THE NIFTY STARTED THE EVENTFUL WEEK WITH A POSITIVE GAP 17786-17910

The Nifty started the eventful week with a positive gap 17786-17910 and continued to march northward during the week. As a result, it approached our intermediate target of 18100. The weekly price action formed a small bull candle carrying higher high-low, indicating continuance of positive bias

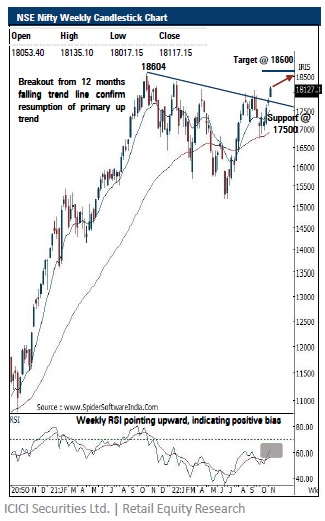

Going ahead, we reiterate our constructive stance and expect the Nifty to challenge the all-time high of 18600 in coming couple of weeks. In the process, bouts of volatility owing to global uncertainty should be used as incremental buying opportunity as it will help short term indicators to cool off the overbought conditions. Our positive stance on the market is anchored upon following observations: a) breakout from 12 month’s falling trend line confirms conclusion of corrective bias, in turn, suggesting resumption of the primary up trend b) Over the past two decades, Q4 returns for the Nifty have been positive (average 11% and minimum 5%) on 15 out of 21 occasions (70%). History favours buying dips c) India VIX, which gauges market volatility, has recorded five month’s range breakdown and is trading below 16, indicating low risk perception among market participants d) Indian equities continued to relatively outperform their global peers, showing inherent strength e) US indices oversold: Percentage of stocks above 200-dma for S&P500 and Nasdaq has approached bearish extreme of 15 and 12. Over two decades, readings below 15 and 12 have led to meaningful durable bottoms. We therefore expect US indices to pose technical pull backs from oversold readings f) US Dollar/INR pair retreated from upper band of long term rising trend line placed at 83.30 while Dollar index has faced stiff resistance from decade long resistance trend line placed around 115

Nifty Bank: 41258

The weekly price action formed a Doji candle with shadows in either direction signaling consolidation after recent strong up move of 11 % in the preceding five weeks

Going forward, we reiterate our positive stance as we expect the index to surpass the all -time high (41840 ) and extend the current up move towards 42900 levels in the coming weeks being the 123 . 6 % external retracement of the recent breather (41840 -37386 ) . Dips on account of global volatility should not be constructed as negative instead should be used as a buying opportunity

Top Mutual Funds

Top Mutual Funds