- 25 Sep 2023

- ICICIdirect

UPDATER SERVICES LIMITED IPO IS OPEN FOR SUBSCRIPTION: ALL YOU NEED TO KNOW

The first IPO that opened for subscription this week was JSW Infrastructure. We have already covered it in an earlier article. You can check it here. Along with JSW Infra, another IPO is opening this week - Updater Services Limited.

In this article, we will discuss the Updater Services Limited (USL) IPO in detail, which opens for subscription on 25th September and closes on 27th September. We will cover various aspects related to the company which will help you decide whether to subscribe or invest in the IPO for the long term.

Updater Services Limited IPO: Key Details

Below are the key details related to the JSW Infrastructure IPO:

- Issue Size: Rs 640 crore

- Price Band: Rs 280 - Rs 300

- Issue Details: Rs 400 crore Fresh Issue, and Offer for Sale (OFS) of Rs 240 crore

- Market Cap: At the upper price band, Rs 2,001.08 crore

- Minimum Investment: Rs 15,000

Updater Services Limited IPO: About the business

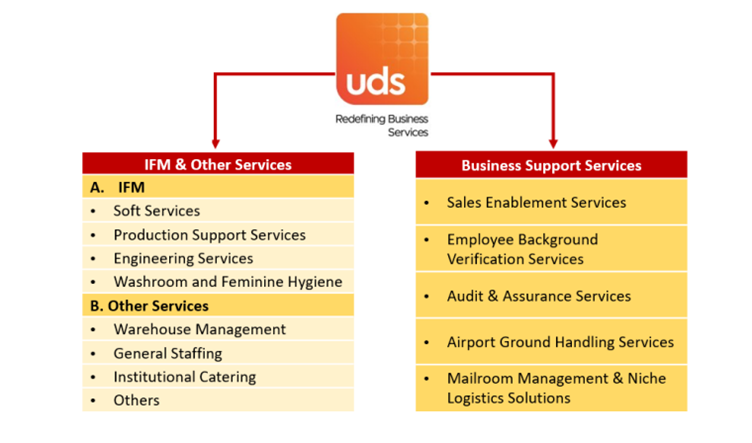

Updater Services Limited is a leading, focused, and integrated business services platform in India offering integrated facilities management.

(IFM) services and business support services (BSS) to their customers, with a pan-India presence. They are the second largest player in the IFM market in India and have the widest service offering in the industry, making them a unique and differentiated player in the market.

Within their BSS segment, they offer Audit and Assurance services through its Subsidiary, Matrix. As per the F&S Report, Matrix is a leading Audit and Assurance company for dealer/distributor audits, and retail audits, and its strong branch reach and field associate reach have driven the company to reach the top spot in India, with a market share of 19.2% for FY23. They also offer employee background verification check services through Matrix, and in this segment, Matrix is the third largest company in India, with a share of 5.4% in FY23.

Updater Services Limited IPO: Business Segments

The company operates in the Business-to-Business (B2B) services space, offering a spectrum of business services, which are broadly classified into the two following segments:

IFM & Other Services Segment

These services include:

- Soft Services: These include services such as housekeeping and cleaning services, disinfecting and sanitizing services, pest control, horticulture, and facade cleaning.

- Production Support Services: It is the solution offered to manufacturing facilities, including material handling, material movement, on-site warehouse management, stores and inventory management, production support activities, and equipment maintenance.

- Engineering Services: These mainly comprise services related to mechanical, electrical, and plumbing (MEP).

- Washroom and Feminine Hygiene Care Solutions: These include feminine hygiene care solutions and products and services such as air fresheners, sanitizers, and washroom solutions.

BSS Segment

It includes below services:

- Sales Enablement Services: These services are mainly provided through their subsidiaries, Denave and Athena.

- Employee Background Verification Check Services: These services comprise address verification, identity verification, educational qualifications verification, employment history verification, and legal case history, among others.

- Audit and Assurance Services: These services – offered through their subsidiary Matrix – are provided to FMCG and consumer durables companies to ensure the integrity and performance of their distribution, channel, and retail management operations.

- Airport Ground Handling Services: These services include baggage and cargo handling, passenger movement, and aircraft turnaround, among others.

