THE NIFTY STARTED THE SESSION ON A SUBDUED NOTE

The Nifty started the session on a subdued note. However, buying demand from 18600 levels helped the index to recover intraday losses. As a result, the daily price action formed an inside bar, indicating a pause in the ongoing breather

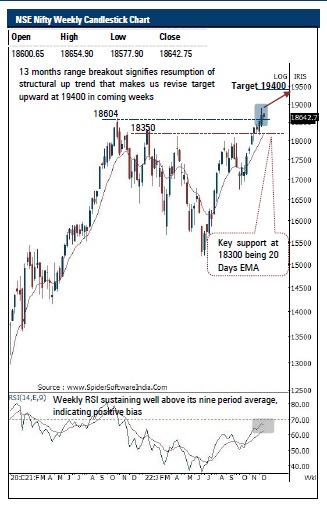

The ongoing breather has helped index to cool off the overbought conditions (daily stochastic drifted to 46) and form a higher base that would eventually pave the way to eventually head towards 19400 in coming weeks. We believe the move towards 19400 would be in a non linear manner as bouts of volatility amid global development cannot be ruled out. In the process, we expect broader markets to relatively outperform as it resolved out of three month’s higher base formation. Thus, dips should be capitalised on as incremental buying opportunity. We expect an extended breather from here on to get anchored around key support of 18300 levels. The aforementioned positive stance is further validated by following observations

Nifty Bank: 43138

The daily price action formed a doji candle with a long upper shadows which remained contained inside previous sessions high -low range signalling continuation of the consolidation after sharp up move measuring 15 % in past nine weeks

We expect the index to maintain positive bias and head gradually towards 44600 levels in the coming weeks being the 161 . 8 % external retracement of the September 2022 breather (41840 -37387 ) . Dips should be used as a buying opportunity index has strong support placed around 41800 levels

Top Mutual Funds

Top Mutual Funds