What is multi-asset investing?

Experts tell you to have a balanced and diversified portfolio. To create that you need to have different asset classes in your portfolio - equity, debt, gold, etc. Finding a good stock or a mutual fund is difficult for an average person. Leave alone creating a portfolio.

Creating a balanced portfolio is a next-level problem for most investors in India. Even if you create it, you may find it difficult to monitor and balance it. The solution to the problem is multi-asset investing - you pick one fund that has all the asset classes under it. In this article, we will discuss multi-asset investing in detail.

What is multi-asset investing?

Before we get to multi-asset investing, did you have this question - why have a diversified portfolio? You should have a diversified portfolio because different asset classes will behave differently as market conditions change. Therefore, they provide a degree of protection in times of market stress. Also, the ability to participate in the upside potential of strongly performing markets.

Now that you understand the need, let us explain the concept of multi-asset investing to you. Multi-asset investing is an investment strategy that involves diversifying a portfolio across different asset classes to achieve a balance between risk and return.

Asset classes are categories of financial instruments that share similar risk and return characteristics. Multi-asset investing recognizes that different asset classes have different risk and return profiles.

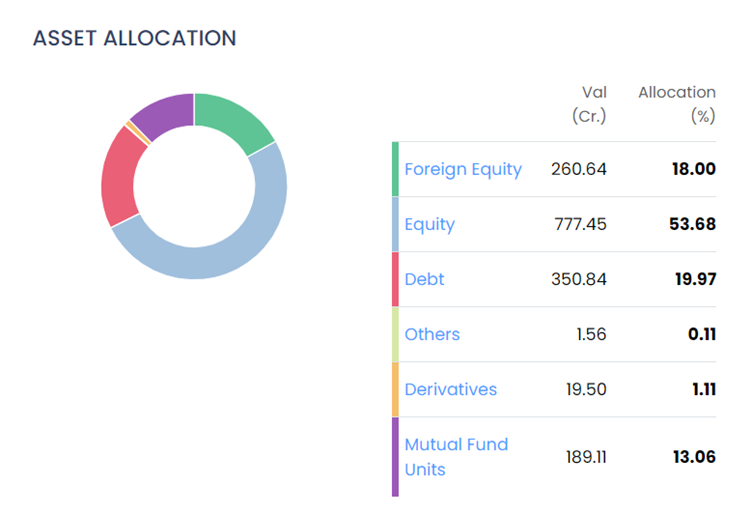

Let us take an example so you better understand them. One of the Multi-asset funds is the Nippon India Multi Asset Fund. You will find details of it on the ICICIDirect page here.

You can see here that the fund has invested in equity (including foreign equity), debt, derivates, mutual funds, etc. Here, the equity exposure is high. You must understand the risk before investing in it.

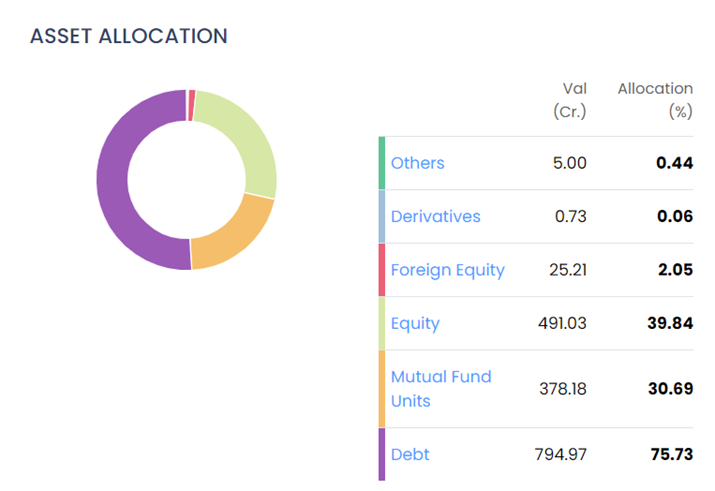

If you don't have high equity exposure, you can look for a fund with lower equity and higher debt exposure. One such fund is the DSP Multi Asset Allocation Fund. As you have seen below, it has higher exposure to debt.

What are the different objectives of multi-asset investing?

By spreading investments across a mix of these assets, you can aim to achieve several objectives. Here are some of them:

- Diversification: Spread risk across different investments to reduce the impact of poor performance in any single asset class.

- Risk Management: Mitigate the impact of market volatility on the overall portfolio.

- Return Enhancement: Take advantage of the potential for higher returns in certain asset classes while managing overall risk.

- Income Generation: Include income-generating assets, such as bonds, to provide a steady income stream.

How does multi-asset investing work?

Fund managers usually adopt one of the two strategies around multi-asset funds. In this section, we will look at them in detail.

1. Strategic asset allocation: In this strategy, the core asset mix of a portfolio is designed to deliver a specific outcome for clients in terms of risk and return. It is based on the fund manager team's view - how the asset class will perform in the long term, in which scientific modelling is used to identify the best combination of asset classes to deliver the desired outcome.

2. Tactical asset allocation: In this approach, the fund manager dynamically adjusts the portfolio in response to changing market conditions, to add value for investors by taking advantage of short or medium-term opportunities.

Before investing in a multi-asset fund, you should clearly know which of the above two strategies the fund is adopting.

Who should invest in a multi-asset fund?

Based on our learning in this article, it is easier to conclude that multi-asset funds are ideal for investors who cannot pick, monitor, and manage multiple funds in their portfolios.

Also, if you have a low-risk appetite but want to enjoy steady returns on your investments, you can check these funds. The multi-asset allocation helps you even out the risk that comes along with investing in just one type of asset class. Additionally, it gives you a steady flow of income even at a time when some asset classes are underperforming than usual.

Risks associated with multi-asset strategies/funds?

You can lower risk in investing, but Investing involves risk, including principal loss. One of the risks is choosing the wrong strategy or type of fund. You may choose a fund that may not align with your actual investment goals. For example, you may invest in an aggressive strategy (the first example we have taken earlier) when a more conservative approach is better suited to you. Alternatively, you may take a too-conservative approach. As a result, you find it difficult to achieve your long-term goals. Therefore, you should carefully analyze funds and strategies to determine which approach best suits your needs.

Before you go

Asset allocation is a critical component of multi-asset investing. It involves determining the optimal mix of asset classes based on your financial goals, risk tolerance, and time horizon. Portfolio managers may adjust the allocation over time in response to changes in market conditions or the investor's objectives.

Investors often use a combination of stocks, bonds, and other asset classes to create a diversified portfolio tailored to their specific needs and preferences. Multi-asset funds are common investment vehicles that implement this strategy for investors.