- 19 Dec 2023

- ICICIdirect

SURAJ ESTATE DEVELOPERS LIMITED IPO: ALL YOU NEED TO KNOW

Over seven companies will launch their IPO this week and raise Rs 4,000 crore overall. One of the seven IPOs going live is Suraj Estate Developers Limited (SEDL). They are a real estate company with more than three decades in the business.

SEDL opened for subscription on the 18th and closes on the 20th of December. In this article, we will look at the various aspects of Suraj Estate Developers' business. It will help you decide whether to subscribe or invest in the IPO for the long term.

Suraj Estate Developers Limited IPO: Key Details

Below are the key details related to the SEDL IPO:

- Issue Size: Rs 400 crore

- Price Band: Rs 340 - Rs 360

- Issue Details: Only Fresh Issue

- Market Cap: At the upper price band, Rs 1,597 crore

- Minimum Investment: Rs 14,760

Suraj Estate Developers Limited IPO: The Business

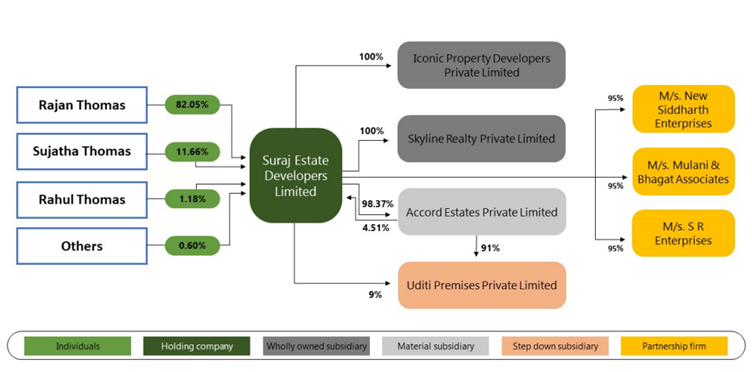

Suraj Estate is a real estate company that has been in the business since 1986. They develop real estate across the residential and commercial sectors in the South Central Mumbai region. SEDL has a residential portfolio located in the markets of Mahim, Dadar, Prabhadevi, and Parel, which are sub-markets of the South-Central Mumbai micro market. They are focused primarily on value luxury, luxury segments, and commercial segments. Recently, they have ventured into residential real estate development in the Bandra sub-market.

Most of the land parcels in the South Central Mumbai market are redevelopment projects. SEDL's core competence lies in tenant settlement which is a key element for unlocking value on such land parcels. The company identifies cessed/ noncessed properties with existing tenants. Then, they tie up with the landlords of such tenanted properties by entering into a development agreement or on an outright purchase basis through a conveyance deed. They do not provide any construction services on their own and are 100% dependent on third-party contractors for the construction services of projects.

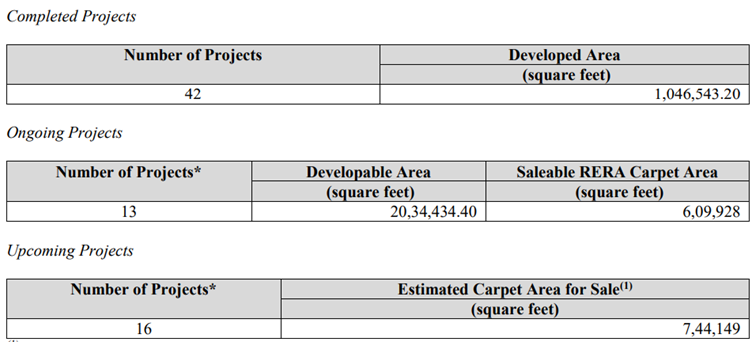

Since incorporation, they have completed 42 projects in the South-Central Mumbai region. In addition to the completed projects, they have 13 ongoing projects and 16 upcoming projects as of October 30, 2023. Also, they have Land Reserves of 10,359.77 sq. mtr.

Suraj Estate Developers Limited IPO: Industry Overview

In the last six to seven years, the real estate sector in India has witnessed several changes because of demonetization, the liquidity crisis, and the implementation of RERA and GST.

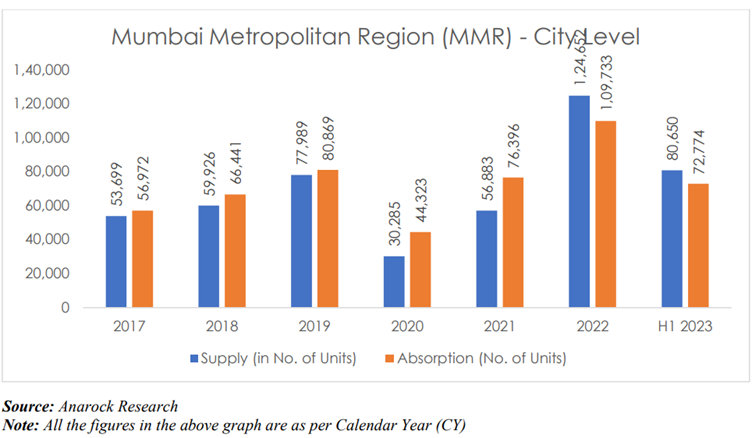

New launches have jumped by 185% - from 127,959 units in 2020 to 236,693 units in 2021. The same is almost in line with the launches recorded in 2019. There has also been an improvement in the 2022 numbers where the total launches are 3.58 Lakhs units. In H1'23 there are 2.12 Lakhs launched units.

