- 03 Aug 2023

- ICICIdirect

CONCORD BIOTECH LIMITED IPO OPENS FOR SUBSCRIPTION ON 4TH AUGUST

In the last post, we covered the first IPO of August – SBFC Finance. The next in the month is Concord Biotech, already in the news as it is backed by big Indian investors. The IPO opens for subscription on the 4th August and closes on the 8th August. In this article, we will share various aspects related to the company which may help you decide whether to subscribe or invest in the IPO for the long term.

Concord Biotech Limited IPO: Key Details

Below are the key details related to Concord Biotech IPO:

- Issue Size: Rs 1,551.00 crore

- Price Band: Rs 705 - Rs 741

- Issue Details: Only Offer For Sale

- Market Cap: At the upper price band, Rs 7,752 crore

- Minimum Investment: Rs 14,820

Concord Biotech Limited: About the business

Concord Biotech is an India-based biopharma company and one of the leading global developers and manufacturers of select fermentation-based APIs across immunosuppressants and oncology in terms of market share, based on volume in 2022. They supply to over 70 countries, including regulated markets such as the US, Europe, Japan, and India.

In 2022, they commanded a market share of over 20% by volume 2022 across identified fermentation-based API products, including mupirocin, sirolimus, tacrolimus, mycophenolate sodium, and cyclosporine. As of March 31, 2023, the company had a total installed fermentation capacity of 1,250-meter cubes.

In 2016, they launched their formulation business in India and emerging markets, including Nepal, Mexico, Indonesia, Thailand, Ecuador, Kenya, Singapore, and Paraguay, and have further expanded to the US. They are amongst the few companies globally that have successfully and sustainably established and scaled up fermentation-based API manufacturing capabilities.

They manufacture below products:

- Bio-pharmaceutical APIs through fermentation and semi-synthetic processes, across the therapeutic areas of immunosuppressants, oncology, and anti-infectives.

- Formulations used in the therapeutic areas of immunosuppressants, nephrology drugs, and anti-infective drugs for critical care.

Concord Biotech Limited: Industry Overview

India's domestic healthcare market is growing rapidly and is projected to grow at a CAGR of 8% to 10% from 2023 to 2026. In addition to improving private insurance coverage and a greater willingness to spend on healthcare, government policies provide catalytic stimuli.

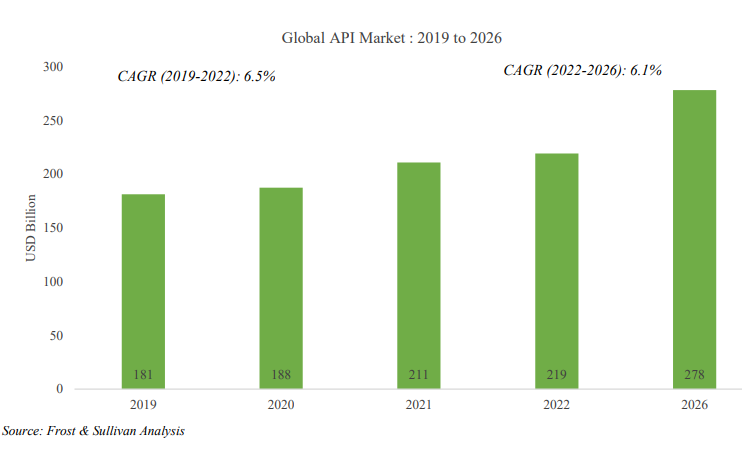

The global API market was valued at approximately $219 billion in 2022, which constitutes about 16% of the total pharmaceutical formulations market and is expected to reach $278 billion approximately by the year 2026, at a projected CAGR of 6.1% over the forecast period of 2022 to 2026. Of the total market, biological APIs accounted for 37% of the share in 2022, and small molecule drug APIs accounted for the remainder of 63% share.

