THE NIFTY CONCLUDED A VOLATILE WEEK ON A POSITIVE NOTE WHEREIN IT OSCILLATED BY 900

The Nifty concluded a volatile week on a positive note wherein it oscillated by ~900 points during the week. The fag end buying demand tracking global up move fuelled by lower-than-expected US inflation number helped the index to recover intra-week losses and witness highest ever weekly closing of 18350. The weekly price action formed a bull candle carrying a higher high-low, indicating continuance of positive bias. The formation of lower shadow signifies elevated buying demand

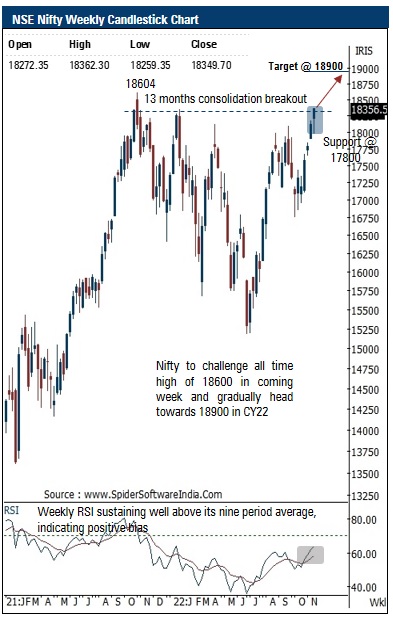

We expect the Nifty to challenge the all-time high of 18600 in the coming week and gradually head towards 18900 by December 2022. The formation of higher peak and trough on the larger degree chart supported by multi sector participation makes us reiterate our constructive stance. Thus, temporary breather from here on should be capitalised on as incremental buying opportunity as we do not expect the index to breach the key support of 17800. Our positive stance on the market is based on following observations: a) the Nifty has given a resolute breakout from 13 month consolidation phase indicating end of corrective phase and beginning of structural uptrend, b) US$, INR pair has reversed from its key resistance around 83 mark on expected lines, supported by similar sharp reversal in US dollar index from multi year trend line resistance. Sequential lower high-low formation in US$, INR pair to favour inflows in Indian equities, c) India VIX has breached six month’s low below reading of 15 indicating low risk perception from market participants, d) global equity indices made sharp bullish reversal this week post favourable US CPI numbers. Dow Jones industrial average has given a breakout from 11- month long declining channel indicating end of corrective phase and expected to pose a technical pullback thereby supporting overall bullish sentiment

Nifty Bank: 42137

The weekly price action formed a bull candle with a higher high -low signaling continuation of the of the positive momentum

The index during last week has generated a breakout above the last eight weeks range (41840 -37387 ) signaling extension of the up move . Going forward, we expect the index to gradually head towards 43500 levels in the coming weeks being the 138 . 2 % external retracement of the recent breather (41840 -37386 ) . Hence, any dips should be used as an incremental buying opportunity in quality banking stocks

Top Mutual Funds

Top Mutual Funds