THE NIFTY WITNESSED A VOLATILE SESSION WHEREIN IT OSCILLATED IN MERELY 80 POINT RANGE DURING SESSION

The Nifty witnessed a volatile session wherein it oscillated in merely 80 points range during the session. The daily price action formed a bear candle carrying higher high-low, indicating extended consolidation amid stock specific action. In the process, broader market relatively outperformed

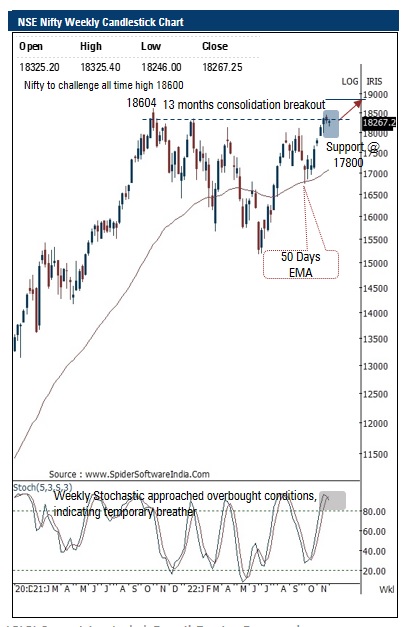

We believe, prolonged consolidation in the narrow range of 18400- 18100 would help index to cool off the overbought conditions and eventually pave the way to challenge lifetime highs of 18600 in coming weeks as the broader bullish structure remains intact. In the process, we expect broader market to witness rejuvenation of upward momentum which will help midcap and small cap indices to witness catch up activity against benchmark. Thus, an extended breather should be capitalised on as an incremental buying opportunity as we do not expect Nifty to breach key support of 17800. Our positive stance is further validated by following observations

Nifty Bank: 42729

The daily price action formed a high wave candle with a higher high -low signalling continuation of the consolidation with positive bias

We expect the index to maintain positive bias and gradually head towards 43500 levels in the coming weeks being the 138 . 2 % external retracement of the recent breather (41840 - 37386 ) . The recent strong up move has led to weekly stochastic at an overbought territory (93 ) . We believe dips should be used as an incremental buying opportunity with strong support placed around 41500 levels

Top Mutual Funds

Top Mutual Funds