- 18 Dec 2023

- ICICIdirect

MUTHOOT MICROFIN LIMITED IPO: ALL YOU NEED TO KNOW

We have lost count of IPOs now! So many of them in this month. However, we ensure to cover every IPO for you. The new IPO going live soon is Muthoot Microfin Limited (MML). It is the Muthoot Pappachan Group Micro Finance arm. MML opens for subscription on the 18th and closes on the 20th of December. In this article, we will look at the various aspects of Muthoot Microfin's business. It will help you decide whether to subscribe or invest in the IPO for the long term.

Muthoot Microfin Limited IPO: Key Details

Below are the key details related to the MML IPO:

- Issue Size: Rs 960 crore

- Price Band: Rs 277 - Rs 291

- Issue Details: Fresh Issue of Rs 760 crore + Rs 200 crore Offer For Sale (OFS)

- Market Cap: At the upper price band, Rs 4,961 crore

- Minimum Investment: Rs 14,841

Muthoot Microfin Limited IPO: About the business

MML is a part of the Muthoot Pappachan Group, a business conglomerate with a presence across financial services, automotive, hospitality, real estate, IT infrastructure, precious metals, and alternate energy sectors. The group has a history of over 50 years in the financial services business. MML is the second-largest company under the group in AUM terms for FY23.

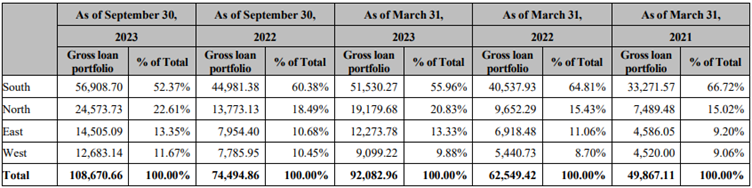

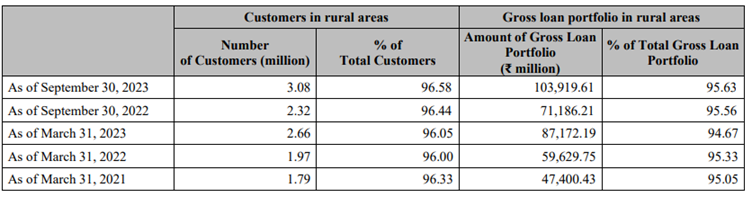

Muthoot Microfin is a microfinance institution with a focus on women customers. They provide micro-loans primarily for income generation purposes, with a focus on rural regions. As per the CRISIL report, they are the fifth largest NBFC-MFI (Micro Finance Institution) in India in terms of gross loan portfolio (FY23). Also, MML is the third largest amongst NBFC-MFIs in South India in terms of gross loan portfolio, the largest in Kerala in terms of MFI market share, and a key player in Tamil Nadu with an almost 16% market share, as of March 31, 2023.

The company’s gross loan portfolio amounted to Rs 10,867.07 crore (as of Sep 2023). For the same period, they have 0.32 crore active customers, serviced by 12,297 employees across 1,340 branches in 339 districts in 18 states and union territories in India.

Muthoot Microfin Limited IPO: Products

The company has four different products on offer. They are as below:

(i) group loans for livelihood solutions such as income-generating loans, Pragathi loans (which are interim loans made to existing customers for working capital and income-generating activities), individual loans, and Suvidha loans (which are digital loans accessible through the Mahila Mitra application and made to existing customers to enable quick access to funds).

(ii) life betterment solutions, including mobile phone loans, solar lighting product loans, and household appliances product loans.

(iii) health and hygiene loans such as sanitation improvement loans.

(iv) secured loans in the form of gold loans and Muthoot Small & Growing Business (MSGB) loans.

Muthoot Microfin Limited IPO: Industry Overview

The Indian banking sector is significantly penetrated as observed in the current bank credit to GDP ratio of 51.40% for India as of Q3CY22. This provides immense opportunities for banks and other financial institutions over the long term.

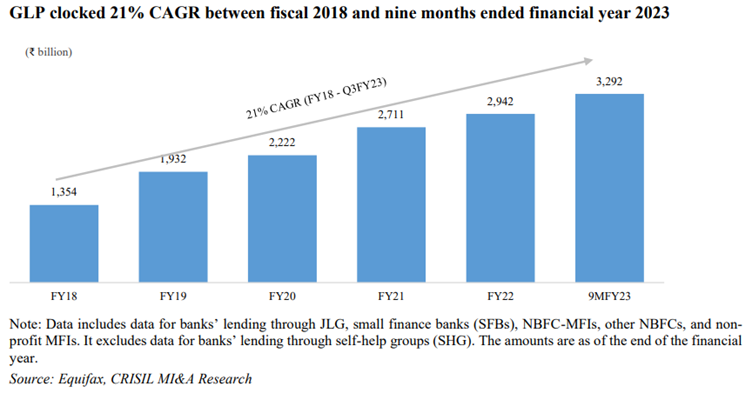

The microfinance industry’s joint liability group (JLG) portfolio has recorded healthy growth in the past few years. The industry’s GLP increased at a 21% compound annual growth rate (CAGR) between Mar'18 and Dec'22 to reach approximately Rs 3.3 trillion. The growth rate for non-banking finance institutions (NBFC)-MFIs is the fastest as compared with other player groups.

