- 26 Jul 2023

- ICICIdirect

BAJAJ FINANCE Q1 RESULTS 2024: PROFIT JUMPS, ASSET QUALITY IMPROVES

BAJFINANCE - 6566 Change: -72.20 (-1.09 %)

Bajaj Finance reported its Q1FY24 numbers on Wednesday afternoon during market hours. Before the result announcement, Bajaj Finance shares were trading in the green, but the share price slipped into the red territory and closed 2.39% lower at Rs 7,424.65 per share. Let us look at everything in detail about Bajaj Finance's Q1FY24 result.

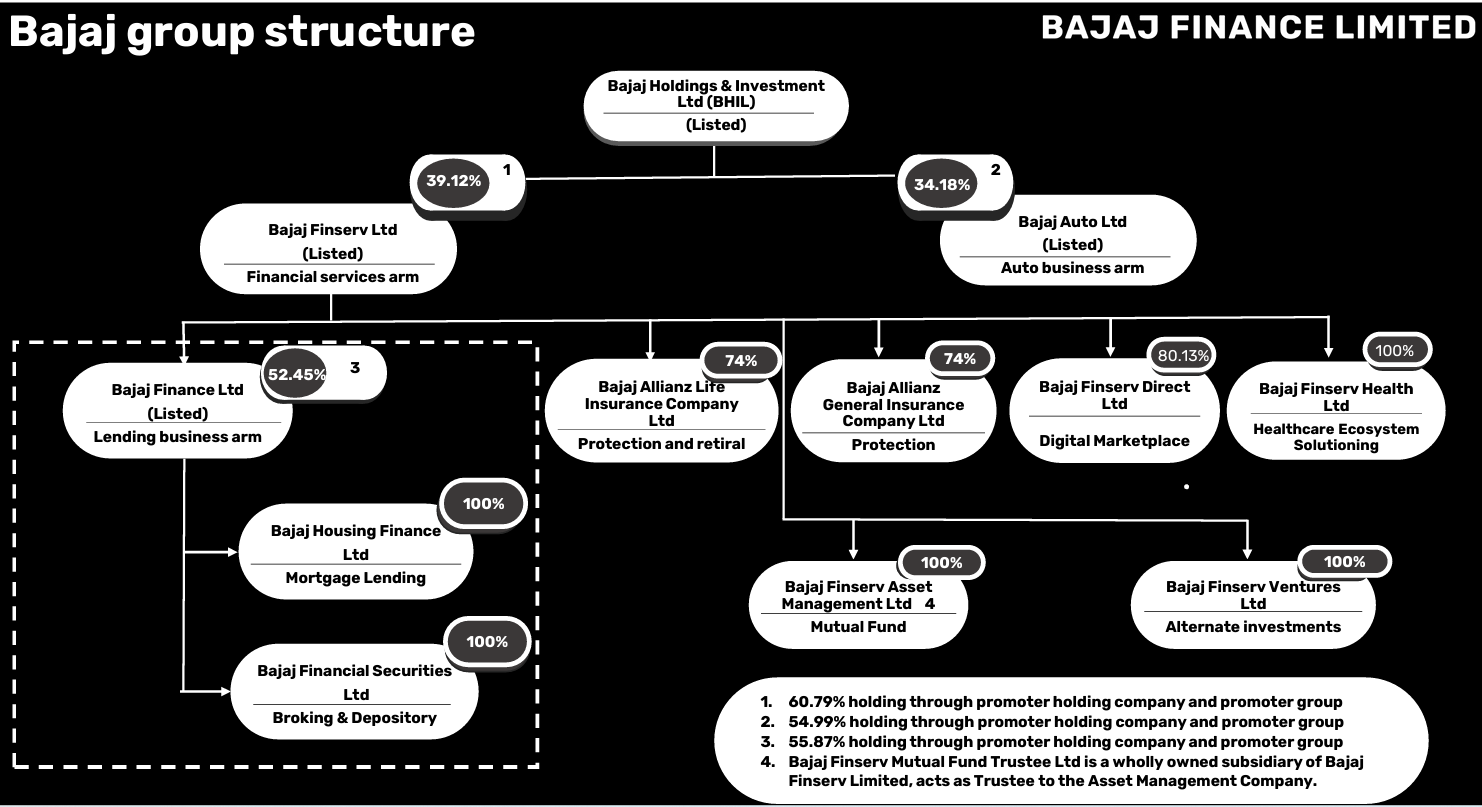

About Bajaj Finance

Bajaj Finance is a prominent non-banking financial company (NBFC). It offers a wide range of financial products and services, including consumer loans, personal loans, and investment options. It is known for its strong market presence and customer base. Bajaj Finance is also India's largest NBFC.

