- 22 Nov 2023

- ICICIdirect

FEDBANK FINANCIAL SERVICES LIMITED IPO: ALL YOU NEED TO KNOW

The last IPO that opens for subscription this week is Fedbank Financial Services Limited (FFSL or Fedfina). Earlier, we have already covered Tata Technologies IPO, IREDA Limited, FWIL and GORIL. FFSL opens for subscription on the 22nd and closes on the 24th of November. In this article, we will look at the various aspects related to GORIL. It will help you decide whether to subscribe or invest in the IPO for the long term.

Fedbank Financial Services Limited IPO: Key Details

Below are the key details related to the FFSL IPO:

- Issue Size: Rs 1,092.26 crore

- Price Band: Rs 133 - Rs 140

- Issue Details: Fresh Issue of Rs 600.77 crore + Rs 492.26 crore Offer For Sale (OFS)

- Market Cap: At the upper price band, Rs 5,165 crore

- Minimum Investment: Rs 14,980

Fedbank Financial Services IPO: About the business

The company is promoted by Federal Bank Ltd and was incorporated on April 17, 1995. Fedbank Financial Services (Fedfina) is a retail-focused non-banking finance company (NBFC) that has the 2nd and 3rd lowest cost of borrowing among the micro, small and medium enterprises (MSMEs), gold loan, and MSME & gold loan peer set in India in FY23 and 3 months period ended June 30, 2023, respectively.

Fedfina is focused on catering to the MSMEs and the emerging self-employed individuals (ESEIs) sector. According to the CRISIL Report, the ESEI and MSME segment is largely unaddressed by lending institutions in India. The NBFC believes that this segment provides them with a sizeable opportunity to rapidly grow and expand further. They have a well-tailored suite of products targeted to match their customers’ needs, which includes:

- mortgage loans such as housing loans

- small ticket loans against property (LAP)

- medium ticket LAP

- unsecured business loans

- gold loans

Fedfina also has a “Phygital” doorstep model, a combination of digital and physical initiatives, for providing customized services to its customers across all of its products. It also helps them to constantly remain in touch with customers. Technology is the core building block of their underwriting model which combines electronic data physical information, and document collection.

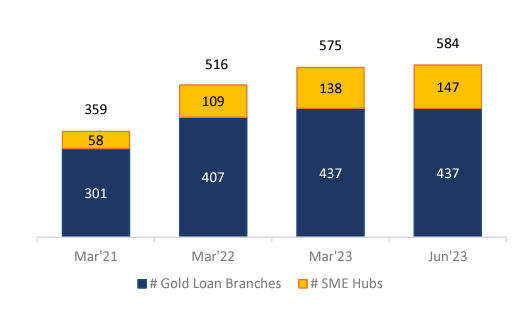

As of June 30, 2023, Fedfina has a presence in 17 states and union territories across India, with a strong presence in Southern and Western regions of India. As of June 30, 2023, they covered 190 districts in 17 states and union territories in India through 584 branches. Their branches are located in states such as Andhra Pradesh (including Telangana) and Rajasthan.

Fedbank Financial Services IPO: Industry Overview

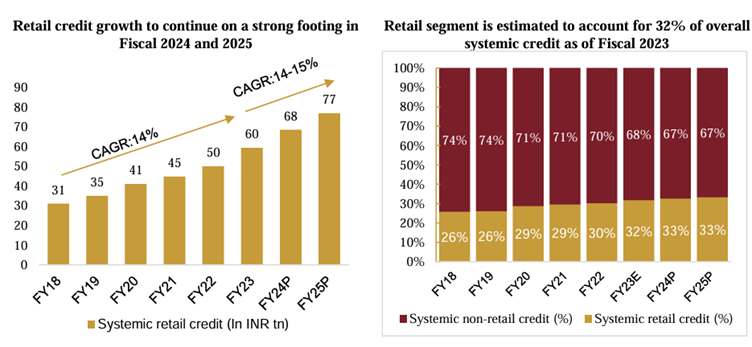

Over the last few years, retail credit grew at a strong pace from Rs 30 trillion in FY18 to Rs 60 trillion in FY23 and it constituted 32% of total systemic credit in India. The credit gap is much larger in the case of Emerging Self-Employed Individuals. Retail credit is expected to further log a CAGR of 14-15% between FY23 and FY25.

While systemic credit in India grew at a tepid rate of 9.6% CAGR annually between FY18 and FY23, systemic retail credit grew at a much faster rate of 14.3% CAGR during the same period. Retail credit growth in FY20 was around approximately 16.3% which came down to approximately 9.5% in FY21. However, post-COVID-19 pandemic, retail credit growth revived back to reach approximately 11.3% in FY22. CRISIL MI&A estimates retail credit to have grown at approximately 19-20% year on year in FY23. CRISIL MI&A thus expects retail credit growth to continue in the long term with banks and NBFCs’ continued focus on the segment.

Fedbank Financial Services IPO: Listed Peers

Fedfina operates in a highly competitive industry and has many listed peers. They are Aptus Value Housing Finance, IIFL Finance Ltd, Five Star Business Finance, Manappuram Finance Ltd, Muthoot Finance Ltd, and SBFC Finance Ltd. Let us look at the financials of Fedfina and listed peers to give you an idea of where the company stands against its peers. We will compare the crucial parameters of FY23 to give you an understanding of the financials of Fedbank Financial Services with respect to peers. Here is the comparison:

- In terms of revenue, Muthoot Finance is the largest, while Fedfina is towards the bottom of the table, only above SBFC Finance.

