- 08 Feb 2024

- ICICIdirect

ENTERO HEALTHCARE SOLUTIONS LIMITED IPO: ISSUE SIZE, PRICE BAND AND MORE

The last IPO that opens for subscription this week is Entero Healthcare Solutions Limited (EHSL), a distributor of healthcare products in India. The IPO opens for subscription on the 9th of February and closes on the 13th of February. In this article, we look at the various aspects of ESHL's business to help you decide whether to subscribe or invest in the IPO.

Entero Healthcare Solutions IPO: Key Details

Below are the key details related to the EHSL IPO:

- Issue Size: Rs 1,600 crore

- Price Band: Rs 1,195 - Rs 1,258

- Lot Size: 11 Shares

- Issue Details: Fresh Issue of Rs 1,000 crore and OFS of Rs 600 crore

- Market Cap: At the upper price band, Rs 5,471 crore

- Minimum Investment: Rs 13,838

Entero Healthcare Solutions IPO: The Business

The company was founded in 2018, with the vision to create an organized, pan-India, technology-driven, and integrated healthcare products distribution platform that can add value to the entire healthcare ecosystem. They are amongst the top three healthcare products distributors in India in terms of revenue in FY22.

It facilitates healthcare product manufacturers by providing access to pharmacies, hospitals, and clinics through its integrated and technology-driven distribution platform. Similarly, clients (pharmacies, hospitals, and clinics) gain access to a broad range of healthcare products through the distribution infrastructure and established relationships with healthcare product manufacturers.

Entero Direct, the company's B2B application, has improved the buying experience for customers. It offers real-time visibility of product range, pricing, inventory levels, order status, outstanding balances, and promotional offers. Entero Direct enables pharmacies to place orders, track their status, make online payments, and arrange for returns and claim settlements through a 'single-click' system.

With their nationwide presence of 77 distribution warehouses located across 38 cities in 19 states and union territories, and a customer base of over 73,700 pharmacies and 2,800 hospitals spread across 501 districts, as of September 30, 2023, they provide vast access to healthcare product manufacturers.

Entero Healthcare Solutions IPO: Industry Overview

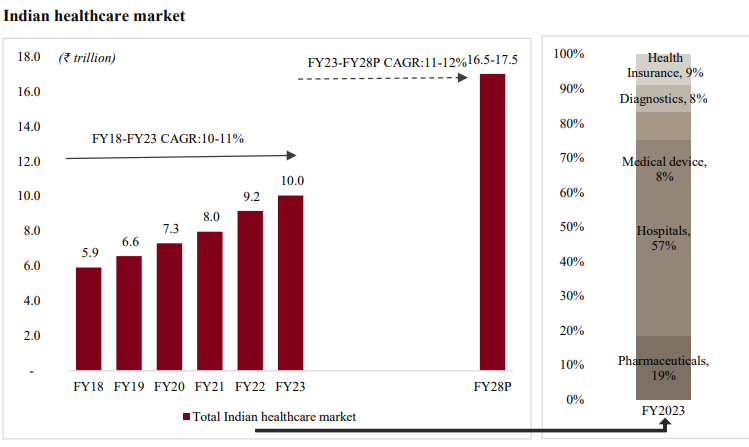

The Indian healthcare industry, consisting of the pharmaceuticals, hospitals, medical devices, diagnostics, and health insurance segments, grew exponentially, logging a 10-11% CAGR between FY18 and FY23. Last fiscal, the industry was valued at ~Rs 10.0 trillion. With an aging population, an increased incidence of lifestyle diseases, greater healthcare awareness, technology adoption, and a growing affluent middle class serving as some of the key drivers, the market is expected to clock an 11-12% CAGR between FY23 and FY28, reaching Rs 16.5-17.5 trillion in FY28.

According to the CRISIL Report, the distribution of pharmaceutical products in India is extremely fragmented, with approximately 65,000 distributors, as of March 31, 2023, that generally service limited local areas only, unlike developed markets where large nationwide distributors occupy a dominant market position. The operational efficiencies can be achieved through reduced logistics costs as a result of streamlined procurement and distribution as provided by large/national distributors.

The market catered by pharmaceutical distributors consisting of pharmaceutical products and medical devices from the target addressable market for pharmaceutical distributors in India is valued at Rs 2.7 trillion in FY23 and is expected to grow at 10-11% CAGR from FY23 to FY28.

Entero Healthcare Solutions IPO: Listed Peers

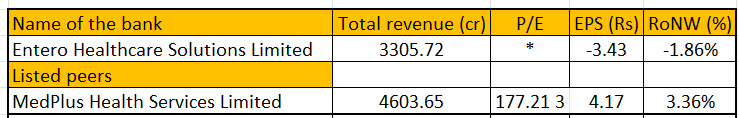

The company has only one listed peer - MedPlus Health Services Limited. Let us look at the FY23 numbers and compare the two companies to give you an idea of where EHSL stands:

- In revenue terms, MedPlus Health is the larger player, with nearly 1.4 times the revenue that of EHSL.

- EHSL has reported losses in FY23, while MedPlus Health is profitable. Therefore, EHSL has negative EPS and RoNW, while that of MedPlus Health Services Limited is positive.

For exact numbers, you can check the below table.

Entero Healthcare Solutions IPO: Financials

Below are the financial numbers of Entero Healthcare from recent years:

The company has reported a revenue of Rs 1,783.67 crore, Rs 2,526.55 crore, and Rs 3,305.72 crore for FY21, FY22, and FY23. The topline has grown at a CAGR of 36.13%. For H1FY24, the revenue reported was Rs 1,898.98 crore.

EHSL has reported an EBITDA of Rs 21.54 crore, Rs 24.44 crore, and Rs 64.01 crore for FY21, FY22, and FY23, respectively. The EBITDA margins for the same period were 1.21%, 0.97%, and 1.94%, respectively. They operate in a very low-margin business.

They have reported a net profit/loss (PAT) of Rs (15.35) crore, Rs (29.44), and Rs (11.04) crore for FY21, FY22, and FY23. The company has turned profitable in H1FY24.

The TTM EPS on post-issue equity works out to Rs 4.2. At the upper price band of Rs 1258, P/E works out to 296.

Return on Capital Employed (ROCE) has increased from 1.88% in FY21 to 6.05% in FY23. ROE for the last three financial years was (4.23)%, (7.35)%, and (2.66)%, respectively.

Working Capital Days have been reduced from 74 days in FY21 to 63 days in FY23.

Entero Healthcare Solutions IPO: Competitive Strengths

Below are the competitive strengths of Entero Healthcare:

- They operate in the large and highly fragmented Indian healthcare products distribution market and expect to benefit from market consolidation.

- Entero is one of India’s largest and fastest-growing healthcare product distribution platforms.

- They have a track record of inorganic expansion and integration to grow their geographic reach, revenues, and scale.

- The company has a differentiated business model offering comprehensive and integrated commercial and supply chain solutions.

Risks associated with Entero Healthcare Solutions

Below are the risks associated with their business:

- They have experienced negative cash flows from operating, investing, and financing activities in the past and may continue to do so in the future.

- The company incurs losses and its reputation may be adversely affected by the return of its products by customers, arising from the distribution of expired, unsafe, defective, ineffective, or counterfeit products, and product spoilage, breakage, and damage during transportation or storage.

- EHSL's lenders have imposed certain restrictive conditions on them under their financing arrangements, which may adversely affect their ability to conduct their business.

- Their operations are subject to high working capital requirements and have incurred substantial indebtedness.

Top Mutual Funds

Top Mutual Funds