annuity for life with a provision for 50% of the annuity to the spouse of the annuitant for life on death of the annuitant/subscriber - Subscriber will receive payment of annuity till he/she is alive and thereafter spouse will receive 50% of payment of annuity till he/she is alive. Payment of annuity stops after the death of spouse. If the spouse predeceases the subscriber, payment of annuity will cease after the death of the annuitant.

It may be noted that this annuity variant may be taken with or without return of purchase price.

(f) Annuity for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant/subscriber – Subscriber will receive payment of annuity till he/she is alive and thereafter spouse will receive payment of annuity till he/she is alive. Payment of annuity stops after the death of spouse. If the spouse predeceases the subscriber, the annuity ceases after death of the annuitant. It can be with or without return of purchase price. It may be noted that this annuity variant may be taken with or without return of purchase price.

*Subscriber can also add spouse in any of the variants above.

**All ASPs may not provide all the variants. It may vary from ASP to ASP.

***Pricing of annuity also varies from ASP to ASP.

Only in annuity types where there is a provision of return of purchase price.

Details of annuity rates and other details may be checked on CRAs’ website [Computer Age Management Services Limited, KFin Technologies Limited and Protean eGov Technologies Limited] and website of respective empaneled ASPs.

Once an annuity is purchased, the option of cancellation or reinvestment with another Annuity Service Provider or in other annuity scheme shall not be allowed unless the same is within the time limit specified by the Annuity Service Provider, for the free look period as provided in the terms of the annuity contract or specifically provided by the Insurance Regulatory and Development Authority.

Tier – I

Lump sum Withdrawal - In case of exit upon attaining the age of 60 years lump sum withdrawal i.e. 60% of the total accumulated pension wealth is tax exempted.

Annuity - The amount utilized for purchase of annuity at exit upon attaining the age of 60 years is tax exempted. However, the annuity income (pension) received will be taxed in the year of receipt as per the applicable tax slab of the subscriber.

Partial Withdrawal – The amount received by employee under the NPS is tax exempted.

Tier – II – No tax benefits

POP-SP's are network of branches empanelled to assist subscribers in opening NPS Tier 1 and 2 a/c's and other service related requests under NPS. Please click the below link to check details of POP-SP's.

NPS is regulated by Pension Fund Regulatory and Development Authority (PFRDA). ICICI Securities Limited is a PFRDA registered POP with Reg. no.: 05092018.

ICICI Securities is just acting as distributor and all disputes with respect to such distribution activity, would not have access to SCORES/ODR, Exchange investor redressal forum or Arbitration mechanism.