Updater Services Limited IPO: Industry Overview

The IFM market in India has been growing steadily over the last decade and is set to witness significant growth momentum over the next 5 years. The total IFM market in India in FY23 is valued at Rs 1,00,386.7 crore, and around 39.3% of this is outsourced to 3rd party companies. Between FY18 and FY23, the outsourced Indian IFM market grew at a CAGR of 9.5%. At the end of FY23, the outsourced IFM market was estimated to be worth Rs 39,480.0 crores. The outsourced IFM market is expected to grow at a CAGR of 17.0% from FY23 to Rs 86,442.0 crore in FY28.

The market for BSS is valued at RS 7,115.0 crore in FY23. The market recorded a CAGR of 8.0% from FY18 to FY23. The market witnessed a decline of 27.1% in FY21 due to restrictions imposed during the COVID-19 pandemic. During the pre-COVID-19 period, the market grew at a CAGR of 12.2% from FY18 to FY20, driven by the growing demand for outsourcing from the growing industrial and commercial sectors. It is expected to grow at a CAGR of 15.3% from FY22 to FY28 and reach Rs 14,477.6 crore in FY28.

Updater Services Limited IPO: Listed Peers

The company has three listed peers - Quess Corp Limited, SIS Limited, and TeamLease Services Limited. Though their listed peers operate in the same industry and may have similar offerings or end-use applications, they derive a significant portion of revenue from staffing and/or security services, which is not USL's focus area. Their business may be different in terms of differing business models (for example – focus on Business

Support Services which might not be an area of focus for their listed peers), different product verticals serviced or focus areas, or different geographical presence.

Updater Services Limited IPO: Financials

Let us now look at the most crucial part investors need to consider while evaluating a new company - the company's financials. Below are the financial numbers of USL over the last three financial years:

- The company has reported a revenue of Rs 1,210.03 crore, Rs 1,483.55 crore, and Rs 2,098.88 crore for FY21, FY22, and FY23, respectively. Revenue has grown at an exceptional 31.71% CAGR in this period.

- The company's top ten customers within the IFM & Other services segment accounted for 35.39%, 35.30%, and 33.96% of their total income for FY21, FY22, and FY23, respectively. The top ten customers within the BSS segment accounted for 47.91%, 46.76%, and 54.95% for FY21, FY22 and FY23, respectively.

- Their top five customers accounted for 26.57%, 29.17%, and 27.47% of their total income for FY21, FY22 and FY23, respectively.

- USL has reported an EBITDA of Rs 70.22 crore, Rs 86.54 crore, and Rs 99.71 crore for FY21, FY22, and FY23, respectively. In the same period, the EBITDA margins were 5.78%, 5.80%, and 4.74%, respectively. The margins have reduced in FY23 over previous years.

- USL has reported a profit of Rs 47.56 crore, Rs 57.37 crore, and Rs 34.60 crore for FY21, FY22, and FY23, respectively. The profits in FY23 have come down because of one time acquisition adjustment.

- For the last three financial years, the company has reported an average EPS of Rs 8.23 and an average RoNW of 12.75%.

- If we attribute its adjusted earnings for FY23 to the post-IPO fully diluted paid-up capital of the company, then the asking price is at a P/E of 57.80, and based on FY22, it stands at 34.88.

- The debt to equity ratio reported by the company for FY21, FY22, and FY23 is 0.04, 0.17, and 0.46, respectively. The ratio has increased every year in the last three financial years.

- Return of Capital Employed (ROCE) has decreased from 22.59% in FY21 to 14.17% in FY23. On the other hand, ROE has also reduced from 15.79% in FY21 to 9.40% in FY23.

What are the competitive strengths of Updater Services Limited?

As per the company, their competitive strength is as below:

- USL is a leading integrated business services platform, operating across diverse segments.

- They have longstanding relationships with customers across diverse sectors leading to recurring business.

- The company has a track record of successful acquisition and integration of high-margin business segments.

- They have a PAN India presence with a large and efficient workforce coupled with strong recruitment capabilities.

Risks associated with Updater Services Limited

Below are the risks associated with USL:

- The company will not receive any proceeds from the Offer for Sale.

- They have issued Equity Shares during the preceding 12 months from the date of this Red Herring Prospectus at a price that may not be indicative of the Offer Price.

- The company may face significant employee-related regulatory risks, and any significant disputes with their employees and/or concerned regulators may adversely affect their business prospects, cash flows, and operations.

- Operational risks are present in their business, as it includes providing services in different business environments.

Top Mutual Funds

Top Mutual Funds