THE NIFTY STAGED A DECENT RECOVERY WHEREIN IT RECOUPED MONDAY’S LOSSES

The Nifty staged a decent recovery wherein it recouped Monday’s losses. The daily price action formed a bull candle confined within previous session’s trading range (18262-18133), indicating pause in breather

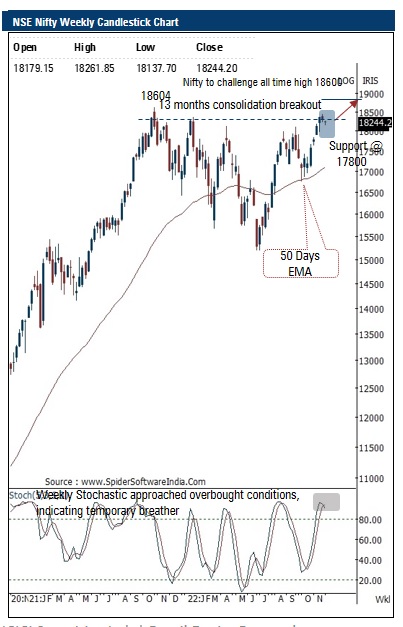

Going ahead, we expect the Nifty to prolong the ongoing consolidation and form a higher base that would set the stage to challenge lifetime highs of 18600 in coming weeks as the broader structure remains strong. We believe, ongoing breather will help index to cool off overbought conditions (weekly stochastic is placed at 90) while sustaining above key support of 17800 wherein stock specific action would prevail. Thus, an extended breather from here on should be capitalised on as an incremental buying opportunity. Our positive stance is further validated by following observations

Nifty Bank: 42457

The daily price action formed a doji candle with a higher high -low signalling continuation of the consolidation with positive bias after the strong up move of more than 13 % in the last seven weeks

We expect the index to continue with its healthy consolidation and form a higher base above the breakout area of 41500 after the recent strong up move which has led to weekly stochastic in overbought zone (93 ) . We believe dips should be used as an incremental buying opportunity for up move towards 43500 levels in the coming weeks being the 138 . 2 % external retracement of the recent breather (41840 -37386 )

Top Mutual Funds

Top Mutual Funds