THE FAG END BUYING DEMAND HELPED INDEX TO RESOLVE OUT PAST THREE SESSION TRADING RANGE 18400-18280

The fag end buying demand helped index to resolve out of past three session’s choppy trading range (18400-18280). The daily price action formed a bull candle carrying higher high, indicating continuance of upward momentum. The formation of lower shadow highlights, elevated buying demand

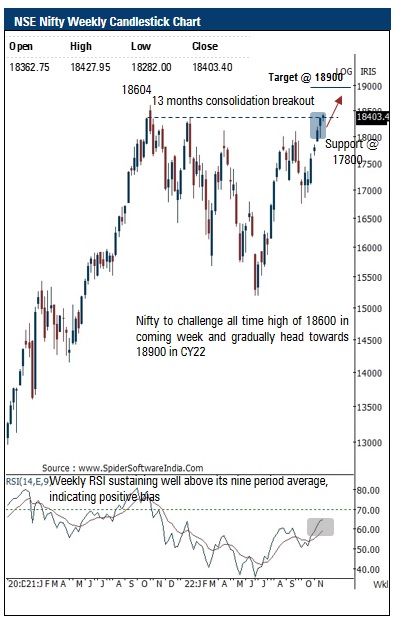

We expect index to endure its northbound journey and challenge the all-time high of 18600 in the coming sessions, consequently paving the way towards 18900 by December 2022. The elongation of rallies along with shallow retracement signifies inherent strength that augurs well extension of ongoing up move. Thus, a temporary breather from here on should be capitalised on as incremental buying opportunity as we do not expect the index to breach the key support of 17800. Our positive stance on the market is based on following observations

Nifty Bank: 42372

The daily price action formed a bull candle with a higher high -low and a fresh all time high (42450 ) signalling continuation of the positive momentum

The index during last week has generated a breakout above the last eight weeks range (41840 -37387 ) signaling extension of the up move . Going forward, we expect the index to gradually head towards 43500 levels in the coming weeks being the 138 . 2 % external retracement of the recent breather (41840 -37386 ) . Hence, any dips should be used as an incremental buying opportunity in quality banking stocks

Top Mutual Funds

Top Mutual Funds