- 22 Jan 2024

- ICICIdirect

KOTAK MAHINDRA BANK Q3 RESULTS 2024: NET PROFIT RISES, BUT BELOW ESTIMATES

KOTAKBANK - 1806 Change: 36.95 (2.09 %)

Kotak Mahindra Bank reported its Q3FY24 numbers on Saturday afternoon during market hours. At the market close, Kotak Mahindra Bank's share price closed at Rs 1,806.80 per share, up 2.40% on NSE. Let us look at Kotak Bank's result in detail.

About Kotak Mahindra Bank

Kotak Mahindra Bank is a leading private-sector bank, offering a wide range of financial products and services, including banking, insurance, and wealth management. Founded in 1985, it has grown to become one of the country's most prominent banking institutions, with a strong presence in various financial sectors.

Crucial parameters

- PE: 27.14

- 52-week high: Rs 2,063.00

- Market Cap: Rs 3,59,059 crore

- ROE: 14.37

Share price movement

In the last six months, the bank's share price has given negative returns of 8%. In the last one year, the share price has remained flat, against positive NIFTY50 returns. For the 5-year time frame, the share price has given a sub-par return of only 43%, lower than the benchmark and peers.

How were Kotak Mahindra Bank's December quarter results?

Kotak Mahindra Bank Q3FY24 results details are as below:

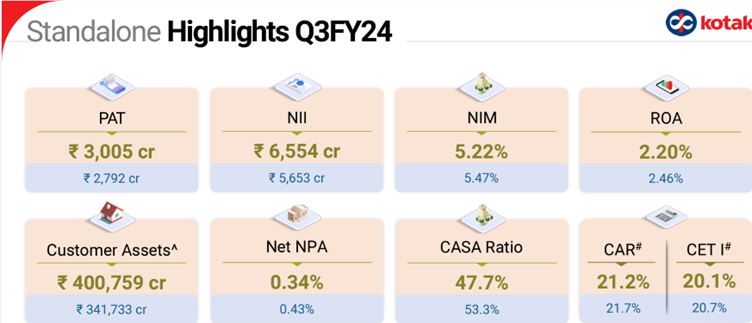

Net Profit: The bank has reported a consolidated profit of Rs 4,265 crore, a 6.7% jump in net profits. The profits have increased from Rs 3,995 crore in the year-ago period. On a standalone basis, the net profit increased by 7.6% on the year to Rs 3,005 crore.

Net Interest Income (NII): Kotak Mahindra Bank reported an NII of Rs 6,554 crore for the third quarter of the current financial year. The NII increased by 15.9% from Rs 5,653 crore reported for the same period of the last financial year. The Net Interest Margins (NIM) reduced from 5.47% in Q3FY23 to 5.22% in Q3FY24.

Asset Quality: Kotak Mahindra Bank's Gross Net Performing Assets (GNPA) for the quarter ended December was 1.73%. It has decreased sharply from the 1.90% reported in the year-ago period and increased marginally from Q2FY24's GNPA of 1.72%. Net NPA lowered from 0.43% a year ago period to 0.34%. Sequentially, the NNPA increased reduced by 3 basis points. In absolute terms, GNPA and NNPA for the quarter ended December stood at Rs 6,302 crore and Rs 1,225 crore, respectively.

Advances and Deposits: The Deposits reported by the bank for the quarter ending December were at Rs 4.09 lakh crore, increased from Rs 3.45 lakh crore from the year-ago period and Rs 4.01 lakh crore in Q2FY24. Net Advances have increased YoY by 15.8% to Rs 3.60 lakh crore and 3% sequentially. CASA ratio stood at 47.7%, down from 53.3% in Q3FY23, and 48.3% in Q2FY24.

Unsecured retail advances, including microfinance portfolio, stood at 11.6% as a percentage of net advances compared with 9.3% a year earlier. The retail microfinance portfolio saw maximum growth of 59% year-on-year to Rs 8,510 crore. This was followed by a growth of 52% to Rs 13,882 crore in credit cards. Personal, business, and consumer durables loans grew 33% to Rs 19,310 crore. The agriculture division saw the slowest growth of 5% to Rs 27,512 crore.

Update from Subsidiaries

- Kotak Mahindra Prime: It reported an NII of Rs 474 crore, a jump of nearly 15% from the year-ago period. PAT increased from Rs 225 crore in Q3FY23 to Rs 239 crore in Q3FY24. NNPA fell sharply from 1.1% to 0.8% year on year.

- Kotak Mahindra Life Insurance: The profit after tax (PAT) reduced to Rs 140 crore for the third quarter of the current financial year. In the same quarter last year, the PAT reported was Rs 330 crore. Overall Group Premium for Q3FY24 grew by 9.7% YoY.

- Kotak Securities: Total Income from this business increased to Rs 999 crore in Q3FY23 from Rs 784 crore in Q3FY23. PAT increased to Rs 306 crore for the quarter ending December. Compared to last year (Dec quarter), the overall market share has increased from 5.8% to 10.3%.

- Kotak Mahindra AMC: Average AUM for the December quarter stood at Rs 3.54 lakh crore, an excellent double-digit growth over the same period last year. PAT decreased from Rs 150 crore to Rs 146 crore in Q3FY24.

Top Mutual Funds

Top Mutual Funds