Mumbai is one of the biggest real estate markets in India. It has various micro-markets along with Mumbai City, suburbs, extended suburbs, and neighboring areas such as Thane and Navi Mumbai. With the recent infrastructure projects completed, such as Mono and Metro, Mumbai witnessed significant physical infrastructure improvements. Upcoming infrastructure projects (coastal roads, metros, etc.) in the medium term will improve the connectivity further.

There has been a ~9% rise in pricing in MMR in 2022 as compared to 2021 levels. Further, there will be a gradual increase in MMR from 2023 till 2026 with an average price appreciation of around ~5% per year, which would showcase an improvement in the overall residential real estate scenario in the MMR.

Suraj Estate Developers Limited IPO: Listed Peers

The company has a long list of peers. Therefore, faces tough competition. The listed peers are Oberoi Realty, Sunteck Realty Ltd, Keystone Realtors, Shriram Properties, Mahindra Lifespace Developers, D B Realty Ltd, and Hubtown Ltd. They also face competition from various small unorganized operators in the residential segment.

We will compare the financials of SDEL with peers to give you an idea of where it stands compared to peers. Here is a comparison based on FY23 numbers:

- In revenue terms, SDEL is the smallest player among all the companies. The largest player is Oberoi Realty.

- The average earning per share (EPS) of all the listed peers is 10.2, and SDEL has an EPS of 10.10, only behind Oberoi Realty.

- SDEL has the highest Return of Net Worth (RoNW) of 58.18%. The second best on the list is Oberoi Realty, with a RoNW of 16.83%.

- Suraj Estate also has the highest ROCE and ROE among all its peers.

Suraj Estate Developers Limited IPO: Financials

Let us now look at the financials of SDEL to give you an idea of how the company has grown in recent years. Below are the financial numbers of SDEL from recent years:

- The company has reported a revenue of Rs 239.99 crore, Rs 272.72 crore, and Rs 305.74 crore for FY21, FY22, and FY23, respectively. Revenue has grown at 12.92% CAGR in this period. The revenue for Q1FY24 was Rs 102.41 crore, which indicates a good start to FY24.

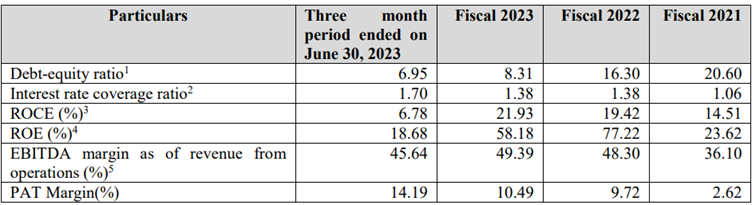

- SEDL has reported an EBITDA of Rs 86.63 crore, Rs 131.73 crore, and Rs 151.00 crore for FY21, FY22, and FY23, respectively. The EBITDA margins for the same period were 36.10%, 48.30%, and 49.39%, respectively. The margins have improved each year.

- They have reported a net profit (PAT) of Rs 6.28 crore, Rs 26.50, and Rs 32.06 crore for FY21, FY22, and FY23. The profits have grown 5X in this period. The growth continued in Q1FY24. The company reported a PAT of Rs 14.53 crore.

- For the last three financial years, SEDL has reported a fully diluted average EPS of Rs. 8.16 and an average RoNW of 58.77%.

- If we attribute annualized FY24 earnings to the post-IPO fully diluted paid-up equity capital of the company, then the asking price is at a P/E 27.48.

- The Return on Capital Employed (ROCE) has increased from 14.51% in FY21 to 21.93% in FY23. ROE in the same period has increased from 23.62% to 58.18%.

- The debt-to-equity ratio has come down from 20.60 to 8.31. It has further reduced to 6.95 in Q1FY24.

Suraj Estate Developers IPO: Competitive Strengths

As per the company, their competitive strength is as below:

- SDEL is an established brand with a long-standing presence in Value Luxury and Luxury Segment in the residential real estate market of South Central Mumbai region.

- They have a diversified portfolio encompassing product offerings across various price points in value luxury and luxury segments.

- The company has strong expertise in tenant settlement in redevelopment projects.

- SDEL has an experienced marketing and sales team tracking market trends, which enables them to position their projects appropriately in terms of location and price points.

Risks associated with Suraj Estate Developers

Below are the risks associated with the SDEL:

- The business is too dependent on the performance of, and the conditions affecting, the real estate sub-markets in the South-Central Mumbai region.

- As of October 31, 2023, they have 216 unsold units in ongoing projects. If they are unable to sell project inventories promptly, then it may adversely affect business, results of operations, and financial condition.

- Their business is subject to seasonality, and they may experience difficulties expanding their business into additional geographical markets including the MMR region, which may contribute to fluctuations in their results of operations and financial condition.

Top Mutual Funds

Top Mutual Funds