Going forward, the overall microfinance industry will continue to see strong growth on the back of the government’s continued focus on strengthening the rural financial ecosystem, robust credit demand, and higher-ticket loans disbursed by microfinance lenders.

While the growth of the MFI industry and NBFC-MFI portfolio is considerably lower than historical growth, incremental industry growth would be driven by continuous expansion in the client base of MFIs and increased penetration in rural areas. The share of NBFC-MFIs is expected to increase to 41% by FY25.

Muthoot Microfin Limited IPO: Peer Comparison

The company has a long list of peers. Therefore, faces tough competition. The listed peers include names like Equitas Small Finance Bank Ltd, Ujjivan Small Finance Bank, CreditAccess Grameen, Spandana Sphoorty Financial, Bandhan Bank, Suryoday Small Finance Bank, and Fusion Micro Finance. We will compare the financials of MML with its peers to give you an idea of where it stands compared to peers. Here is a comparison based on FY23 numbers:

- In terms of revenue (total income), Muthoot Microfin is towards the bottom, only above Suryoday Small Finance. The largest player is Badhan Bank (not apple to apple comparison), followed by Equitas Small Finance.

- The average earning per share (EPS, basic) of all listed peers is 20.5, while that of MML is 14.19. Even though it is less than average, it is better than most peers.

- The average Return on Net Worth (RoNW) of all listed peers is 12.61%, while that of Muthoot Microfin is 10.08% - close to the average.

Muthoot Microfin Limited IPO: Financials

Let us now look at the financials of MML to give you an idea of how the company has grown in recent years. Below are the financial numbers of MML:

- The company has reported a revenue of Rs 684.17 crore, Rs 832.51 crore, and Rs 1,428.76 crore for FY21, FY22, and FY23, respectively. Revenue has grown at an exceptional 44.54% CAGR in this period. The revenue for H1FY24 was Rs 1042.33 crore, which suggests excellent growth in FY24.

- MML has reported Net Interest Margins (NIM) of 8.24%, 9.60%, and 11.60% for FY21, FY22, and FY23, respectively.

- They have reported assets under Management (AUM) of Rs 4,986.71 crore, Rs 6,254.94 crore, and Rs 9,208.30 crore, respectively. The AUM has nearly doubled in this period.

- MML has reported an EBITDA of Rs 327.22 crore, Rs 425.66 crore, and Rs 788.49 crore for FY21, FY22, and FY23, respectively.

- They have reported a net profit of Rs 7.05 crore, Rs 47.40, and Rs 163.89 crore for FY21, FY22, and FY23. The profits have grown exponentially in this period. The trend continued in H1FY24, the company reported a PAT of Rs 205.26 crore, more than FY23 combined,

- For the last three financial years, MML has reported a fully diluted average EPS of Rs 7.25 and an average RoNW of 6.35%.

- If we annualized FY24 earnings and attribute it to the post-IPO fully diluted paid-up equity capital of the company, then the asking price is at a P/E of 12.08.

- The Gross Net Performing Asset (NPA) for the company has come down from 7.97% in FY21 to 2.97% in FY23. In H1FY24, it has further reduced to 2.37%. The Net NPA has fallen from 1.42% in FY21 to 0.60% in FY23 and 0.33% in H1FY24.

- Return on Average Equity for FY22 and FY23 was 4.26% and 11.06%, respectively.

Muthoot Microfin Limited IPO: Competitive Strengths

As per the company, their competitive strength is as below:

- They enjoy market leadership with PAN India's presence.

- MML has a history of serving rural markets with high growth potential in the microfinance segment and has maintained a track record of financial performance and operational efficiency through consistently high rates of customer acquisition and retention and expansion into underpenetrated areas.

- The company has brand recall and synergies with the Muthoot Pappachan Group.

- They have a robust risk management framework leading to healthy portfolio quality.

Risks associated with the Muthoot Microfin Limited

Below are the risks associated with the MML:

- The microfinance industry in India faces certain risks due to the category of customers that it services, which are not generally associated with other forms of lending. As a result, they may experience increased levels of NPAs and related provisions and write-offs that may adversely affect their business.

- Their business is vulnerable to interest rate risk, and volatility in interest rates could impact their net interest income and net interest margin.

- The company is subject to certain conditions under its financing arrangements, which could restrict its ability to conduct the business and operations in the manner it desires.

- The increase in its revenue from operations between FY21 and FY23 was primarily due to an increase in interest on the loan portfolio, mainly on account of an increase in gross loan portfolio due to expansion in the number of branches. They cannot assure they will be able to continue to do so in the future.

Top Mutual Funds

Top Mutual Funds