INTRADAY OUTLOOK: BUY BANK NIFTY IN THE RANGE OF 43100-43150

Nifty F&O View:

For today’s weekly expiry, the Nifty is expected to face resistance at higher levels as healthy Call writing was observed at 18700 and 18800 levels. However, our bias remains positive and dips towards 18500 levels should be used to create fresh long positions

Sell Nifty 18300 Put option (December 15 expiry) in the range of Rs 40-42 Target: Rs 20 Stop loss: Rs 51

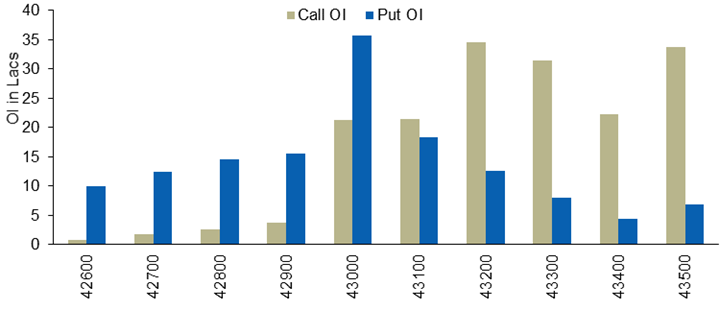

Bank Nifty F&O View:

On Thursday, the Bank Nifty is also expected to remain subdued as aggressive Call writing at higher levels is likely to keep upside limited. However, 43000 Put strike holds substantial OI, which should act as immediate support

Buy Bank Nifty future in the range of 43100-43150 Target: 43350-43450 Stop loss: 43000

Disclaimer

ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The securities quoted are exemplary and are not recommendatory. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds