THE RANGE BOUND ACTIVITY CONTINUED OVER A FIFTH CONSECUTIVE SESSION WHEREIN IT OSCILLATED IN 150 POINTS RANGE

The range bound activity continued over a fifth consecutive session wherein it oscillated in 150 points range. The daily price action formed a small bear candle carrying lower high-low, indicating extended breather amid stock specific action

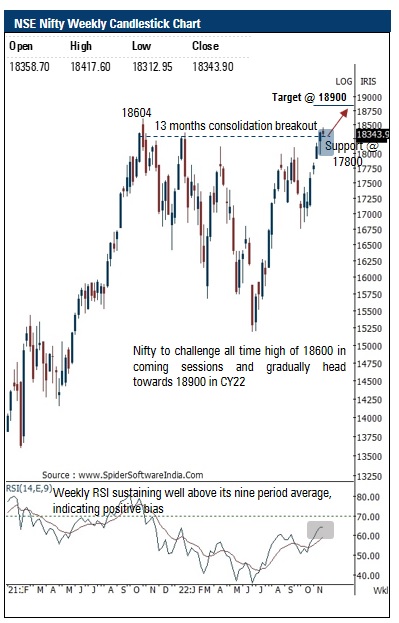

The index is taking breather after recent 1500 points sharp up move seen during past four weeks. We believe, ongoing breather would help index to cool off the short term overbought condition and help index to form a higher base that would pave the way to challenge the all-time high of 18600 in the coming sessions and eventually head towards 18900 by December 2022. Thus, extended breather from here on should be capitalised on as incremental buying opportunity as we do not expect the index to breach the key support of 17800. Our positive stance on the market is based on following observations

Nifty Bank: 42458

The daily price action formed a small bull candle with an upper shadow signalling consolidation at all time high after the recent strong up move

The index is seen extending its up move after recently generating a breakout above the last eight weeks range (41840 -37387 ) signaling strength . Going forward, we expect the index to gradually head towards 43500 levels in the coming weeks being the 138 . 2 % external retracement of the recent breather (41840 -37386 ) . Hence, any dips should be used as an incremental buying opportunity in quality banking stocks

Top Mutual Funds

Top Mutual Funds