- 29 Mar 2024

- ICICIdirect

BHARTI HEXACOM LIMITED IPO: ISSUE SIZE, PRICE BAND AND MORE

The first IPO that opens for subscription in the new financial year is Bharti Hexacom Limited (BHL), a fixed-line telephone and broadband services provider. The IPO opens for subscription on the 3rd of April and closes on the 5th of April. In this article, we look at the various aspects of BHL's business to help you decide whether to subscribe or invest in the IPO.

Bharti Hexacom IPO: Key Details

Below are the key details related to the BHL IPO:

- Issue Size: Rs 4,275 crore

- Price Band: Rs 542 - Rs 570

- Lot Size: 26 Shares

- Issue Details: Only Offer for Sale

- Market Cap: At the upper price band, Rs 28,500 crore

- Minimum Investment: Rs 14,820

Bharti Hexacom IPO: The Business

They are a communications solutions provider offering consumer mobile services, fixed-line telephone, and broadband services to customers in the Rajasthan and the North East telecommunication circles in India, which comprises the states of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, and Tripura.

BHL offers its services under the brand ‘Airtel’. They have a distinct strategy to premiumise their portfolio by acquiring and retaining quality customers and delivering an experience through their omnichannel approach and data science.

It has a gamut of digital offerings to enhance customer engagement and differentiated customized offerings through family and converged plans under the Airtel Black proposition, which has resulted in the continuous improvement of its revenue market share during the last three financial years.

The company has undertaken prudent cost optimization measures to improve its profitability and maintain an efficient capital structure with a comfortable leverage position. They continuously invest in network expansion, technology advancement, and judicious spectrum investments. As of December 31, 2023, they had invested Rs 206 billion in capital expenditure in their future-ready digital infrastructure.

They derive significant synergies from our relationship with their promoter, Airtel, through the expansive digital infrastructure, digital experience, and the digital services it provides to its customers.

Bharti Hexacom IPO: Industry Overview

The telecom industry is capital-intensive and highly competitive. Players undertake mergers and acquisitions (M&As) to not only survive but also upgrade technologically, expand the customer base and widen product diversification. Acquisitions in the sector primarily involve horizontal integration as the companies aim to gain a competitive advantage by acquiring competitors. Fewer market players lead to economies of scale and a reduction in the overlapping infrastructure. This lowers operational expenses and allows more efficient use of capital investments. In most key countries, 2-5 telecom companies dominate the sector.

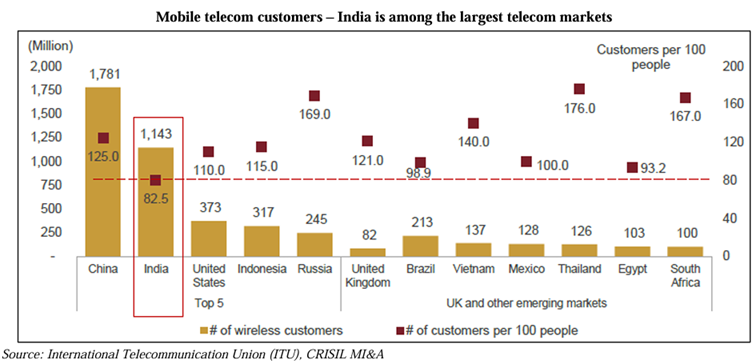

China is the largest telecom market, with 1,781 million wireless customers as of 2022. India follows with 1,143 million wireless customers as of 2022. India has emerged as one of the five fastest-growing wireless telecom markets, with its customer base clocking a 2.9% CAGR between 2013 and 2022.

In FY23, at 82.5 customers per 100 people, India’s wireless teledensity is the lowest among the top five wireless markets in the world and among emerging markets. Even India’s telephone and fixed broadband customers at 1.9 and 2.4 per 100 people, respectively, are much lower than those in other large economies. The under-penetration of telecom services implies growth potential, especially in rural areas, supported by projected growth of the Indian economy and per capita income.

Bharti Hexacom IPO: Listed Peers

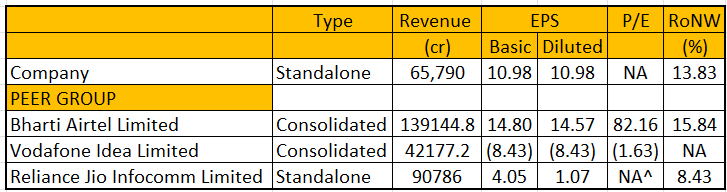

The company has two listed peers - Vodafone Idea, Bharti Airtel, and Reliance Jio Infocomm. In this section, we look at the financial performance of the three companies and see where BHL stands:

- In terms of revenue, BHL is the smallest player, while Bharti Airtel is the largest player.

- Bharti Airtel has the highest earnings per share (EPS), followed by Bharti Hexacom and Reliance Jio Infocomm.

- Again, the same sequence follows for Return in Net Worth (RoNW).

Below are the exact numbers for comparison.

Bharti Hexacom IPO: Financials

Let us now look at the financials of Bharti Hexacom. Here are the details:

- The company has reported a revenue of Rs 4,704.30 crore, Rs 5,494.00 crore, and Rs 6,719.20 crore for FY21, FY22, and FY23. The topline has grown at a CAGR of 19.51%. For 9MFY24, the revenue reported was Rs 5,069.60 crore.

- The revenue market share for the Rajasthan circle was 40.4%, 39.2%, 39.5%, 36.7%, and 32.7%, while for the North East circle was 52.7%, 52.4%, 52.5%, 48.5% and 42.0% during the nine months ended December 31, 2023, and 2022 and FY23, FY22 and FY21, respectively.

- For FY23, FY22 and FY21, the capital expenditure was 46.39%, 16.18%, and 34.26% of their revenue from operations, respectively.

- The company has been able to consistently increase ARPU for mobile services from Rs 135 for FY21 to Rs 155 for FY22 to Rs 185 for FY23 to Rs 197 for the 9MFY24.

- BHL has reported an EBITDA of Rs 1,137.30 crore, Rs 1,898.50 crore, and Rs 2,884.40 crore for FY21, FY22, and FY23, respectively. The EBITDA margins for the same period were 24.71%, 35.12%, and 43.90%, respectively.

- They have reported a net profit/loss (PAT) of Rs (1,033.90) crore, Rs 1,674.60, and Rs 549.20 crore for FY21, FY22, and FY23.

- Return on Capital Employed (ROCE) has increased from (1.58)% in FY21 to 10.72% in FY23.

Bharti Hexacom IPO: Competitive Strengths

Below are the competitive strengths of BHL:

- The company has established leadership and a large customer base in its area of operations.

- They have a presence in markets with high growth potential.

- Airtel owns 70% of their outstanding equity share capital - they have strong parentage and an established brand.

- It relies on a robust network infrastructure through owned and leased assets. The company benefits from the telecommunication infrastructure and other digital assets of Airtel and its investment in Indus Towers.

Bharti Hexacom IPO: Risks

Below are the risks associated with their business:

- They derive their revenues from providing mobile telephone services in Rajasthan and the North East circle, and any unfavorable developments in such regions could adversely affect their business.

- As of December 31, 2023, they had contingent liabilities that have not been provided for in their Restated Financial Information and could adversely affect the business, financial condition, and results of operations.

- Reduction in revenue we earn for their telecom services, due to regulatory ceilings on pricing, or owing to pricing pressure, reduction in average revenue per user (ARPU), may impact the business.

- It requires significant capital to fund their capital expenditure, and if they are unable to raise additional capital, the business, financial condition, and results of operations could be adversely affected.

Top Mutual Funds

Top Mutual Funds