TAX BENEFITS

Retirement & Tax planning can be two sides of the same coin! Invest in NPS & avail Tax benefits!

Invest NowTier-I account mandatory to join NPS

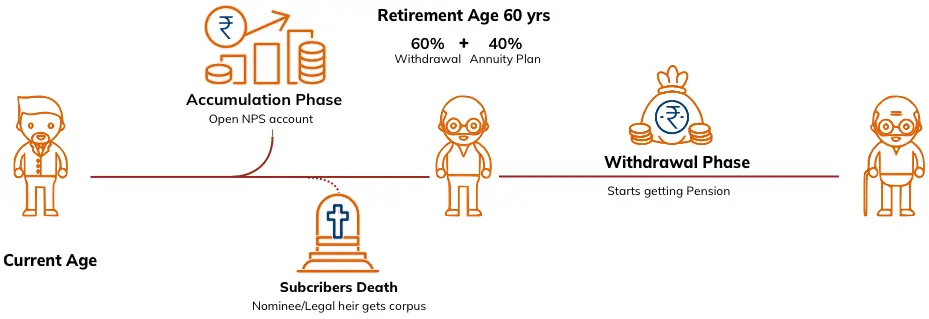

Investment is locked-in until the age of 60

Withdrawals are conditional

Tax benefits can be claimed

Only Tier-I account holders can open it

No Lock-in period on investment

Flexible Withdrawal & Exit Rules

No Tax Exemptions on Contributions

A government sponsored retirement savings scheme

Regulated by Pension Fund Regulatory and Development Authority (PFRDA)

Allows regular contribution to a pension fund during working life

Subscribers choose from Equity and Fixed Income funds to grow savings

On retirement, a part of the corpus can be withdrawn in lump sum

Remaining corpus is invested in an annuity plan to secure regular income

Open your NPS Account digitally in less than 10 minutes

Start with just ₹ 1,000 per annum through Lumpsum or SIP

Seamlessly transfer pension account across jobs and location

Annual Fund Management fees on investment less than 0.09%

Combination of Equity and Debt offers higher return than traditional retirement schemes

Lock-in till the age of 60 years enusres subscribers remain invested for a long period of time

| Category | IT Section | Investment Limit in Old Regime | Investment Limit in New Regime |

|---|---|---|---|

| Self-Contribution | 80 CCD (1) | 1,50,000 | Not Applicable |

| Self-Contribution | 80 CCD (1B) | 50,000 | Not Applicable |

| Employer Contribution | 80 CCD (2) | 10% of Basic Salary* | 14% of Basic Salary* |

*Employer Contribution to NPS account qualifies for deduction u/s 80 CCD (2). Permissible limit is 10% of basic salary for employees in old regime and 14% of basic salary for employees in new regime. Please note that employer’s contribution to NPS, EPF and/or Superannuation Upto Rs. ₹7.5 Lakhs P.A are eligible for deduction; excess amount will be taxed as perquisite in the hands of the employee

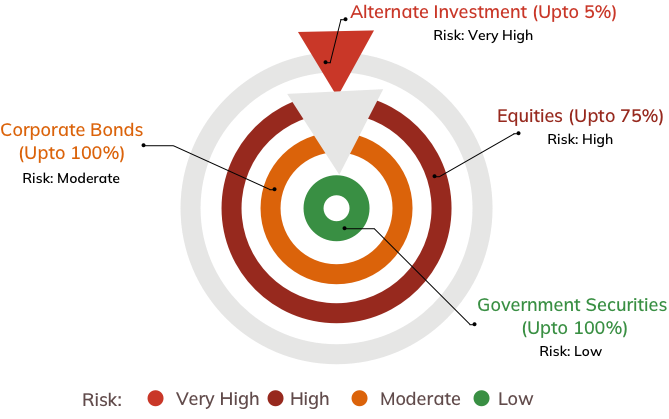

| Fund Options | Risk Profiling | Exposure Limit |

|---|---|---|

| Government Securities | Low | Upto 100% |

| Corporate Bonds | Moderate | Upto 100% |

| Equities | High | Upto 75% |

| Alternate Investment | Very High | Upto 5% |

Under Active Choice, subscribers get the flexibility to decide allocation mix across 4 asset classes

| Charge Head | Charges |

|---|---|

| Account Opening | ₹ 200 |

| Contribution Processing | 0.50% subiect to min & 30 and max ₹ 25,000 |

| Non-Financial Transaction Processing | ₹ 30 |

| Persistency Charges | Transaction Value |

| ₹ 50 per annum | ₹ 1,000 - ₹ 2,999 |

| ₹ 75 per annum | ₹ 3,000 - ₹ 6,000 |

| ₹ 100 per annum | above ₹ 6,000 |

| Applicable for subscribers (except corporate NPS) active for more than 6months with a POP. | |

| AUM Slab (in Cr) | PFM charges % for the Slab |

|---|---|

| Upto ₹ 10,000 | 0.09% |

| ₹ 10,001 to ₹ 50,000 | 0.06% |

| ₹ 50,001 to ₹ 1,50,000 | 0.05% |

| ₹ 1,50,001 and Above | 0.03% |

| * UTI Retirement Solutions Ltd charges a fee of 0.07% under this slab. | |

| Charge Head | Kfintech | NSDL |

|---|---|---|

| PRAN Generation | ₹ 39.36 | ₹ 40.00 |

| Annual Maintenance | ₹ 57.63 | ₹ 69.00 |

| Financial Transaction processing | ₹ 3.36 | ₹ 3.75 |

| Intermediary | Charge Head | Charges (Annual) |

|---|---|---|

| Custodian | Custodian Fee | 0.0032% p.a |

| NPS Trust | Reimbursement of Expenses | 0.005% p.a |

We appreciate your patience. Your content is on the way.