Stock Market and 2024 Elections

India is the world's largest democracy. We are no strangers to the excitement and anticipation that come with the general elections. We are only six months away from the 2024 elections, which are expected to happen in April and May 2024.

The impact of general elections in India extends beyond the realm of politics. It significantly influences the Indian stock markets and economic landscape. In this article, we will explore the relationship between the Indian stock market and general elections. It will help you decide how you want to plan the coming months.

Stock Market and General Elections

The Indian stock market often functions as a barometer of political sentiment and economic stability during election periods. Investors closely monitor election developments, as the outcome can have a significant effect on market dynamics. Here's how general elections in India intersect with the stock market:

Volatility Pre-election

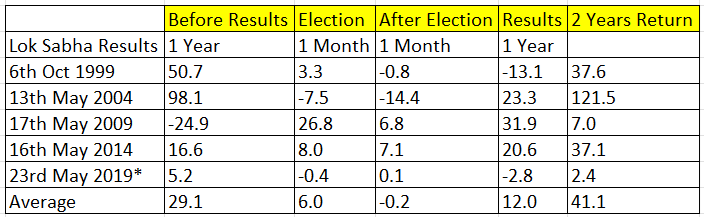

In the lead-up to general elections, the stock market typically experiences increased volatility. You may become cautious and adopt a "wait-and-see" approach, leading to fluctuations in stock prices. Uncertainty about the election outcome and potential policy changes can contribute to this volatility. Let us look at how the market has performed in the year leading to the election and a month before the election.

You can see that the average return in the year before the election is 29.1%. (*For the 2019 elections, we have taken returns up to 5 March 2020, as the market collapsed post-it due to COVID-19). In the one month before the election, the market has given an average return of 6%. Both numbers suggest that the market performed well in the pre-election year. Except for the 2009 results, when the market fell by (24.9%), it has given positive returns in every other year (between 1999 and 2019). However, the fall in the pre-year in 2009 was compensated by the jump in the market in the month post-election, when the market jumped by 26.8%.

Election Outcomes

The stock market's reaction to election results is swift and often dramatic. A stable government with a clear mandate tends to reassure investors, leading to positive market reactions. Conversely, a fragmented or uncertain election outcome can lead to market turbulence. If we look at 1-month and 1-year returns after election returns, the average one-month return is -(0.2)%, and one year return is 12%. The investors look for stability in the government.

As per Morgan Stanley's recent report, for the 2024 elections, if the current government wins the election with a clear majority, then the market could gain between 0% and 5% in the three months after the election. If the government does not win a clear majority and a coalition government is formed, the market may fall between 5% and 25%. If the BJP government loses and the leading party gets fewer than 200 seats, forming a weak coalition that would mean little power, the stock market could crash by a massive 40%. It would be the worst-case scenario.

Policy Implications

The party that comes to power often shapes economic policies. Investors closely analyze the political party's economic agenda, as changes in taxation, regulations, and economic reforms can impact specific sectors and industries. The stock prices of companies in these sectors may be influenced accordingly.

Foreign Investment

General elections also influence foreign investors' decisions. International investors assess the political and economic stability when deciding whether to invest in Indian stocks or withdraw their investments. A stable government can attract foreign capital, while political instability can lead to outflows.

Case Study: 2019 Elections and Market Performance

Let's look at a recent example: the 2019 Indian general elections.

The year 2018 saw the economy finding its legs after the demonetization shock. The domestic markets were hit by the IL&FS credit default debacle. The crisis triggered a liquidity crunch in the NBFC sector. Non-banking stocks across the board bore the brunt as most of them suffered losses by the last quarter of 2018. The Nifty crossed the 11,000 mark in January and then dipped to the year's low of 9,998.05 on 23 March. It staged a recovery to touch the year's high of 11,738.5 on 28 August. From there on, the Nifty fell again to around 10,000-level in October, inching up to close the year just shy of 11,000. It delivered returns of 4.09% during the year.

The Bharatiya Janata Party (BJP) secured a decisive victory, leading to the formation of a stable government under PM Narendra Modi. The stock market reacted positively to this outcome, with benchmark indices such as the Sensex and Nifty reaching record highs shortly after the election results were announced. Investor confidence was bolstered by the expectation of policy continuity and economic reforms.

Before you go

Based on our discussion, it is clear that in the Indian market, there is short-term volatility during the election period - before and after. However, the long-term trajectory is determined by the government's policy action and ability to promote a conducive business environment for the companies.

Investors should approach the stock market with a long-term perspective, focusing on fundamentals and diversification to mitigate election-related volatility. Moreover, staying informed about election developments and their potential economic implications can help investors make informed decisions during election cycles. While general elections can significantly impact the stock market, a well-thought-out investment strategy and a focus on the broader economic landscape are key to successful long-term investing in this dynamic and vibrant democracy.

Top Mutual Funds

Top Mutual Funds