- The average EPS of all the listed peers is around 29, while that of Fedfina is much lower - it is only 5.60. Comparing one to one, it is only above SBFC Finance.

- Return on Net Worth (RoNW) is the highest for IIFL, followed by Muthoot Finance and Manapurram Finance. Fedfina is towards the bottom of the table again.

- The Gross Net Performing Asset (NPA) is lowest for Aptus Value (1.15%), followed by Manapurram Finance (1.30) and Five-Start Business Finance (1.36%). FedFina comes fifth on the list.

Fedbank Financial Services IPO: Financials

Let us now look at the most crucial part that one needs to consider while evaluating a new company. Below are the financial numbers of Fedfina over the last three financial years:

- The NBFC has reported a revenue of Rs 691.83 crore, Rs 869.32 crore, and Rs 1,178.80 crore for FY21, FY22, and FY23, respectively. Revenue has grown at a solid 30.50% CAGR in this period. The revenue for Q1FY24 was Rs 361.39 crore.

- Fedfina's Net Interest Income (NII) stood at Rs 344.92 crore, Rs 474.24 crore, and Rs 638.02 crore for FY21, FY22, and FY23, respectively. For the same period, the Net Interest Margins (NIM) were 8%, 8.92%, and 8.99%, respectively. The margins have improved over this period.

- Fedfina has reported an EBITDA of Rs 417.39 crore, Rs 523.56 crore, and Rs 757.04 crore for FY21, FY22, and FY23, respectively.

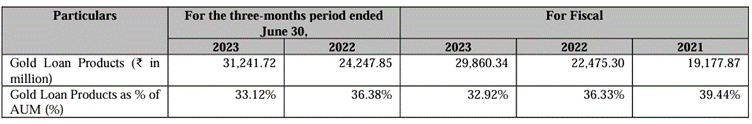

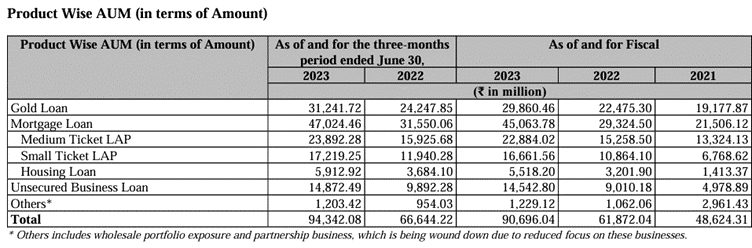

- The Asset Under Management (AUM) has increased from Rs 4,862.43 crore in FY21 to Rs 9,069.60 crore in FY22 - more than doubled. The AUM across various products was 33.12% for gold loans, 25.33% for medium-ticket LAP, 24.52% for small-ticket LAP and housing loans, and 15.76% for unsecured business loans.

- The average cost of borrowing was 8.52%, 7.77%, 7.44%, and 8.30% for the three-month periods ended June 30, 2023, FY3, FY22, and FY21, respectively.

- They have reported a net profit of Rs 61.68 crore, Rs 103.46, and Rs 180.13 crore for FY21, FY22, and FY23. The bottomline has nearly tripled in this period.

- For the last three financial years, Fedfina has reported an average EPS of Rs 4.26 and an average RoNW of 10.87%.

- If we attribute annualized FY24 earnings to post-IPO fully diluted paid-up equity capital, then the asking price is at a P/E of 23.97. Thus the issue appears fully priced.

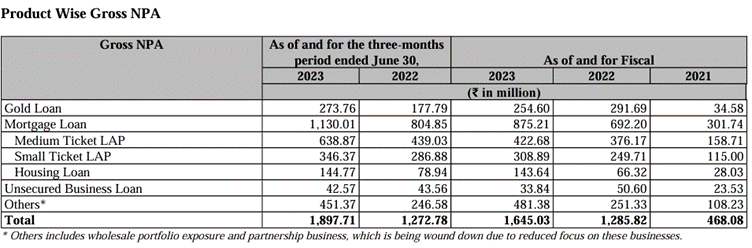

The asset quality has come down in recent years. The Gross Net Performing Asset (NPA) for FY21, FY22, and FY23 was 1.01%, 2.23%, and 2.03%, respectively. The Net NPA in the same period was 0.71%, 1.75%, and 1.59%, respectively.

What are the competitive strengths of Fedbank Financial Services Limited?

As per the company, their competitive strength is as below:

- They are present in large, underpenetrated markets with strong growth potential.

- Fedfina is focused on retail loan products with a collateralized lending model targeting individuals and the emerging MSME sector.

- They have a strong underwriting capability and presence in select customer segments combined with robust risk management capabilities focused on effective underwriting and collections.

- Fedfina has well well-diversified funding profile with the advantage of lower cost of funds.

Risks associated with Fedbank Financial Services Limited

Below are the risks associated with the Fedfina:

- They may face asset-liability mismatches, which could affect their liquidity and consequently may adversely affect their operations and profitability.

- They have had negative cash flows in the past and may continue to have negative cash flows in the future.

- Because they handle high volumes of cash and gold jewelry in a dispersed network of branches, they are exposed to operational risks, including employee negligence, fraud, petty theft, burglary, and embezzlement, which could impact their financial position.

- Their inability to maintain a capital adequacy ratio could adversely affect the business, results of operations, and financial performance.

Top Mutual Funds

Top Mutual Funds