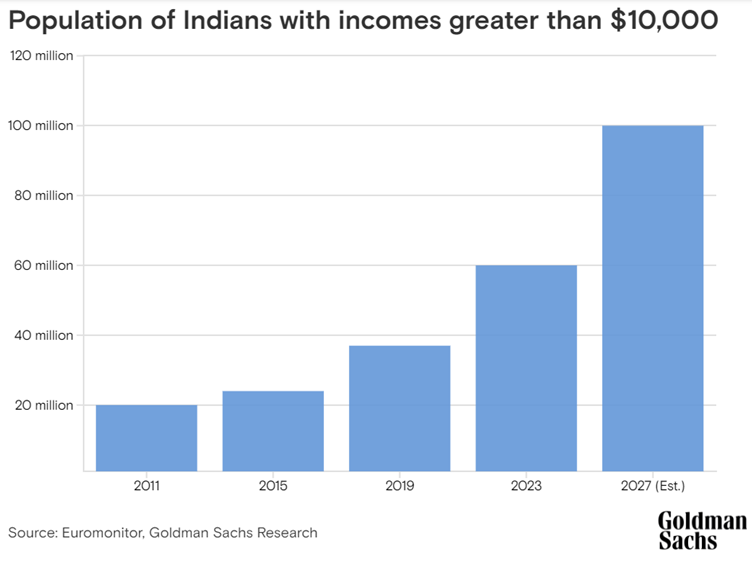

India's affluent population at 100 million by 2027: Goldman Sachs Report

Goldman Sachs recently published a report, 'The Rise of Affluent India'. It has some fascinating insights for us. If you believe in India's growth story, it would be worth your time to know the report details. In this article, we look at some interesting data from the report.

What is the affluent population?

Let me first break down the term - affluent population for a better understanding of the report. The affluent population in India refers to individuals or households that have a relatively high level of wealth or income compared to the rest of the population. Affluent individuals in India often have significant purchasing power and may enjoy a comfortable lifestyle, with access to luxury goods, upscale services, and premium amenities. They are often targeted by marketers of luxury brands and high-end products and services.

Data taken to define an affluent class by Goldman Sachs

The research firm took different parameters to put the Indian population in the affluent class. Here are the different parameters under consideration:

- The number of people who take a flight at least once a year

- The number of people who order from food delivery services at least once a month

- Number of people who file income taxes on sums of more than Rs 10 lakh ($12,046)

- The number of people who have credit cards and postpaid mobile connections

Number used by the research firm

Here are a few crucial points based on which the research firm has concluded the numbers.

As per the report, affluent Indians have grown at a 12% CAGR between 2019 and 2023, much higher than the 1% CAGR of India's population.

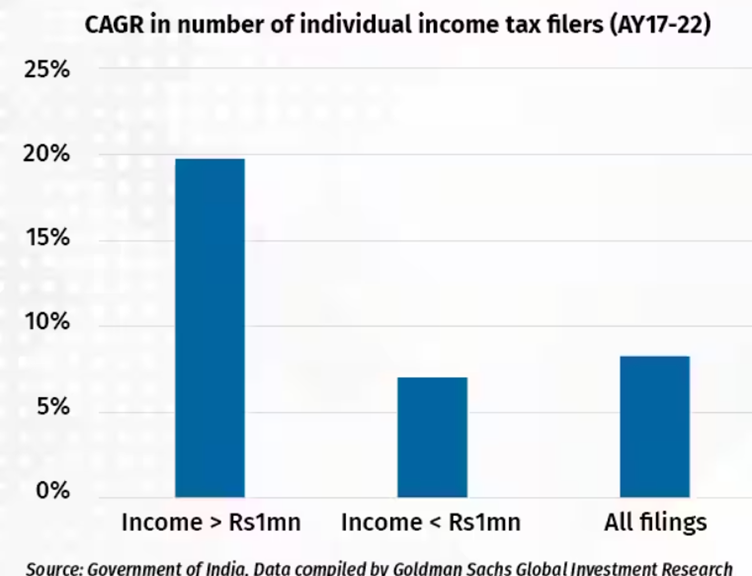

The total number of Indians filing income tax with disclosing income above Rs 10 lakh has grown at a CAGR of approximately 19% between FY17 and FY22. Again, this is significantly higher than the overall growth of income tax filings, which has grown at only 8% CAGR in the same period.

