- 24 Jul 2023

- ICICIdirect

RELIANCE INDUSTRIES Q1 RESULTS 2024: NET PROFIT DOWN, DIVIDEND DECLARED

RELIANCE - 1251 Change: 9.35 (0.75 %)

Reliance Industries reported its Q1FY24 numbers on Friday evening. The stock price has fallen post the record date for Jio Financial shares. On Friday, the stock closed more than 3% lower. Let us look at Reliance's quarterly numbers in detail.

About Reliance Industries

Reliance Industries is an Indian conglomerate founded by Dhirubhai Ambani in 1966. It operates in various sectors, including petrochemicals, refining, oil and gas exploration, retail, and telecommunications. It was one of the largest companies in India.

Crucial parameters

- PE: 44.19

- 52-week high: Rs 2,855

- Market Cap: Rs 17,15,895.17 crore

- ROE: 7.73

Share price movement

In the last month, Reliance's share price has traded flat. In 2023, the share price is down 1.5% despite an exceptional rally in the benchmark indices. However, in the five-year time frame, Reliance shares have given investors more than 120% returns, much higher than the benchmark indices.

How has Reliance performed in Q1FY24?

Let us look at Reliance's June'23 quarter numbers in detail:

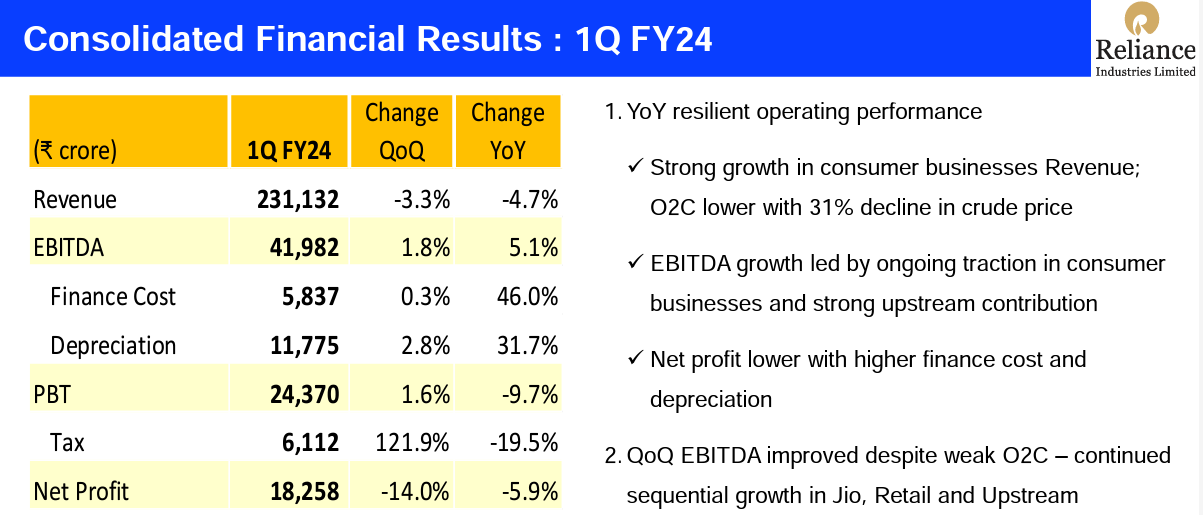

Revenue: The consolidated revenue reported by the company for the quarter ended June was Rs 231,132 crore. The revenue reported was down 4.7% YoY and 3.3% sequentially. The revenue from the O2C business was down, which led to overall lower numbers. However, strong growth in consumer business compensated for it largely.

EBITDA: The company reported an EBITDA of Rs 41,982 crore for Q1FY24 compared to Rs 41,239 crore in Q4FY23 (1.8% growth sequentially) and Rs 39,945 crore in the year-ago period (5.1% growth YoY). The EBITDA growth was led by ongoing traction in consumer businesses and strong upstream contribution.

Net Profit: Reliance Industries reported a net profit of Rs 18,258 crore, down 14% sequentially and 5.9% YoY. The net profit has gone because of the higher Finance Cost and depreciation, which increased by 46% and 31.7% YoY, respectively.

How have different segments performed under Reliance in Q1FY24?

Except for O2C, all the segments have performed well for the three months between April and June (2023). Let us look at the performance of each sector in detail:

Retail: The retail segment reported a revenue of Rs 69,962 crore, strong double-digit growth of 19.5% YoY. EBITDA reported was Rs 5,151 crore, a growth of 33.4% YoY. The profit after tax (PAT) reported was Rs 2,448 crore, 19% growth YoY. The total store count has increased by 555 in Q1FY24, taking the total store count to 18,446. Digital Commerce and New Commerce grew at 18%, expanding the revenue base. In this quarter, the company completed Metro Cash and Carry India acquisition, and integration is underway.

Digital Servies: The segment includes the Telecom business. It reported a revenue of Rs 32,077 crore, a growth of 12.5% YoY. EBITDA reported was 13,271 crore, a growth of 17.2% YoY. ARPU for the June quarter reported was Rs 180.5, a marginal growth of 2.8% YoY. The subscriber base at the end of the June quarter was 44.85 crore, a net addition of 92 lakhs in the June quarter. Data traffic was up 28.3% YoY at 33.2 Bn GB with healthy customer traction. The company also launched Jio Bharat to enable existing 250 million feature phone users with internet-enabled phones. At only Rs 999, it is the lowest entry price for an internet-enabled phone.

O2C: The revenue was down by 18% compared to the year-ago period and stood at Rs 133,031 crore. The EBITDA was down by an even higher percentage, 23% down YoY, and stood at Rs 15,271 crore. The sequential decline in EBITDA was due to a sharp correction in fuel cracks with higher supplies and global macro headwinds, and a Lower PVC delta. The company has said that there was a strong demand in the domestic markets – Oil demand up 4.9%, Polymer up 16%, Polyester up 5%.

Oil & Gas: The oil & Gas segment reported a revenue of Rs 4,632 crore, up 28% YoY. The EBITDA was up 47% YoY and stood at Rs 4,015 crore. The company successfully placed 29 MMSCMD of KG D6 gas. Also, signed GSPAs with customers across Fertilizers, CGD, Power, Refinery, Steel, Ceramics, etc.

Has Reliance announced a dividend?

The company's board has declared a dividend of Rs 9 per equity share for FY23. The payment of dividends is subject to the approval of members of the company at the ensuing annual general meeting of the company.

To Sum Up

Reliance Industries has a robust balance sheet with high liquidity and supports accelerated growth plans. The retail segment has been the standout performer for the company. For investors, how Jio Financials shapes up post-listing would be something to look forward to.

Top Mutual Funds

Top Mutual Funds