Crucial parameters

- PE: 44.78

- 52-week high: Rs 7,999.90

- Market Cap: Rs 4,46,865.29 crore

- ROE: 19.98

Share price movement

In the last month, Bajaj Finance's share price climbed 6%. In 2023, the share price beat benchmark indices with a gain of 13.5%. For the 5-year time frame, the share price has been one of the best-performing large-cap stocks, with a share price jump of 175%.

How has Bajaj Finance performed in Q1FY24

Below are key highlights of Bajaj Finance's Q1FY24 numbers:

Profits: Bajaj Finance reported a profit of Rs 3,437 crore for Q1FY24, a sharp jump of 32% compared to the year-ago period. The bottomline is also above the estimates. In the same quarter last financial year, the company reported a net profit of Rs 2,596 crore.

Net Interest Income: NII represents the difference between the interest earned by an NBFC on its loans, advances, and other interest-bearing assets and the interest paid on its liabilities, such as borrowings and deposits.

Bajaj Finance's NII grew by 26% to Rs 8,398 crore, as against Rs 6,640 crore in Q1FY23. Opex to NII improved to 34.0% in Q1FY24 versus 35.9% in Q1FY23.

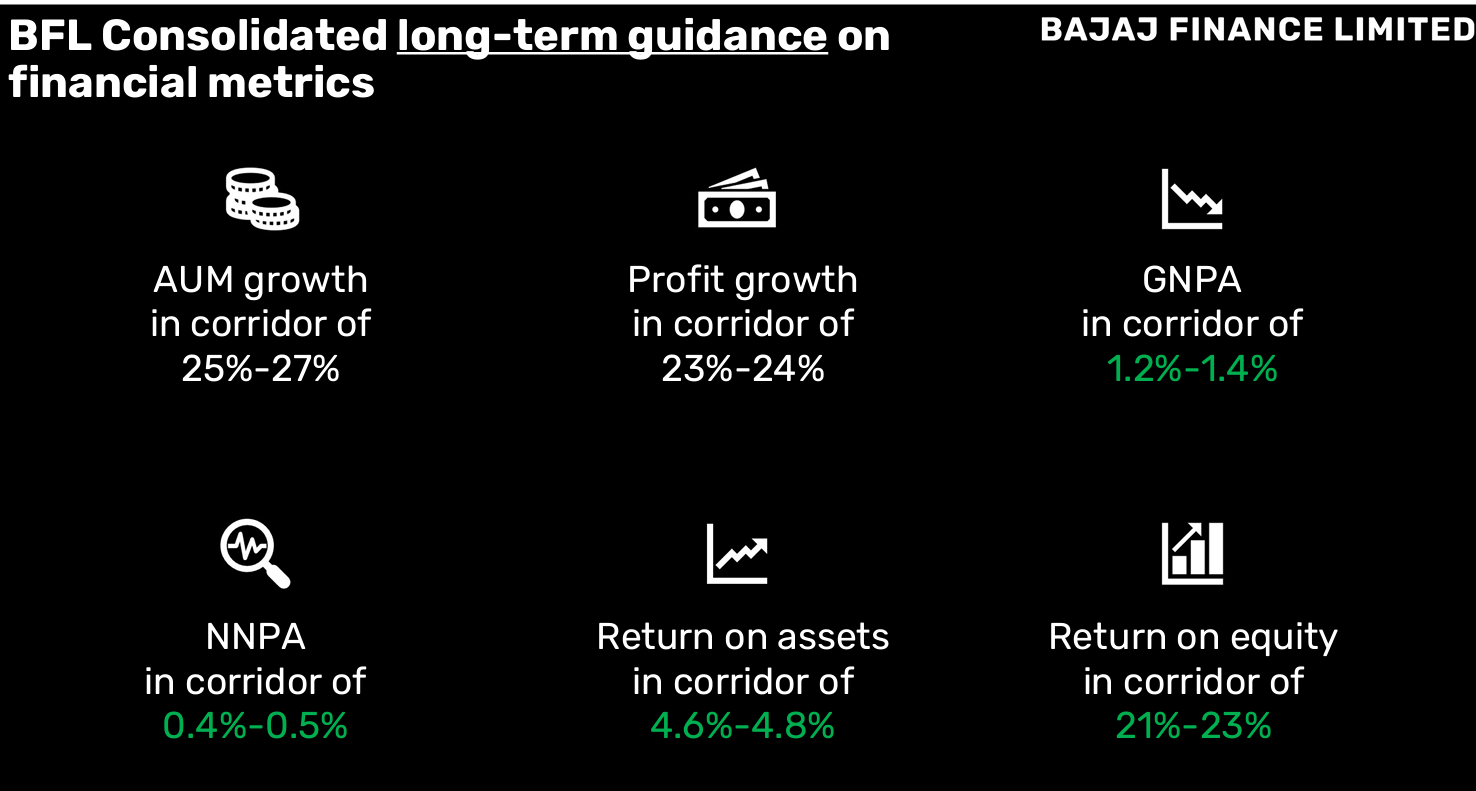

Asset Quality: Bajaj Finance reported its lowest-ever GNPA (Gross Net Performing Asset) of 0.87% and NNPA (Net) of 0.31% for the quarter that ended in June. In the year-ago period, the GNPA and NNPA were 1.25% and 0.51%, respectively. The loan losses & provisions stood at Rs 995 crore.

Bajaj Finance holds a management & macroeconomic overlay of Rs 840 crore as of 30 June 2023. Their risk metrics were strong across all businesses except Rural B2C businesses. They have taken risky actions in the Rural B2C business, resulting in muted growth in Q1.

