India's forex reserve at 22-month high: Why it matters to you?

India’s Forex Reserves are making news these days. But what are they? Foreign Exchange Reserves, popularly known as forex reserves, are the assets held by a country's central bank (RBI in India) in various foreign currencies. These reserves play a crucial role in supporting the stability and strength of a country's economy. India's foreign reserves are at a 22-month high. What does it mean for us? In this article, we will try to answer it for you.

Understand the Components of Forex Reserve

The forex reserve consists of five main components:

Foreign Currencies Assets (FCA): The central bank (RBI in India) holds currencies like the US Dollar, Euro, Japanese Yen, etc. These currencies are used for international trade, debt payments, and maintaining exchange rate stability.

Gold: Gold is a traditional component of forex reserves, providing a tangible and universally accepted store of value. Countries hold gold as a hedge against currency fluctuations and economic uncertainties.

Special Drawing Rights (SDRs): SDRs are international reserve assets created by the International Monetary Fund (IMF). They represent a potential claim on freely usable currencies of IMF member countries.

Reserve Position in the IMF: It represents a country's share in the IMF and can be used for international transaction

Foreign Securities: Central banks may also hold foreign government bonds and other securities as part of their reserves.

India's Current Forex Reserve

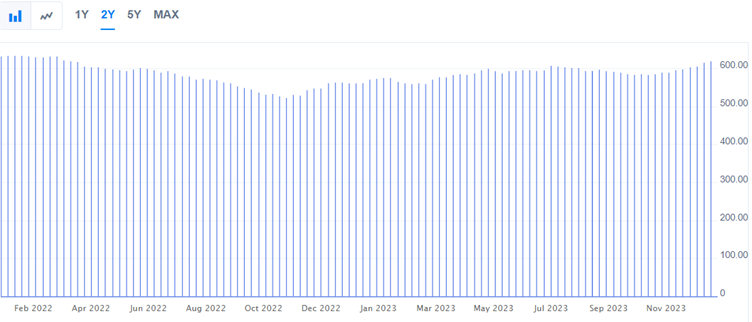

With our understanding of the forex reserve, let us now see what India's forex reserve looks like. India's forex kitty had reached an all-time high of $645 billion in October 2021. In October 2022, India's forex reserve touched a low of $524.8 billion. Since then, we have seen the forex reserve increasing.

On 5 January 2024, RBI released the data for the week ending December 29. It showed India's forex reserve increased to $623.20. It was a significant increase from $620.44 billion from the previous week of 22 December.

Using our knowledge of components of forex reserve, let us see how India's forex reserve breaks down to:

- Foreign currency assets (FCAs) witnessed a rise of $1.87 billion, reaching $551.62 billion.

- Gold reserves reached $48.33 billion, increasing by $853 million.

- Special drawing rights (SDRs) experienced a jump of $38 million and ended at $18.37 billion.

- The reserve position in the International Monetary Fund (IMF) saw a marginal decrease and declined by $2 million to $4.89 billion.

Forex Reserve Significance

Let us look at the significance of forex reserve. How does the rise and fall in forex reserve impact the Indian economy? Here are a few points to note:

Stability of the Rupee

Forex reserves help maintain stability in the domestic currency by allowing the RBI to intervene in the foreign exchange market. If the rupee depreciates, the central bank can sell foreign currencies to stabilize its value. We mentioned earlier that forex reserves were high in October 2021. In the below image, you can see that the rupee started to depreciate against the dollar at the same time. To control the free-fall,, the RBI started selling the forex reserve, and it hit a low in October 2022. At the same time, when the rupee stabilized.

Trade Balance and Imports

Countries engaging in international trade may experience trade imbalances or current account deficits. Forex reserves help cover these deficits by providing the necessary foreign currency to settle international transactions.

India is an import-dependent economy. It needs forex reserves to pay for imports. If India imports more goods and services than it exports, it will have a trade deficit. The forex reserves can be used to bridge the gap and ensure smooth international trade transactions. Reserves ensure that the country can meet its external payment obligations and support a favorable trade balance.

Speculative Attacks and Contingencies

Forex reserves act as a deterrent against speculative attacks on a country's currency. Knowing that a country has significant reserves, traders and investors are less likely to engage in speculative activities that could destabilize the currency. If there are rumors of a potential devaluation of the rupee, the presence of ample forex reserves can discourage speculative attacks as traders may fear losses if the central bank intervenes.

Debt Servicing

Countries often borrow funds from international sources, and they need to make periodic payments on this debt. Forex reserves play a crucial role in meeting these external debt obligations.

If India has borrowed funds in US dollars, it needs USD to make interest and principal payments. Forex reserves can be utilized for servicing such external debt.

Interest Rates and Inflation

Adequate forex reserves give the central bank flexibility in managing interest rates and controlling inflation. Reserves allow the central bank to pursue independent monetary policies without the fear of external pressures.

Before You Go

The reason we have covered forex reserve is to show you the importance of forex reserve and why it is essential for investors to keep track of it. A substantial reserve position enhances investor confidence in the country's economic stability. For a country like India, with a large and dynamic economy, maintaining substantial forex reserves is crucial for sustainable growth and resilience against external uncertainties.