THE WEEKLY EXPIRY SESSION STARTED WITH A POSITIVE GAP (18758-18872).

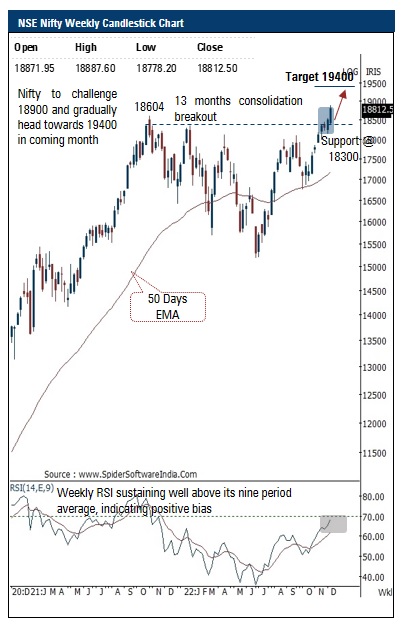

The weekly expiry session started with a positive gap (18758-18872). As a result, index approached near our target of 18900. The daily price action formed a small bear candle, indicating minor profit booking at higher levels. However, formation of higher high-low displays continuation of prevailing upward momentum

The formation of higher peak and trough signifies elevated buying demand that makes us confident to revise our target to 19400 for coming weeks. Key point to highlight is that current up move is supported by improving market breadth, across sector participation that augurs well for durability of ongoing structural up trend. However, we believe the move towards 19400 would be in a non linear manner as bouts of volatility amid global development can not be ruled out. Thus, dips should be capitalised on as incremental buying opportunity as we expect temporary breather to get anchored around key support of 18300. In the process, we expect midcaps to relatively outperform and witness catch up activity against benchmark.

Nifty Bank: 43260

The Daily price action formed a small bear candle with a higher high -low indicating continuation of the consolidation with positive bias after sharp up move measuring 14 % in past eight weeks which led weekly stochastic at overbought territory with reading of 91

We expect the index to maintain positive bias and head gradually towards 44600 levels in the coming weeks being the 161 . 8 % external retracement of the September 2022 breather (41840 -37387 )

Top Mutual Funds

Top Mutual Funds