Number of DEMAT accounts opened in June hits a four month high

The Indian stock market witnessed a phenomenal rise in investor participation in June 2024, with a record number of new demat accounts opened. As the market is increasing and reaching new heights every month, so is the number of DEMAT accounts opened. The accounts are not opening only on the back of new market highs, but there are other factors also. We look at the DEMAT open numbers and understand the reason behind it.

New account additions in June

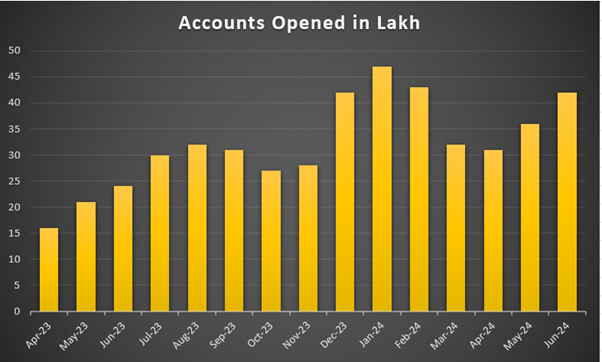

In June, the new Demat account openings hit a four-month high, backed by many factors. According to data from the Central Depository Service (CDSL) and National Securities Depository (NSDL), the Demat accounts opened in June were over 42.4 lakh. It is the highest account opening rate since February of this year. In the year-ago period, the number was only 23.6, and 36 lakh additions a month ago.

This is the seventh consecutive month where the Demat count opened was over 30 lakh. Previously, similar milestones were achieved in December 2023, January 2024, and February 2024. The total demat accounts now exceed 16.2 crore, reflecting a 4.24% increase from the previous month and a 34.66% rise compared to last year.

Here are the numbers from the recent past:

Reason for the growing number of Demat accounts

Here are some reasons for the increase in Demat account numbers:

- Bullish Market: A strong bull run in the Indian stock market, with key indices like Nifty and Sensex reaching record highs, has fueled investor sentiment. Nifty is up over 11% in a 6-month timeframe and 25% in the past one year. People are optimistic about potential gains and eager to participate in the market growth.

- IPO Frenzy: A series of high-profile Initial Public Offerings (IPOs) from promising companies has attracted significant interest from retail investors. Emcure from the Pharma space recently got listed. Reliance Jio, Hyundai, and many other companies are lined up, and investors don't want to miss out on the opportunity to own these companies. Also, the potential for listing gains and the excitement surrounding new listings are encouraging people to open demat accounts.

- Growing awareness: Financial literacy initiatives and readily available online resources are empowering individuals to understand the stock market and investment opportunities. People are becoming more comfortable investing beyond traditional options like fixed deposits (FDs) or gold.

- Young Investor Base: A growing young population in India is more tech-savvy and open to exploring investment avenues like the stock market for wealth creation. This demographic shift is contributing to the rise in demat accounts.

Way Forward

The Indian stock market's growth trajectory and potential for high returns are likely to continue attracting new investors. As financial literacy initiatives and access to technology improve, we can expect even more individuals to embrace demat accounts and participate actively in the Indian capital market.

Before you go

As discussed, one of the reasons for the increase in opened Demat accounts is due to the current market conditions, and the future growth rate of Demat accounts may vary depending on various factors. It would be interesting to see how investors react if there is a correction or market falls considerably.

Top Mutual Funds

Top Mutual Funds