THE INDEX STARTED THE SESSION ON A FLAT NOTE AND GRADUALLY INCHED UP AND CONTINUED WITH ITS RECORD

The index started the session on a flat note and gradually inched upward and continued with its record setting spree over second session in a row. However, profit booking in second half pared some of initial gains. The daily price action formed a bull candle carrying higher high-low, indicating elevated buying demand

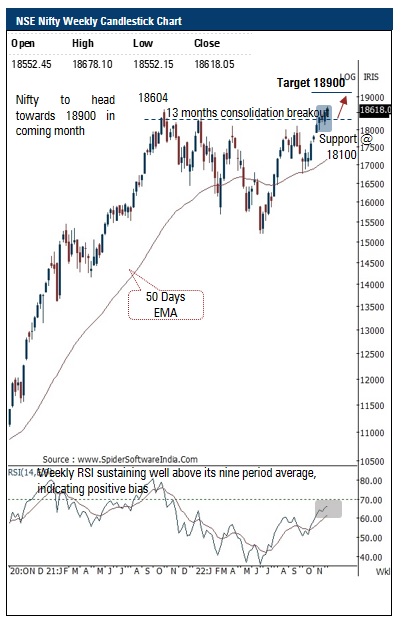

Going ahead, we reiterate our positive stance and expect Nifty to head towards 18900 in coming month. In the process, we expect midcaps to relatively outperform as it approaches maturity of price/time wise correction. Thus, any dip from here on should be capitalised on as incremental buying opportunity as we do not expect index to breach the key support of 18100 amid global volatility. Our positive stance is further validated by following observations

Nifty Bank: 43053

The Daily price action resulted in a small bull candle with a long upper shadow indicating consolidation with positive bias after sharp up move measuring 14 % in past eight weeks which led weekly stochastic at overbought territory with reading of 91

We expect the index to maintain positive bias and head gradually towards 44600 levels in the coming month being the 161 . 8 % external retracement of the September 2022 breather (41840 -37387 )

Disclaimer

ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is a Member of National Stock Exchange of India Ltd (Member Code :07730), BSE Ltd (Member Code :103) and Member of Multi Commodity Exchange of India Ltd. (Member Code: 56250) and having SEBI registration no. INZ000183631. Name of the Compliance officer (broking): Mr. Anoop Goyal, Contact number: 022-40701000, E-mail address: complianceofficer@icicisecurities.com. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. The securities quoted are exemplary and are not recommendatory. The contents herein above are solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments or any other product. Investors should consult their financial advisers whether the product is suitable for them before taking any decision. The contents herein mentioned are solely for informational and educational purpose.

Top Mutual Funds

Top Mutual Funds