How to compare mutual funds? Alpha, Sharpe Ratio, Sortino Ratio, Standard Deviation and more

If you decide to invest in a mutual fund today, you have to find the best from 2,500 different mutual fund schemes offered by 44 fund houses. Even if you narrow down your search based on the category, you will still be left with around 10 mutual funds from the same category. How do you pick the best among them? Like everything else, you need to evaluate and make the right choice. In this article, we discuss key parameters that can help you compare mutual funds and pick the best one.

Metrics to Use to Compare Mutual Funds

Let us look at the top metrics you can use to compare mutual funds:

Number One: Expense Ratio

It is a measure of how much it costs to operate a mutual fund, expressed as a percentage of the fund's average net assets. It includes operating expenses like management fees, administrative costs, and other miscellaneous charges.

As an investor, the essential point to know is that a lower expense ratio is generally preferable, as it means a smaller portion of your investment is being used to cover fund expenses. Also, note that the expense ratio is deducted from the fund's assets, so it directly impacts your returns.

Let us say a mutual fund X has an expense ratio of 1%. It means that on average, you can expect to pay Rs 1 for every Rs 100 invested annually to cover the fund's operating expenses.

A lower expense ratio, even by a few percentage points, can contribute to higher net returns over time. How much difference will it make? Let us understand with an example.

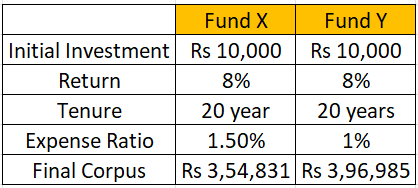

We assume that you make an initial investment of Rs 100,000 and an annual return of 8% before expenses over 20 years (Fund X). The expense ratio for you is 1.5%. Your friend invests in a similar fund (Fund Y), everything being the same except the expense ratio. Fund Y has an expense ratio of 1% only. After 20 years:

- Your corpus: Rs 3,54,831

- Your friend's corpus: Rs 3,96,985

Your friends get nearly 13% extra returns. Imagine the absolute difference if the invested amount is large!

Number Two: Alpha and Beta

Alpha is a measure of a fund's risk-adjusted performance. Let us elaborate. It represents the excess return of the fund compared to its benchmark (Nifty or Sensex). In other words, alpha assesses the fund manager's ability to generate returns beyond what would be expected given the risk level associated with the investment. On the other hand, Beta measures the sensitivity of a fund's returns to changes in its benchmark index. It quantifies the fund's volatility about the overall market.

Let us take an example to understand these terms better. We start with Beta. The Beta is represented as a number and calculated as below:

Beta= Covariance (Mutual Fund Returns, Benchmark Returns) / Variance (Benchmark Returns)

Not going into the details of the formula, let us look at what the Beta tells you:

- Beta = 1 implies the fund tends to move in line with its benchmark.

- Beta > 1 indicates higher volatility than the benchmark

- Beta < 1 suggests lower volatility than the benchmark

So, depending on your risk appetite, you can pick mutual funds by looking at the Beta.

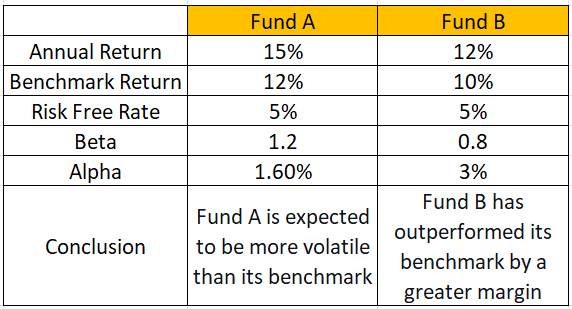

Let us move to alpha now and use two funds to show a comparison also - A and B. First, we will calculate the Alpha for Fund A. Here is how the scenario looks for Fund A:

- Annual Return of Fund A: 15%

- Benchmark Index Return: 12%

- Risk-Free Rate: 5%

- Beta of Fund A: 1.2 - It means Fund A is expected to be 1.2 times as volatile as its benchmark

The formula to calculate Alpha is as below:

Alpha=Actual Return − (Risk- Free Rate + Beta × (Benchmark Return − Risk-Free Rate))

Let me put the numbers and find A's alpha.