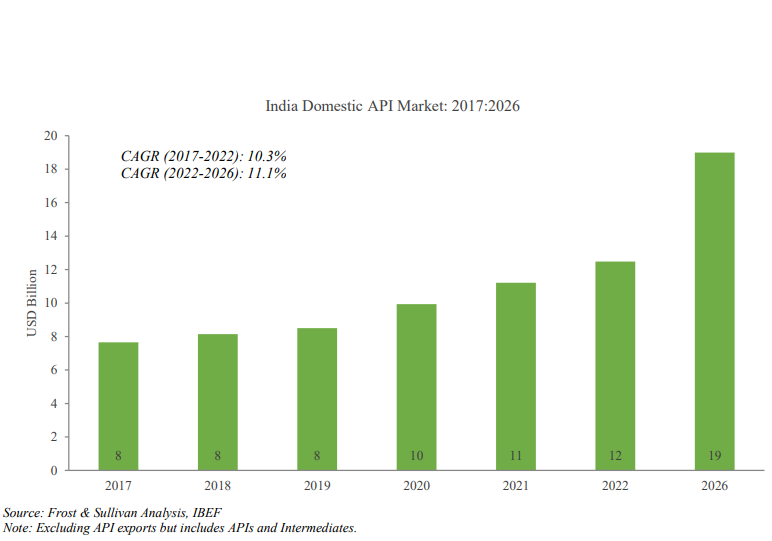

India's growth trajectory of the API market is well-cemented for domestic API consumption and exports. The Indian API market, valued at $17 billion in 2022, comprises APIs manufactured for export and APIs consumed in formulation manufacturing. These formulations are domestically consumed and exported to the global market. While API exports accounted for $5 billion in 2022, APIs required for formulation manufacturing amounted to $12 billion in 2022.

Concord Biotech Limited: Peer comparison

Concord Biotech has multiple listed peers. Some of them are Divi's Lab, Suven Pharmaceuticals, Laurus Labs, and Shilpa Medicare. Let us look at how Concord Biotech stands compared to the above-listed peers:

- In terms of total revenue FY23, Concord Biotech is the smallest player, the largest being Divi's Lab.

- In terms of Earning Per Share (Basic), Divi's Lab is at the top of the list followed by Concord Biotech.

- Return on Net Worth is 20.06% for Concord Biotech, only behind Suven Pharmaceuticals' 23.70%.

Concord Biotech Limited: Financials

Let us now look at the most crucial part that one needs to consider while evaluating a new company (and also a new company). Below are the financial numbers of Concord Biotech over the last three financial years:

- For FY21, FY22, and FY23, the revenue from operations reported was Rs 616.94 crore, Rs 712.93 crore, and Rs 853.17 crore, respectively. The revenue has grown at a CAGR of 17.58% in this period.

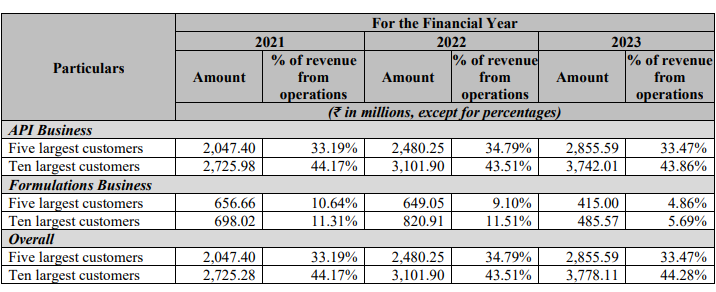

- For FY21, FY22, and FY23, they generated revenues of approximately 44.17%, 43.51%, and 44.28%, respectively, of their revenue from operations for the same years, from the ten largest customers by revenue for the respective years.

- EBITDA for FY21, FY22, and FY23 was Rs 327.10 crore, Rs 269.64 crore, and Rs 345.25 crore, respectively. There has been no significant growth in EBITDA, the reason being the margins have fallen. The EBITDA margin for the same period was 53.02%, 37.82%, and 40.47%, respectively.

- Concord Biotech reported a net profit of Rs 234.89 crore, Rs 174.93 crore, and Rs 240.08 crore for FY21, FY22, and FY23. The net profit margins for the same period were 38.07%, 24.54%, and 28.14%, respectively.

- For the last three financial years, the company has reported an average EPS of Rs 20.79 and an average RoNW of 20%.

- If we attribute FY23 earnings to its post-IPO paid-up equity capital, the asking price is at a P/E of 32.29.

- For FY21, FY22, and FY23, the company reported ROCE of 53.02%, 37.82%, 40.47%, respectively.

- The debt to equity ratio is low for the company. In FY21, it was 0,09 and, it has come down to 0.02 in FY23.

What are the competitive strengths of Concord Biotech?

As per the company, their competitive strength is as below:

- They have established capabilities across the fermentation value chain. The fermentation value chain encompasses aspects such as R&D, patents, key starting materials, API and formulation manufacturing, and marketing and distribution of fermentation-based products.

- Concord Biotech is one of the leading global developers and manufacturers of select fermentation-based APIs across immunosuppressants and oncology in terms of market share, based on volume in 2022.

- The company has scaled manufacturing facilities with a consistent regulatory compliance track record supported by strong R&D capabilities.

- They have established long-standing relationships with certain key customers, including leading global generic pharmaceutical companies.

Risks associated with the Concord Biotech

Below are the risks the company has highlighted in its RHP documents:

- Any delay, interruption, or reduction in the supply of raw materials or the transportation of raw materials or products may adversely impact the pricing and supply of their products and hurt the business.

- Any manufacturing or quality control issues may damage their reputation, subject them to regulatory action, and expose them to litigation or other liabilities, which could adversely affect the business.

- The company depends on a limited number of customers for a substantial portion of its revenues.

Top Mutual Funds

Top Mutual Funds