THE NIFTY STARTED THE SESSION ON A SUBDUED NOTE AND GRADUALLY DRIFTED DOWNWARD

The Nifty started the session on a subdued note and gradually drifted downward as the day progressed. The daily price action formed a bear candle carrying a lower low over a fourth consecutive session, indicating an extended breather

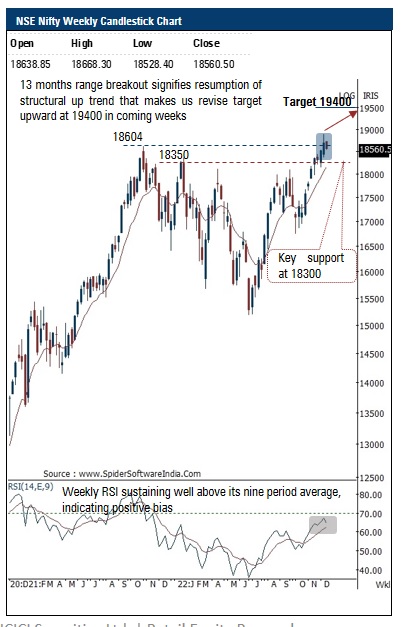

We believe the ongoing breather would make market healthy by cooling off overbought conditions (daily stochastic slipped to 24) and form a higher base that would gradually pave the way to challenge 18900 mark and eventually head towards 19400 in coming weeks. We believe the move towards 19400 would be in a non-linear manner as bouts of volatility amid global development cannot be ruled out. In the process, we expect broader markets to relatively outperform as it resolved out of three month’s higher base formation. Thus, extended breather from here on should be capitalised on as incremental buying opportunity as strong support is placed at 18300. The aforementioned positive stance is further validated by following observations

Nifty Bank: 43098

The daily price action formed a high wave candle with shadows in either direction signalling continuance of the consolidation after sharp up move measuring 15 % in past nine weeks

We expect the index to maintain positive bias and head gradually towards 44600 levels in the coming weeks being the 161 . 8 % external retracement of the September 2022 breather (41840 -37387 ) . Dips should be used as a buying opportunity index has strong support placed around 41800 levels

Top Mutual Funds

Top Mutual Funds