- Alpha for Fund A=15% − (5% + 1.2 × (12% − 5%))

- Alpha for Fund A=15% − (5% + 1.2 × 7%)

- Alpha for Fund A=15% − 13.4% = 1.6%

It means that the fund has outperformed its benchmark by that margin.

Scenario for Fund B:

- Annual Return of Fund B: 12%

- Benchmark Index Return: 10%

- Risk-Free Rate: 5%

- Beta of Fund B: 0.8 - It is expected to be 0.8 times as volatile as its benchmark.

Let me put the numbers and find B's alpha.

- Alpha for Fund B=12% − (5% + 0.8 × (10% −5%))

- Alpha for Fund B=12% − (5% + 4%)

- Alpha for Fund B=12% − 9% = 3%

Fund B has an Alpha of 3%, indicating it has outperformed its benchmark by that margin.

Now comes the vital part - how to use these numbers for comparison. Here is how you can these for interpretation:

- Fund B has a higher Alpha (3%) compared to Fund A (1.6%), indicating that Fund B has outperformed its benchmark by a greater margin.

- The Beta values suggest that Fund A is expected to be more volatile than its benchmark, while Fund B is expected to be less volatile.

Number Three: Standard Deviation

Standard Deviation (SD) measures the extent of a mutual fund's returns' dispersion from its average. It indicates the volatility or risk associated with the fund. If a fund has a standard deviation of 10%, it means that the fund's returns have deviated, on average, by 10% from its mean return.

If a mutual fund has an average return of 12% and an SD of 2%, it means that the returns can deviate by 2% on either side (13% or 17%). The essential thing to know for investors is that a fund with a low standard deviation over some time means it has given consistent returns over the long term. On the other hand, a higher standard deviation suggests higher volatility in the fund.

How to use it? Standard deviation works on the underlying principle of the law of averages. Therefore, on a standalone basis, it does not tell you anything. For example, if the fund's A SD is 4%, you cannot conclude anything. However, if you have another fund B, with an SD of 8%, you can compare and draw a conclusion.

Number Four: Sharpe ratio

The Sharpe Ratio is a measure of a mutual fund's risk-adjusted performance, indicating how much return an investment is providing for each unit of risk taken. The formula for the Sharpe Ratio is:

Sharpe Ratio = (Return of Fund - Risk-Free Rate) / Standard Deviation of Fund

For a mutual fund with a return of 12%, a free rate of 5%, and an SD of 10%, the Sharpe Ratio comes to be 0.7. A Sharpe Ratio of 0.7 suggests that the fund has generated 0.7 units of return for each unit of risk taken.

The Sortino Ratio is similar to the Sharpe Ratio but focuses only on the downside risk, considering the standard deviation of negative returns. It uses downside SD, which is a risk measure used in finance to assess the volatility of the negative returns of an investment.

The formula for the Sortino Ratio is:

Sortino Ratio = (Return of Fund − Risk-Free Rate) / Downside Standard Deviation of Fund

For a mutual fund with a return of 10%, a free-free rate of 5%, and a Downside SD of 8%, the Sortino Ratio comes to be 0.625. A Sortino Ratio of 0.625 indicates that the fund has generated 0.625 units of return for each unit of downside risk.

Let us see how you can use these ratios for comparing mutual funds. Here are points to note:

- A higher Sharpe or Sortino ratio is generally preferred, as it implies better risk-adjusted performance.

- Compare the Sharpe and Sortino ratios of different funds. A fund with a higher ratio has historically provided better returns for a given level of risk.

- Compare the ratios against an appropriate benchmark to evaluate if the fund is adding value above what the market provides.

Top Mutual Funds

Top Mutual Funds