THE INDEX WITNESSED A GAP DOWN OPENING ON THE WEEKLY EXPIRY SESSION TRACKING FED MEET OUTCOME

The index witnessed a gap down opening on the weekly expiry session tracking Fed meet outcome. Subsequently, buying demand from 17950 mark helped it to recoup initial losses and settle above 18000 mark. The daily price action formed a small bull candle carrying lower high-low, indicating extended breather over a second consecutive session

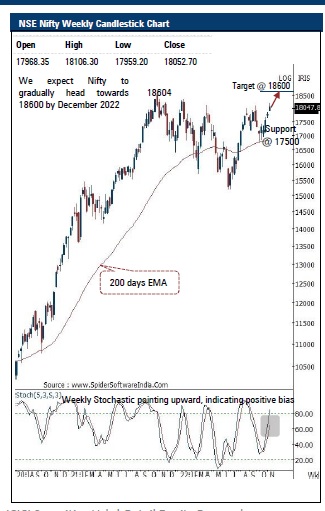

The sturdy bullish structure makes us confident on reiterating our positive stance. We expect the Nifty to challenge all-time high of 18600 by December 2022. We believe the ongoing temporary breather would help the Nifty to cool off overbought conditions post >1200 points rally seen over past three weeks. In the process, stock specific action would prevail amid progress of Q2FY23 earning season. The secondary correction is an integral part of the bull trend. Thus, extended breather from here on should not be construed as negative. Instead, dips should be used as a buying opportunity as that has been the prudent strategy over the past couple of months. Our positive stance is based on following observations

Nifty Bank: 41298

The index started the session on a soft note and tested the lower band of last seven session trading range 40800 -41600 in the opening trade . Buying demand at lower levels saw the index recouped its entire decline and closed the session higher by 0 . 4 % . The index in the process formed a bull candle highlighting buying demand at the lower band of the last seven sessions range .

We believe dips on account of global volatility should not be constructed as negative instead should be used as a buying opportunity in quality banking stock . We expect index to surpass the all -time high (41840 ) in the coming sessions and extend the current up move towards 42900 levels in the coming week being the 123 . 6 % external retracement of the recent breather (41840 - 37386 ) .

Top Mutual Funds

Top Mutual Funds