The number of term deposits in banks above Rs 15 lakh has grown at a CAGR of 45% between FY19 and FY23, while the number of term deposits below Rs 15 lakh has grown at a CAGR of 3% over the same period.

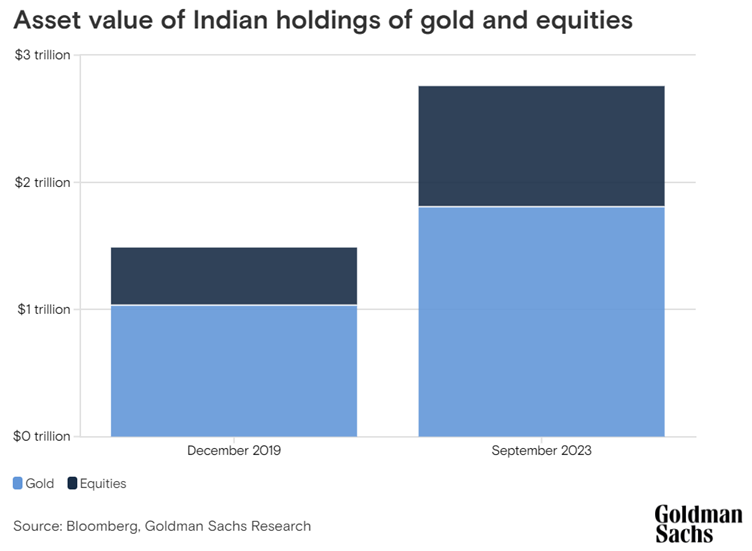

There is one government survey showing that 90% of gold is owned by people in the top 10% of India’s earners. With equity, before the pandemic, there were 41 million Indians with stock trading accounts (online). Again, this syncs with the 60 million figure the research firm postulates for affluent Indians.

The number of credit cards in India has grown at a CAGR of 16% over FY19 and FY23, compared to the number of debit cards, which grew at a CAGR of around 1% in the same period. There were ~960 million debit cards in India in FY23, compared to ~85 million credit cards.

The number of post-paid connections rose by nearly 30% over FY21-22.

The Numbers to Increase

Now, coming to the interesting part, what did the firm conclude? The analysts have seen these growth numbers of 12-13%. Next, they investigated whether any factors driving upper-income growth are changing. Let us understand the mindset here through the wealth effect.

The 'Wealth Effect' refers to the psychological and behavioral phenomenon where changes in the value of assets, such as stocks or other investments, influence consumer spending and economic activity. When the value of these assets increases, individuals tend to feel wealthier, even if their income has not changed, leading them to spend more money.

Changes in asset values may not immediately influence consumer behavior. There could be a delay between when asset values rise or fall and when individuals adjust their spending habits accordingly. As time passes, this lag effect might become more evident, with the wealth effect gaining strength throughout several economic cycles.

So, they extrapolated the growth rate between 2019 and 2023, which is around 12-13%. Based on these numbers, they expect the number of affluent Indians to be 100 million by 2027. And if the wealth effect is strong, it could be even more.

Conclusion: Importance of the Affluent class

So, you must be wondering why all the hype around the affluent class - does the increase in number benefit the economy in any way. Let us end the article with this insight. Here is how they are crucial:

Consumer Spending: Affluent individuals have significant purchasing power and tend to spend more on discretionary items such as luxury goods, high-end services, and leisure activities. Their consumption patterns contribute to economic growth and drive demand for a wide range of products and services, thereby stimulating production and employment in various sectors.

Investment and Capital Formation: Affluent individuals often invest in financial assets such as stocks, bonds, and real estate. Their investments provide capital for businesses to expand operations, innovate, and create new job opportunities. Additionally, affluent investors may support startups and entrepreneurial ventures - we will see more startups creating products and services only for this sector.

Consumer Confidence and Market Sentiment: The behavior and sentiment of affluent consumers can influence overall consumer confidence and market dynamics. Positive sentiment among affluent individuals can boost investor confidence, encourage consumer spending, and support economic stability and growth.