AUM: Bajaj Finance reported highest ever quarterly Asset Under Management (AUM) growth of Rs 22,718 crore in Q1FY24. Based on a strong Q1 start, the company has estimated AUM growth to be in the range of 29-31% for FY24. For Q1FY24, AUM was up 32% at Rs 2,70,097 crore, as against Rs 2,04,018 crore as of 30 June 2022.

Customer Base: In Q1FY24, Bajaj Finance added the highest-ever new customers, 3.84 million, to the franchise. Customer franchises stood at 73.0 million as of 30 June 2023, and cross-sell franchises stood at 44.3 million. The company is confident of adding 12-13 million new customers in FY24.

Deposits: In the April-June quarter, the consolidated deposit registered a 46% on-year growth to Rs 49,944 crore. In the corresponding quarter last year, it stood at Rs 34,102 crore.

ROA and ROE: The company delivered an annualized ROA of 5.42% as against 5.33% in Q1FY23. Adjusted for the reversal of deferred tax liability, ROA was 5.30%. In Q1FY24, it delivered an annualized ROE of 24.47% as against 23.07% in Q1FY23. Adjusted for the reversal of deferred tax liability, ROE was 23.95%.

How have Bajaj Finance's subsidiaries performed?

Below is the performance of Bajaj Finance's subsidiaries:

- Bajaj Housing Finance Limited: The AUM was up 29% at Rs 74,124 crore as against Rs 57,425 crore as of 30 June 2023. Net interest income (NII) grew by 18% to Rs 702 crore. GNPA and NNPA stood at 0.23% and 0.08%, respectively.

- Bajaj Financial Securities Limited (BFinsec): Customers acquired during Q1FY24 were approximately 19,900. BFinsec's customer franchise as of 30 June 2023 was over 585,000. Total Income for Q1FY24 was Rs 75 crore, as against Rs 39 crore for Q1FY23.

To sum up

Bajaj Finance, yet again, has reported an excellent set of numbers. The project around customer base and AUM growth is phenomenal. Another positive for the company is its low NPA numbers - the numbers have considerably reduced in this quarter.

Top Mutual Funds

Top Mutual Funds