- 23 Oct 2023

- ICICIdirect

ITC Q2 RESULTS 2024: NET PROFIT INCREASES IN DOUBLE-DIGIT

ITC - 428 Change: -2.25 (-0.52 %)

ITC Limited reported its Q2FY24 numbers on Thursday evening after the market closing. On Friday morning, ITC's share price opened more than a percent lower at Rs 443.50. Let us look at everything in detail about ITC's Q2FY24 quarter.

About ITC

ITC Limited is a diversified Indian conglomerate with interests in various sectors, including FMCG (Fast-Moving Consumer Goods), agribusiness, hotels, and information technology. Founded in 1910, ITC is known for its iconic brands, sustainable practices, and contributions to India's economic growth.

Crucial parameters

- 52-week high: Rs 499.60

- 52-week low: Rs 325.35

- Market Cap: Rs 5,54,207.44 crore

- ROE: 28.83

Share price movement

In the last one month, ITC's shares have fallen nearly 2%. However, despite the recent fall, the ITC share price is up by 32% in 2023. In the five-year time frame, the ITC returns are poor - the stock price has only increased by 58%.

How has ITC performed in Q2FY24?

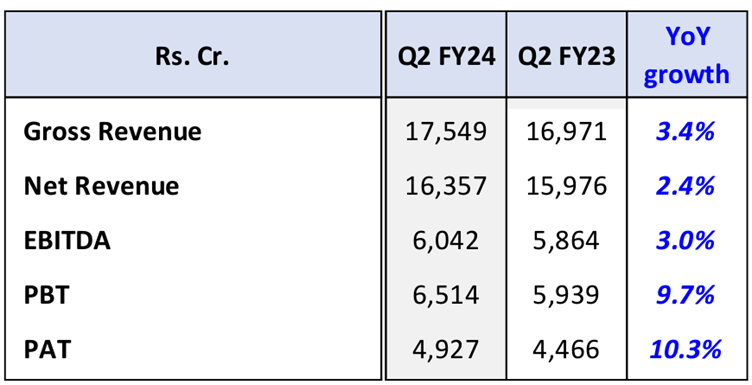

Below are the topline and bottomline numbers from ITC's September quarter:

Revenue: For Q2FY24, ITC reported a revenue of Rs 17,705.08 crore. In the year-ago period, the company had reported a revenue of Rs 17,159.56 crore, the YoY revenue has fallen 3.17%.

Net Profit: The company has reported a standalone net profit of Rs 4,927 crore for the July to September quarter. The profits have increased by 10.3% over the same period in the last financial year.

How have different segments performed under ITC?

Below is the performance of different segments in Q2FY24:

FMCG - Others

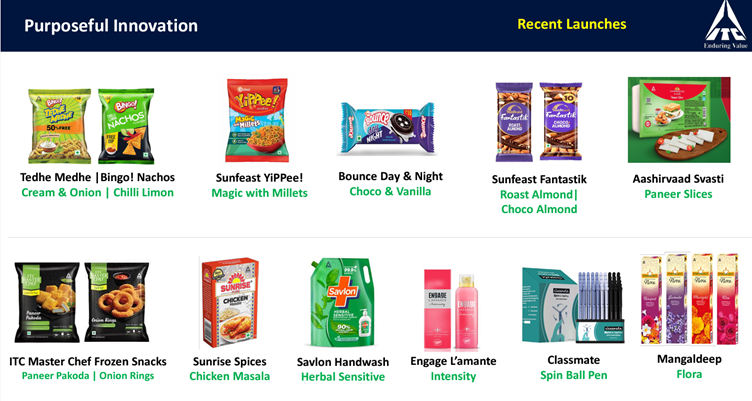

The FMCG businesses continue to deliver robust performance, with Segment Revenue growing 8.3% YoY on a high base to Rs 5,292 crores (2-yr CAGR +14.5%). The segment's EBITDA margins expanded 150 bps YoY to 11%. Atta, Spices, Personal Wash, and Agarbatti drive growth amidst a relatively subdued consumer demand environment.

FMCG - Cigarettes

The Business continues to counter illicit trade and reinforce market standing by fortifying the product portfolio through innovation, democratizing premiumization across segments, and enhancing product availability backed by superior on-ground execution. Net Segment Revenue and Segment PBIT are up 8.5% and 8.0% YoY respectively.

Hotels

The company reported stellar performance in the hotel business with record high second quarter performance. Segment Revenue and PBIT are up 21% and 50% YoY respectively. Strong growth was witnessed in ARRs across properties. Occupancy remained flattish YoY mainly due to renovations and relatively fewer wedding dates during the quarter. The Business continued to focus on its strategy of offering a host of curated propositions across accommodations and iconic cuisine brands to augment revenues across properties.

Paperboard, Paper & Packaging

Performance in the Paperboards, Paper, and packaging Segment reflects the impact of low-priced Chinese supplies and muted demand in export markets, a sharp reduction in global pulp prices, relatively subdued domestic demand, and a high base effect; Segment Revenue declined 9.5% YoY.

Agri-Business

During the quarter, stock limits on wheat, a ban on non-basmati rice exports, and export duty on parboiled rice, further limited business opportunities for the Agri-Business.

Top Mutual Funds

Top Mutual Funds